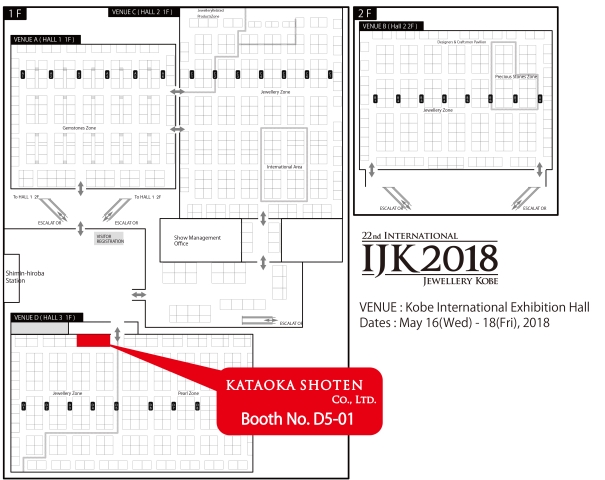

We had exhibited at 22nd International Jewelry Kobe, held at Kobe International Exhibition Hall for 3 days from 16/05/2018 to 18/05/2018.

As the paradigm shift progresses in various industries around the world, this phenomenon is progressing also in our industry. Like evaluating commodity prices using AI or selling diamond appraised by AI began even in retail sales, our industrial structure is also changing.

There is also another paradigm shift that we have to watch out for in our industry.It is an expansion of price difference between platinum and gold. 40% of platinum’s applications are for automotive exhaust gas catalysts, making it easy to respond sensitively to the industrial demand. If trade friction between the US and the China gets worse, trade volume will decrease and there is a risk that the world economy will slow down.It is predicted that the economic downturn could directly lead to a decline in demand for platinum with many industrial applications.And it makes speculators to relinquish platinum and the price of platinum continues to decline.

Recently, price of platinum has been sluggish due to sales slump of diesel cars in Europe. Furthermore, changes in the industrial structure to the EV shift are approaching.France and the United Kingdom promptly prohibit the sale of diesel and gasoline vehicles by 2040 and such as Netherlands and Norway are considering doing until 2025. Demand for platinum will sharply decrease as the automobile turns into EV. If it progresses widely, price of platinum will fall and the value of platinum itself might change in the future.

Platinum is dealt as a valuable thing due to low production and ease of processing. Although platinum is regarded as important material as a frame used for jewelry in Japan,gold is used in most of the overseas’ countries. If the price difference between platinum and gold expands more and more, there is a possibility that jewelry made of platinum will become worthless compared to the present in the future.

Moreover, it is undeniable that the automobile industry strongly supports the Japanese economy. And it is believed that paradigm shift will occur in many Japanese industries as EV conversion progresses.If change to EV progresses in the future automotive industry, it is thought that not only horizontal specialization like digital products will proceed but also weight reduction of the car’s body replacement from iron to light aluminum and carbon fiber will progress.The ratio of iron used for automobile is said to fall to about 40% in 2030, and if the steel industry misjudges the direction like the former semiconductor industry, it will lose competitiveness at once. Since having a wide-range of subcontractors, if the Japanese automobile industry misjudges the direction, it will kill the competitiveness of the Japanese industry as a whole, and it will have a major impact on the Japanese economy.Currently there is a situation where large paradigm shift can occur due to small factor. I think that it is necessary to create a situation that can respond promptly to what changes in other industries will affect our industry.

And the current world economy, the expectation for stability in politics increased and the stock price rose by the decision of the US-North Korea talks on June 12th.Also, the long-term interest rate in the US has reached 3% level in 4 years and 3 months, resulted in the investor money flowed from Japanese yen with low interest rate to dollar with high interest rate. As a result, it made the yen depreciation heading toward to the 110 yen level. The world economy is exactly driven by accordance with the theory; as the interest rate differential between Japan and the US spreads,the money flows into the dollar. Although weak yen is a strong favor in Japanese corporate earnings, the depreciation of the yen linked to the interest rate between the United States and Japan is quite uncertain. And if the rise in US interest rates is so sudden, there is also a possibility to depress the US economy; stock prices will decline and selling pressure will be applied to the dollar as well.

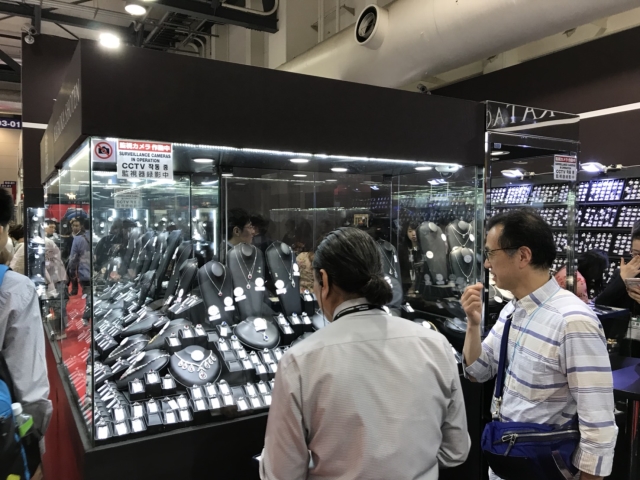

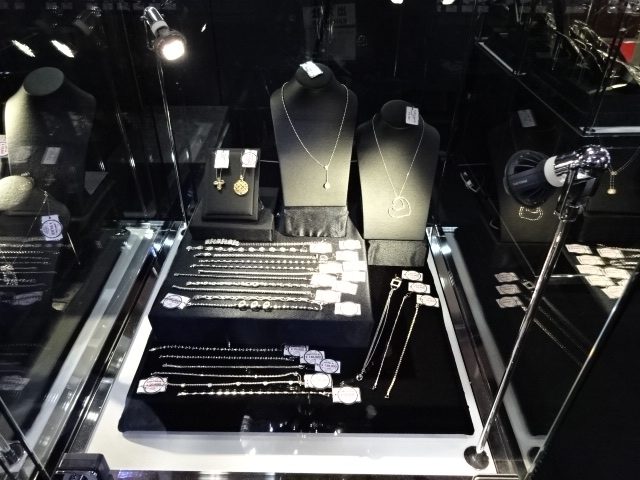

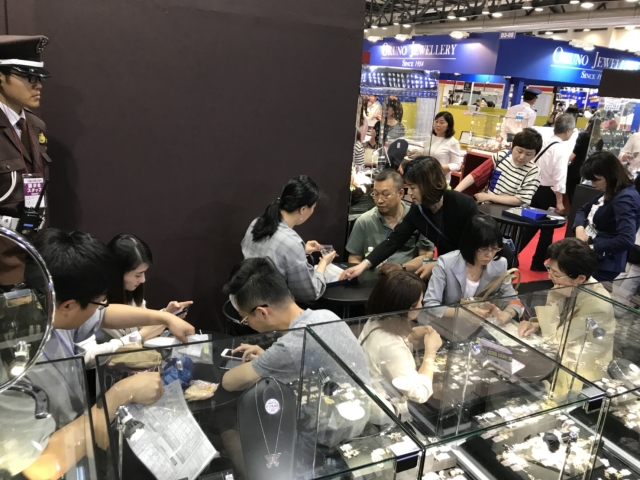

This jewelry show was held in this situation, and it seemed to have a lot of Chinese buyers and much less Japanese buyers as the last year.The venue was crowded every day with Chinese buyers. The situation of retailing in Japan seemed to be bad. And, what they purchased was common items and seemed not in the mood to try unique items. On the contrary, overseas buyers tended to choose unique items to differentiate from others, and were thinking about improving the profit ratio accompanying with it.The recent jewelry show held in Japan is in a situation where Japanese buyers are few except for IJT in January, and this situation is considered to continue.

Because of such situations, many exhibitors are shifting their stock for overseas buyers, and it may become increasingly meaningless jewelry shows for Japanese buyers in the future. We will make an effort so that we can propose selections of merchandise that is attractive to both domestic and overseas buyers at our booths, considering this balance as a future task. We had a lot of visitors during this jewelry show, and would like to give our sincere gratitude to all of you.

We are looking forward to seeing all of you at the next fair.