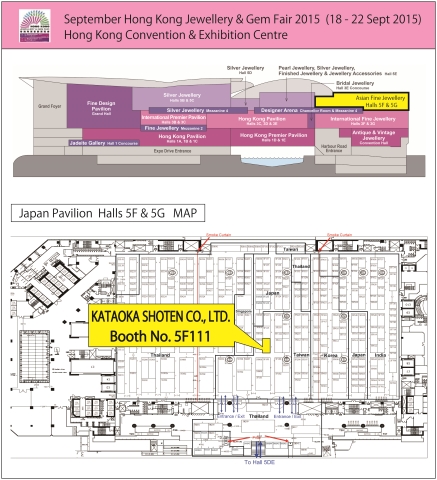

We had exhibited at the September Hong Kong Jewellery & Gem Fair from 18/09/2015 to 22/09/2015 for 5 days.

Since the beginning of September, it seems that the world money market is becoming unstable more and more. The reason is that the economic indicators had been announced by China and the U.S., and it put the investors in the maze; they can’t judge the China’s economic performance, or predict the timing of the increase in interest rate by the U.S. Nikkei average also repeats the volatility every day. Nikkei average lost 390 points, on 4th, because investors had cleared off the long position before employment statistics announcement of America, and the stock fluctuation was 500 points on 7th. Nikkei average did hit the lowest in 7 month on 8th, under background of concern about decelerating China’s economy caused by the announcement of China’s foreign trade statistics. And it jumped up 1300 points on 9th, caused by buyback of sellers due to the announcement of increasing public spending to stimulate economy by finance minister of China.But Nikkei average lost 800 points next day.

The current world economy is sensitive to United States and China in every move. It is not an exaggeration to say that we must keep our eye on the trend of these two major economic powers.These factors influenced our industry also, and the gold price had fallen drastically on 10th. Recently diamond price had fallen, too. Our industry might be in chaos if the price of colored stone and pearl would fall in near future; these items are quite stable in price at this moment.Also, the national bond of emerging countries became risky.Specially, Fragile 6 (Brazil, Colombia, Malaysia, Indonesia, Turkey and South Africa) are facing an increased risk of devaluation of debt rating; they depend heavily on commodity export, have strong economic relation with China, and are riddled by foreign debt.

By the economic slowdown of the rising nation, the investors are pushing forward the sale of rising nation government bonds.It seemed that 30 to 40 billion dollars investors’ money from stock market or government bond was flown out of the emerging countries, in one month until the beginning of September. As a result, inflation rate is hovering high in each country. And there seem to be only little choice left to leverage economic performance. Japanese government bond had been downgraded one stage from AA- to A+ on 16th. That is because real Japanese economy was judged as discouraging; Abenomics had not led to adequate economic growth, recovery of the Japanese economy was slow, and income also didn’t rise, too.

Under such circumstances, FRB maintained zero-interest-rate policy in the U.S. Federal Open Market Committee (FOMC) on 17th, and shelved a rise in interest rates in order to minimize the aftereffects of worldwide stock plunge caused by slowdown of the Chinese economy, and to avoid further strong dollar, low price of crude oil, disruption of emerging countries. Nevertheless, the rise of interest rate has been postponed on a temporary basis, but it does not allow optimism. The Hong Kong show for materials had started in this kind of atmosphere from 16/09/2015 at AWE, 2 days earlier than jewellery, and we heard the rumor that sales amount was 50 % to 60% compared to previous year. At CEC side, we didn’t expect much, because of the worldwide economic slowdown.

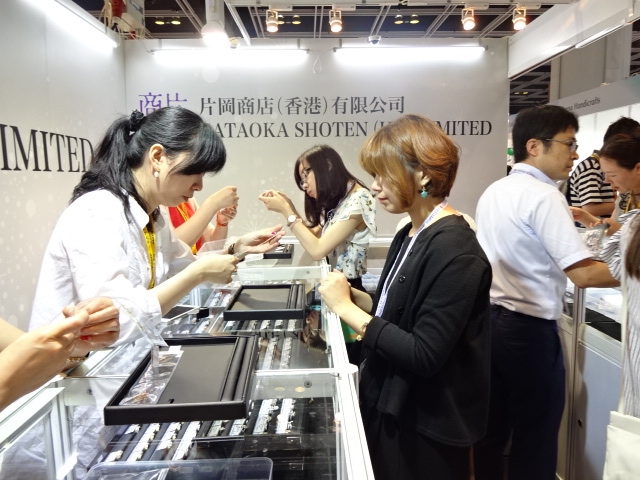

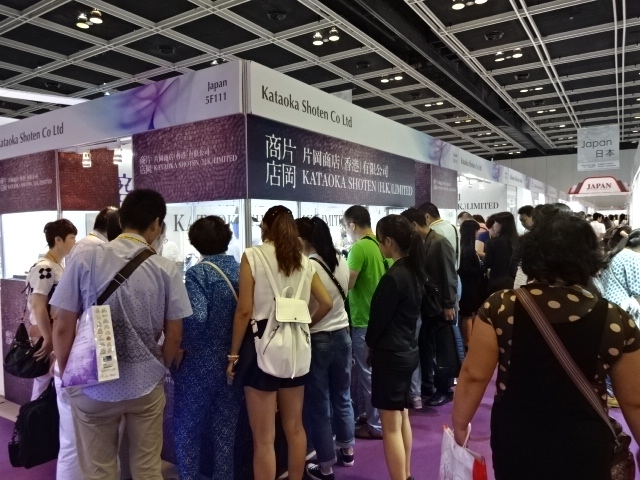

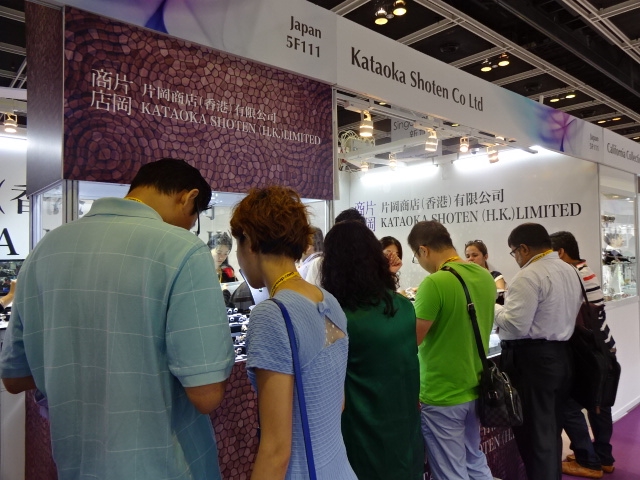

However, expectations went wide of the mark from the first day of the show at the CEC. Especially Japanese booth had a lot of visitors from the early morning of the first day. Even though they understand economy was still in the harsh situation, they were trying hard to bring about breakthrough.The buyers checked our goods very carefully, severely, and took more time to examine. They didn’t buy same kind of goods which they already had in their stock, but didn’t hesitate to buy the items which they could sell easily, regardless of the prices.

By seeing the positive attitude of buyers, I felt a little bit relief. This exhibition betrays the expectations in a good way, but real economy is not in the good condition yet. I keenly felt the importance of our effort to meet your expectation. We would like to give our sincere gratitude to all of you, and are looking forward to see you at the next exhibition.