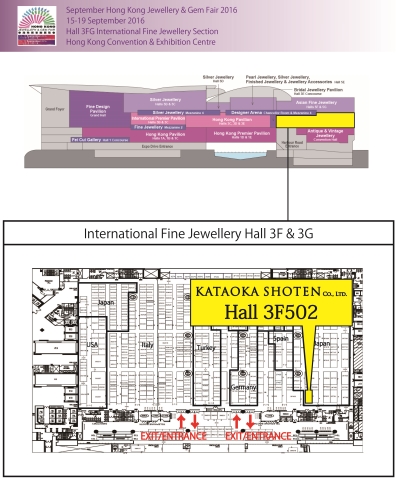

We had exhibited at the September Hong Kong Jewellery & Gem Fair 2016 for 5days, held in the Hong Kong Convention & Exhibition Centre from 15/09/2016 to 19/09/2016.

Same as Japan, the world situation has been changing suddenly. As a result of the slowdown of the world economy, the deflation seems to become dominant from the inflation which had been continued for a long time. In the world trade, problems have been being caused in steel and other products under the FTA. As for steel in particular, China has been performing the overproduction to maintain economic growth, and causing slump of the market price of steel by exporting at the dumping price.

The problem of current Chinese economy is to be said the excess liquidity by having too much funds. A large-scale of financial stimulus about 4 trillion yuan was performed after Lehman shock, but the fund flowed into the real estate, but not to the real economy. Then the real estate bubble collapsed, receivable which was secured with real estate became a bad debt, and the finance rattled, too. Because a large quantity of building materials were necessary at the time of real estate construction rush, the increase in production of steel was performed one after another. After all, steel, as the main building material, became over stocking and it was undersold.

Then it caused price distraction and gave great impact to the world economy. Because present China’s real economy is not restored yet, competitiveness of the companies has been lost. Especially, labor-intensive industry seems to be totally destructive due to the increased labor cost. Both the steel and the heavy industries are not doing well. And the pioneering industry such as IC and the computer does not meet profitability due to the overproduction in the world. Since possibility of the recovery of China’s real economy has been low, and become risky to invest, then the funds flowed out of China for investment in the other countries. But the Chinese government has put restrictions on this flow of funds to foreign countries.

Around Chinese New Year Festival, Chinese authorities had set the strict restriction to the upper limit of the cash takeout to the abroad, and raised the consumption tax to 2 to 3 times. 60% of consumption tax is imposed on the cosmetics and watches, upper limit of China Union Pay card was strictly reduced also. Chinese’s massive buying reached sudden death, not only in Japan but also in all over the world. Upper limit of taking out RMB to Hong Kong has been restricted to 20,000 yuan, and the shopping boom seemed to be over. The money that used to be invested in abroad stagnates in China, and it has caused a new bubble economy due to the excess liquidity of money. This current bubble which does not stimulate the real economy is thought as the big problem, same as the previous bubble. And, what is most feared by the world now is sudden drop of yuan, but not crushes of real estate or stock market. If RMB, which is planning to enter as one of the SDR component currency of IMF, would become weak, then the trust to the China’s economy is lost and U.S dollar would be affected since the RMB is one of the dollar peg currencies.

In addition, the situation changes suddenly in the other countries. A rise in the interest rates fades away and the economy becomes uncertain in the United States, the relationship between the U.S and other countries seems to change, no matter who becomes the president. The ASEAN countries, which wear influenced by the economic depression of China, do not have the chance of an economical boost. Also, there are many problems, such as terrorism, economic refugee, economic downturn, increase in numbers in breakaway faction from E.U., and so on, exist in the Europe. Furthermore, oil-producing countries’ economy is suffering from the slump of the crude oil price, and is showing no signs of recovery, too.

When we see so many problems in each country, protecting own country becomes the first priority, and skepticism about globalism, or observation about collapse of TPP is becoming strong. It is said that if a poor country becomes rich, war happens, and if rich country become poor, political change happens. Perhaps, it might be the world is moving toward to this stage. The world situation changed dramatically, and it seems the speed of the change has been accelerated further.

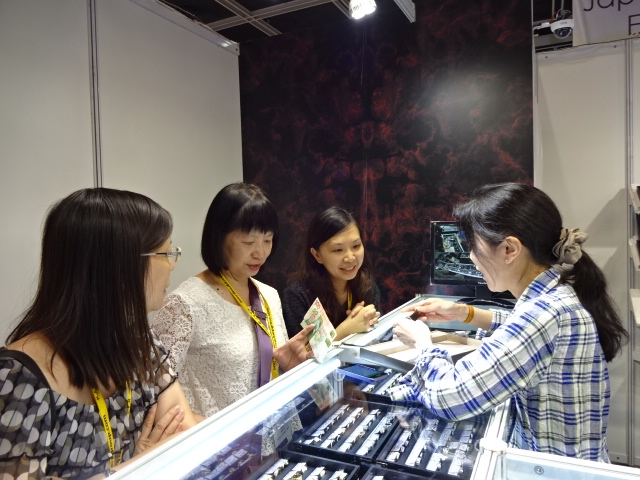

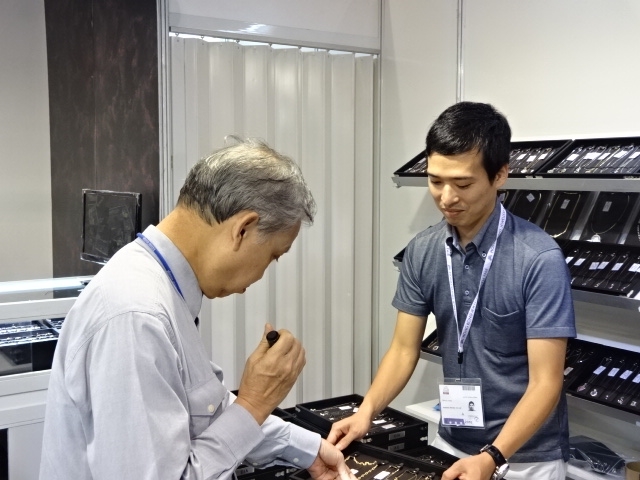

Because this was the biggest exhibition in Asia, and the other fairs in the world was in slump, anticipation to this fair, which was held under this kind of situation, was high. It seemed to be crowded on the first and second day as we have expected, and thought be a good start. However, I felt that there was less number of Chinese visitors than before.

The Mid-Autumn Festival and Shenzhen jewelry show was started at the same time as this jewelry fair. This is one of the reasons, but the biggest reason was sluggish Chinese economy.Most of the Chinese buyers, who visited us at this fair, had talked about the recession.They had considerable amount of stock, due to the dull sales demand, and they told me that increasing additional stock should have to be avoided.

The price which had been offered was severe, and they bought only if they found bargain items. When I saw the business was performed at the lower price than before at the whole venue, I realized that we were really in the deflation stage. The same situation applied to the material show which took place at the airport side. It seemed that the market price of pearl and diamond had become weak also. Same as after the collapse of Lehman Brothers, responding to this kind of sudden change is required in the situation where the market is rapidly changing.

We predict to see further world economic downturn and the change in the situation. We won’t be able to survive in a world that awaits us in the future, if we can’t overcome this situation. We promise to strive harder to become your good business partner. At last, we would like to give our sincere gratitude to all of you who visited us at this exhibition.