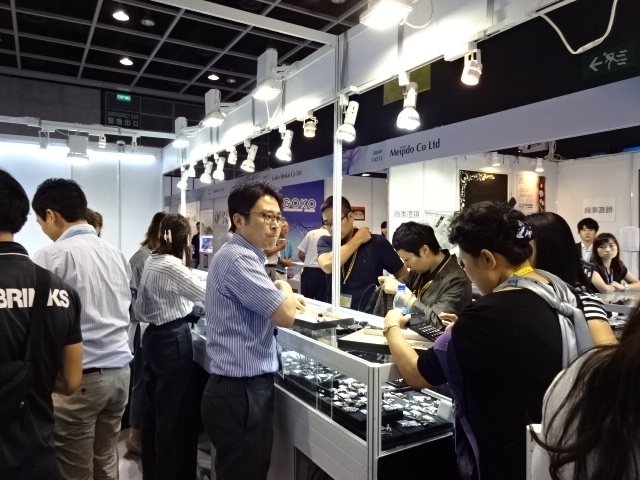

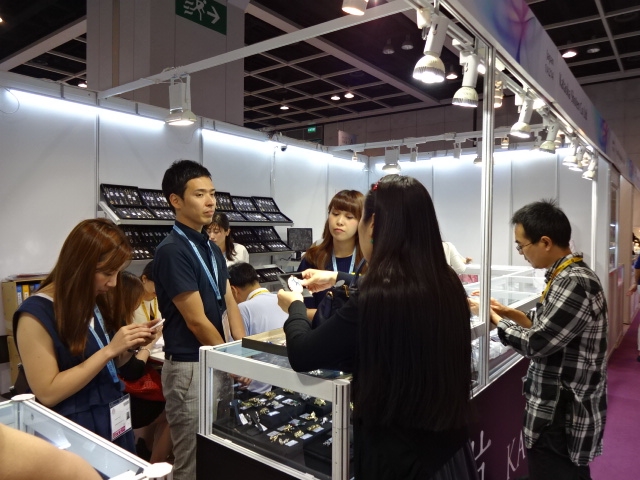

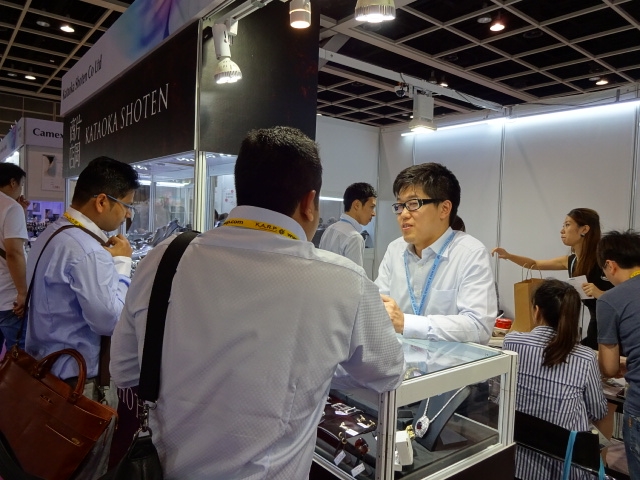

We had exhibited at the June Hong Kong Jewellery & Gem Fair, held in the Convention and exhibition centre from 23/06/2016 to 26/06/2016, for 4 days.

The world economy is still sluggish, even in June. According to the corporation statistics that Ministry of Finance announced in Japan on June 1st, ordinary profit of all industries declined 9.3% & sales amount declined 3.3%, compared with the same month of the last year. As a result, both sales & profit declined in two consecutive years. Receiving the fact that the Japanese economy has been sluggish, Prime Minister Shinzo Abe expressed that consumption tax hike to 10% would be postponed till October 2019, about 2 and half years, at the press conference in the Prime Minister’s office. In response to this, the sense that governmental policy had been exhausted out strengthened. Then Nikkei Average plunged at the Tokyo Stock Exchange, and the Yen became strong against the dollar at 108 levels on June 2nd. Consequently, the economy which had been recovering slowly by high stock market and weak yen had just been rewound.

Furthermore, the employment statistics by the U.S. Department of Labor on June 3rd, which represented the economic trend of May, showed that the rate of increase in employment had declined to the low-level for the first time in 5 years and 8 months. Slowdown of the overseas economy has influenced the employment in the U.S. The employment of the manufacturing industry had shrunk about 10,000 workers for the first time in 2 months by stagnation of export; also the employment of the mining industries had shrunk about 10,000 workers by resources weak. This employment statistics caused yen buying dominant in the N.Y. Foreign Exchange Market at the 106 level against one dollar, then U.S. long-term interest rate in N.Y. bond market fell sharply. In response to this situation, Federal Reserve Board (FRB) decided to maintain the status quo of monetary policy in the U.S. Federal Open Market Committee (FOMC) on 15th and to shelve a rise in interest rates.

Also the Bank of Japan decided to postpone an additional monetary easing in the monetary policy meeting, and to maintain the present minus interest rate policy. Also the Bank of Japan decided to postpone an additional monetary easing in the monetary policy meeting and to maintain the present minus interest rate policy. It seemed that they would like to ascertain the relaxation effect of the negative interest rate that introduced in February, even though prices were weakening by the uncertainty of the economy. Reacting to this, buying yen and selling dollar became strong trend; yen became 104 levels against 1 dollar, Nikkei Stock Average had dropped sharply, long-term interest rate did not stop lowering, and newly issued 10-year government bond interest rate became -0.195% which hit the record low. Both Japan and the U.S. has become in the situation to experience further economic slump.

However, not only Japan and the U.S., European Union was facing the Brexit. United Kingdom European Union membership referendum would be held on 23rd. As a result, it caused worldwide stock price plunge and interest rate of developed country government bonds had experienced the lowest. Furthermore, selling pound andBut the poll was favorable to the Brexit, and a sense of caution has been spread in the market. And, tendency to transfer risk assets to safer assets had been intensified among the world investors, because the prediction of the impact which extends to the economy and financial markets would become very difficult, if the U.K. decided to leaves EU. The high-risk stock was sold, and a fund flowed into developed country government bonds which were thought as safer assets euro were intensified in the foreign exchange market. Then, Japanese yen became stronger against pound after 3 years and 2 months and against euro after 3 years and 5 months.

Moreover, by foreseeing Bank of Japan would not implement the monetary easing before United Kingdom European Union membership referendum, short-term investors attempted yen buying and yen became strong at 103 levels against 1 dollar.

This jewellelry Show, which was held under such circumstances, represented the current world situation. The number of visitors had decreased significantly, compared to the previous year, and the atmosphere of the venue was quiet deserted. It seemed that buyers had come to check the current market trend rather than purchasing purpose. And they were interested only in bargain items, and did not have any intention to buy regular items.

The purchase unit price seemed to fall more and more, and the sale of the expensive items seemed to be very difficult.Even a criterion to choose emerald, which has been very popular among buyers, seems to became narrower. They only bought if it was a value for money and excellent quality. I sensed that the market price of Emerald, which had remained at high levels, might go down in the future. Due to the current world economic situation and weak dollar, market price of diamond should be watched carefully also. It seemed that both exhibitors and buyers had felt the uneasiness in the future at this show.

In addition to above situation, the U.K. voted for Brexit during the show, and then it shook the world. Financial and capital market was disturbed on 24th; Nikkei Average experienced range of reduction first time in 16 years, Asian and European stock market plunged, and pound hit lowest against a dollar first time in 31 years. The money flowed into the safer assets, like Japanese yen or gold; yen became 99 levels against 1 dollar and the price of the gold put highest price first time in 2 years. Brexit shook the world and it became a new risk to the world economy and politics.

This jewelry show was a big turning point and seemed to give us a warning of the situation that would become severer in the near future. We would like to give our sincere gratitude to all of you who visited our booth even in such circumstances, and are looking forward to meet you at the next exhibition.