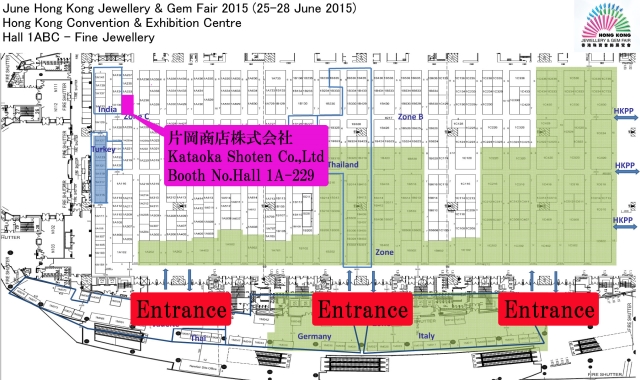

Hong Kong Jewellery & Gem Fair June 2015 was held at the Hong Kong Convention & Exhibition centre from 25/06/2015 to 28/06/2015 for 4 days.

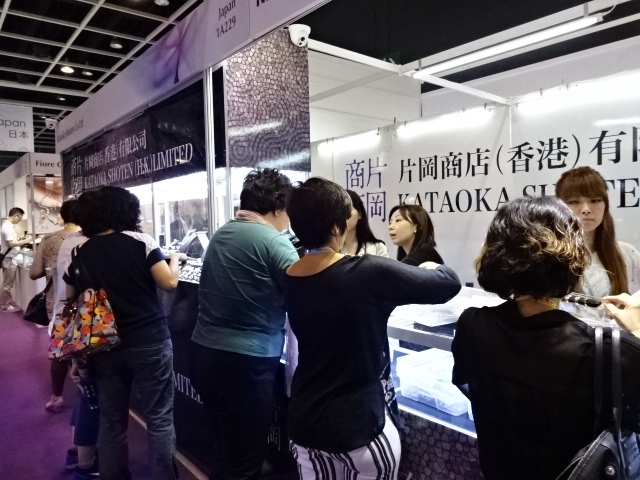

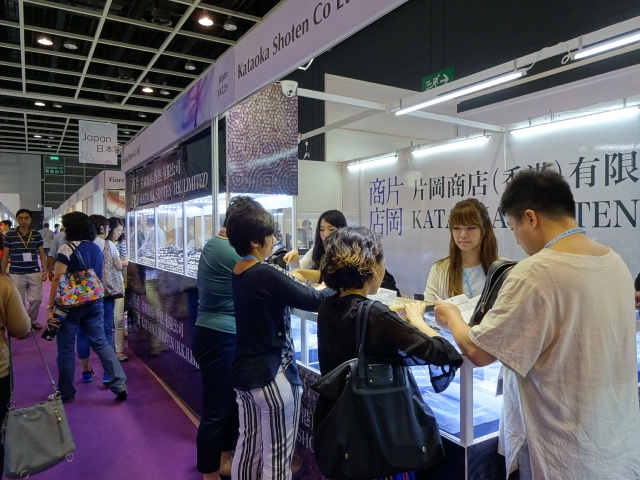

In response to the sluggish Japanese domestic economy, many new Japanese companies had exhibited for the first time, in order to find a solution.The number of exhibitors from Japan had exceeded more than 200 now, and I had an impression that most of the regular exhibitors at the Japanese fair were at this exhibitionJapanese companies have received a lot of support around the Chinese buyers now, and it attracts customers to the Japanese company’s booth than other countries’ booth.

However, many Japanese companies exhibited at this time and I had an impression that a guest was sparse by having the Japanese booth scattered in each floor. Hong Kong Gem & Jewellery Fair June has the least number of visitors among the Hong Kong show, but it seemed to have much less visitors this year.Chinese visitors to Hong Kong have been plummeted by the political reasons, and it also affects dramatically to the sales amount among every Hong Kong industries. Therefore, there were less Hong Kong buyers, also.Even in China, Shanghai stocks fell sharply on 26th.It became approximately 20% decline from the highest, and cannot imagine how much damage it would give to the Chinese economy which 15% of the population has been doing equity investment.

Currently, the world economy is said to be depended upon American interest rates.It is believed if the U.S. takes a step forward to raise interest rate, it causes the outflow of investment money from emerging countries and also currency depreciation. In addition, raising American interest rates presage further strong dollar, and also affects the commodity prices such as dollar-based crude oil. Currently, the US dollar and crude oil prices are like two sides of the same coin, and it would give a large impact to the emerging countries which depends on resource exports.Furthermore, it is said that if interest rates go up the stock prices would fall.And it might trigger the worldwide stock plunge. It is believed Greek default would not be inevitable since Greece declared unable to meet the repayment to the IMF.We have to observe very carefully what would happen to the world economy if Greek default would occur.

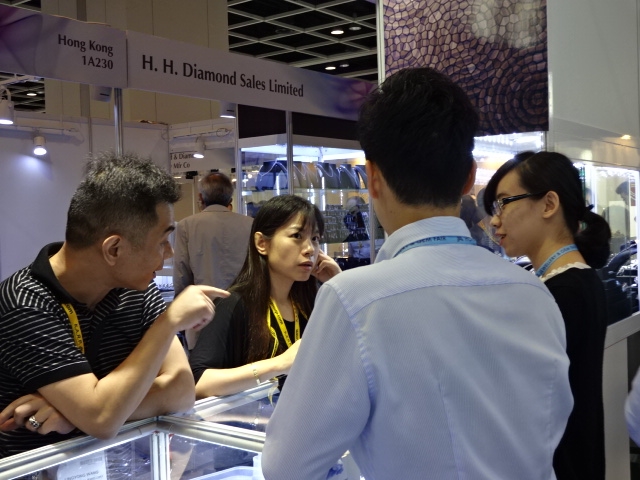

The current world is in confusion in this way. Quotient materials have soared in form in inverse proportion to the real economy.It may be about the time when we should think about whether it is the ceiling market price, or whether the remarkable rise of current quotient materials is appropriate.I believe that it is depend on the world situation in the future whether quotient materials of our industry go up more or depreciate suddenly.There were a lot of buyers from the first day at our booth, in spite of this chaos situation. We promise to strive hard to satisfy your needs, and are looking forward to see you at the next fair.At last, we would like to give our sincere gratitude to those who visited us at this fair.