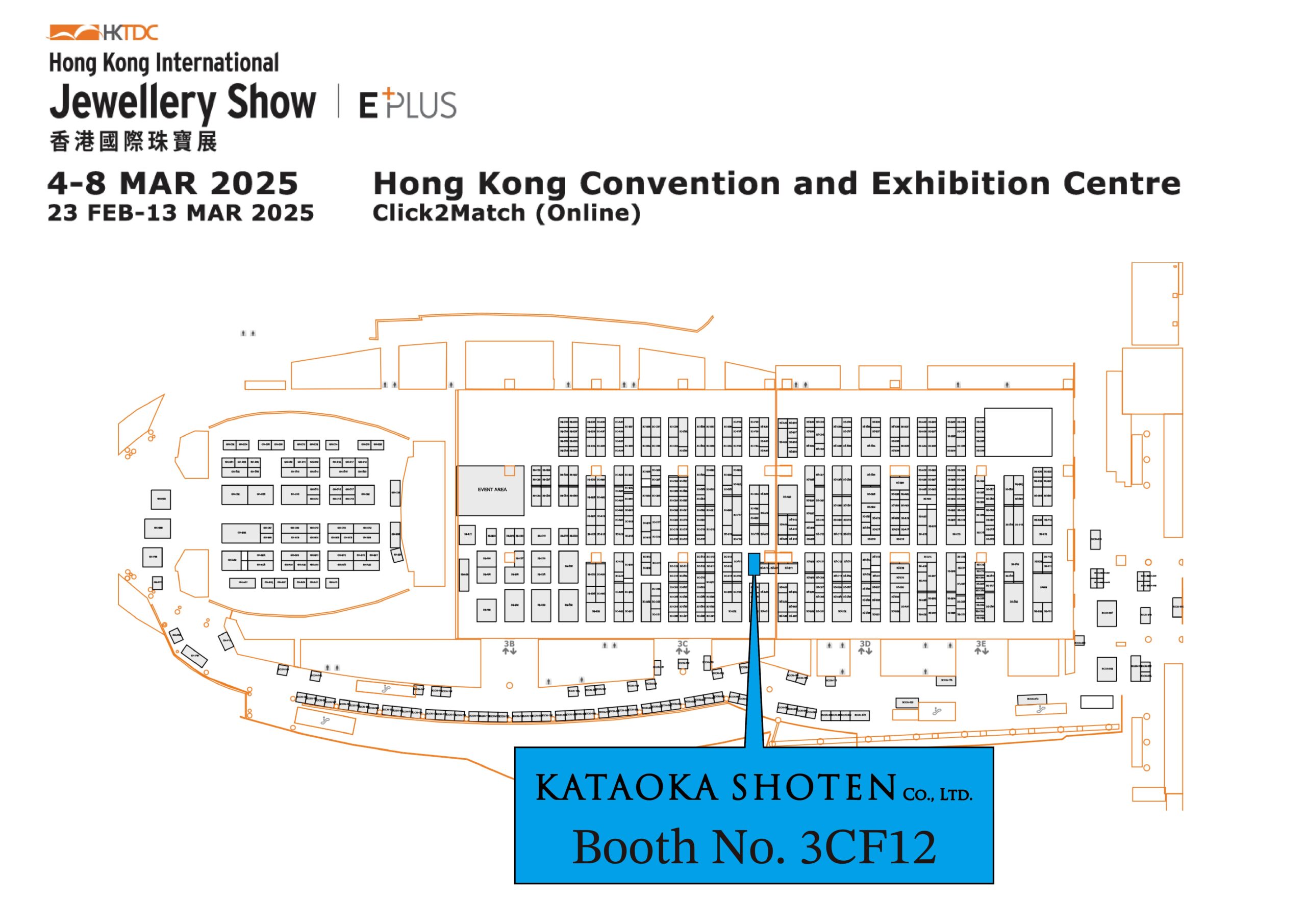

We had exhibited at the Hong Kong International Jewellery Show 2025, held at the Hong Kong Convention and Exhibition Centre, for 5 days from 04/03/2025 to 08/03/2025.

A month has passed since Trump 2.0 was launched and the global situation is already beginning to change. He has begun to impose tariffs on other countries, fundamentally undermining the free trade system that has brought prosperity to the world. They consider the consumption tax as the tariffs for all the countries around the world, and it seems that the idea is to mutually impose reciprocal tax on customs duties and consumption taxes of the other country.

After assuming office in January, he first declared a 25% tariff on Mexico and Canada, and on February 4 he imposed an additional 10% tariff on all Chinese imports. In response, China retaliated by imposing additional tariffs of up to 15% on coal, liquefied natural gas, and other products imported from the United States on January 10th.If the United States continues to politicize economic and trade issues and further additional tariffs are imposed, there is a risk that this would lead to an exchange of retaliatory tariffs, similar to the trade war of 2018, and there are concerns about the impact on the global economy.

The target of Trump’s tariffs is not only countries but also individual items. It has been announced that, an additional 25% tariff will be imposed on steel and aluminum products from March 12, and additional tariffs on automobiles will also be implemented in April. If actually implemented, it would have a significant impact on the world, including Japan, so the situation will depend on future negotiations. However, a predatory structure is emerging where the United States wields high tariffs against other countries to force them to comply with its demands, raising concerns about the future global situation.

The Trump administration’s tariff policies have raised concerns about the future of inflation in the United States, leading to fears that the U.S. economy will slow down. U.S. economic indicators have deteriorated more than expected, and risk-averse stock selling is spreading. With deteriorating U.S. economic indicators, there are growing concern that the FRB will cut interest rates, bond prices are rising in the U.S. bond market, interest rates are falling, and the yen is being bought and the dollar is being sold with an awareness that the Japan-U.S. interest rate differential is narrowing. With inflation progressing, any economic slowdown could lead to stagflation.

In our industry, the market prices of many commercial products, especially diamonds and pearls, have fallen due to the poor global business climate, and there are concerns that the market prices will fall further in the future due to restrained buying. The current global situation has caused a slump in sales in many countries. However, despite this situation, only the price of gold continues to rise. As a result, jewelry has also become more expensive in spite of sluggish sales.

Gold continues to soar to historic highs, reflecting U.S. monetary policy and geopolitical risks. The interest rate cuts by the FRB, concerns over the situation in the Middle East, and Russia’s invasion of Ukraine are also supporting the inflow of funds into gold, which is a tangible asset that price is unlikely to fall. Due to uncertainties in the global situation, the current trend of buying gold worldwide may lead to higher gold prices in the future.

A gradual change is taking place in which investment in gold is gaining while the demand of gold jewelry is decreasing around the world. The market prices of each product are fluctuating wildly, and the prices of jewelry as products are also changing significantly from what it used to be. It is expected that the commodities and product prices in our industry will continue to change significantly in the future due to global trends. It seems more difficult to respond in the future. This jewelry show was held under these circumstances.

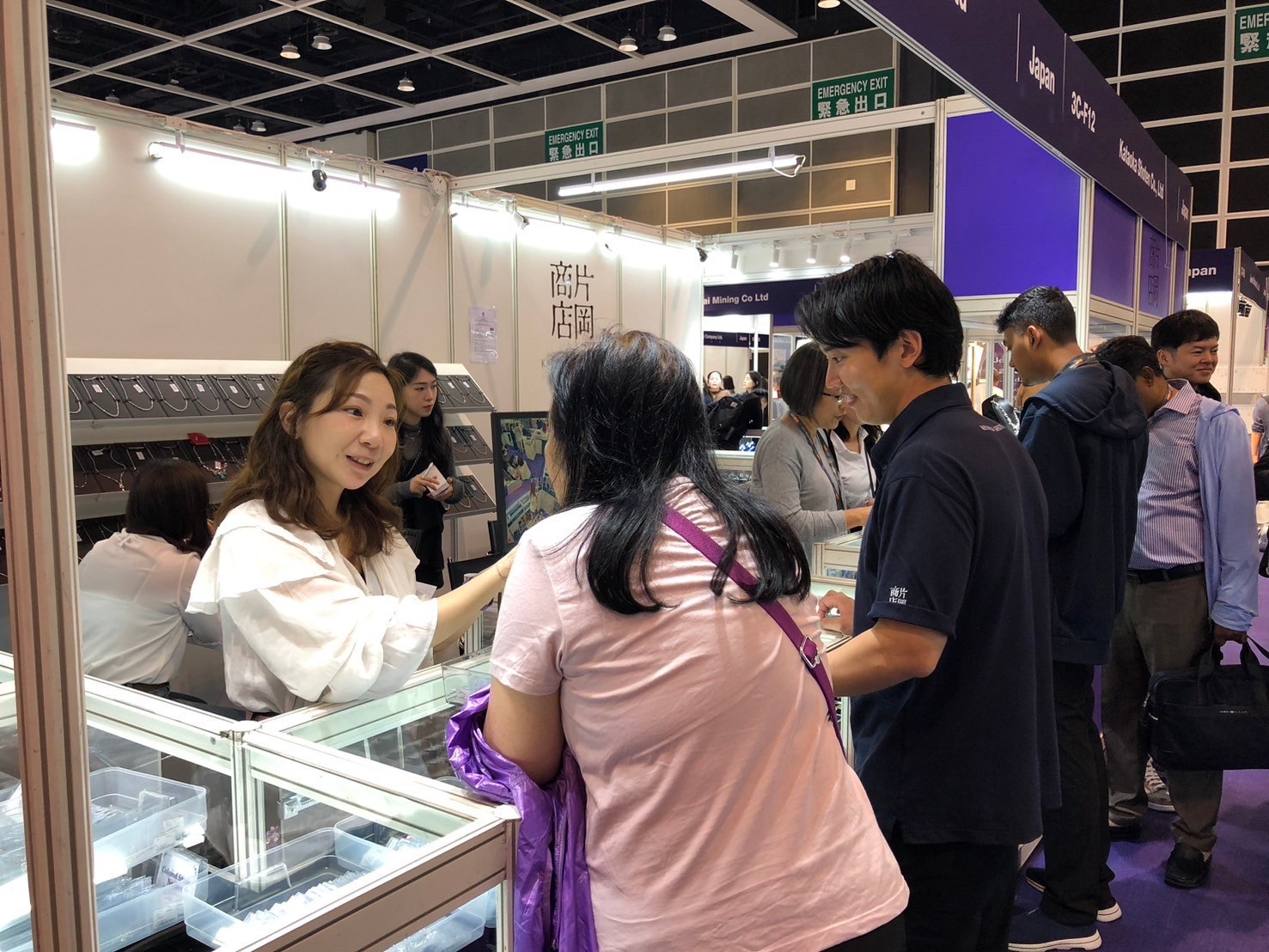

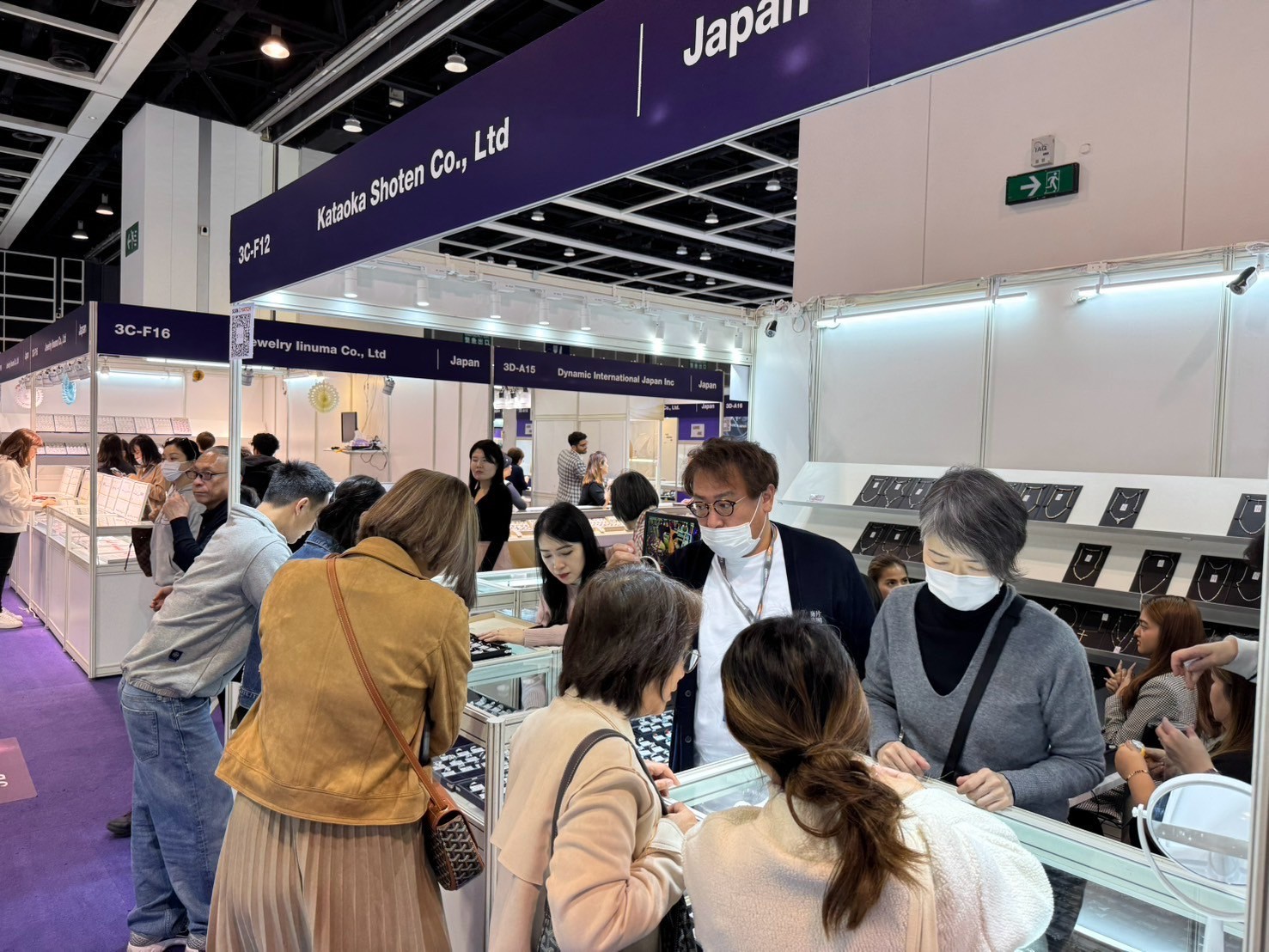

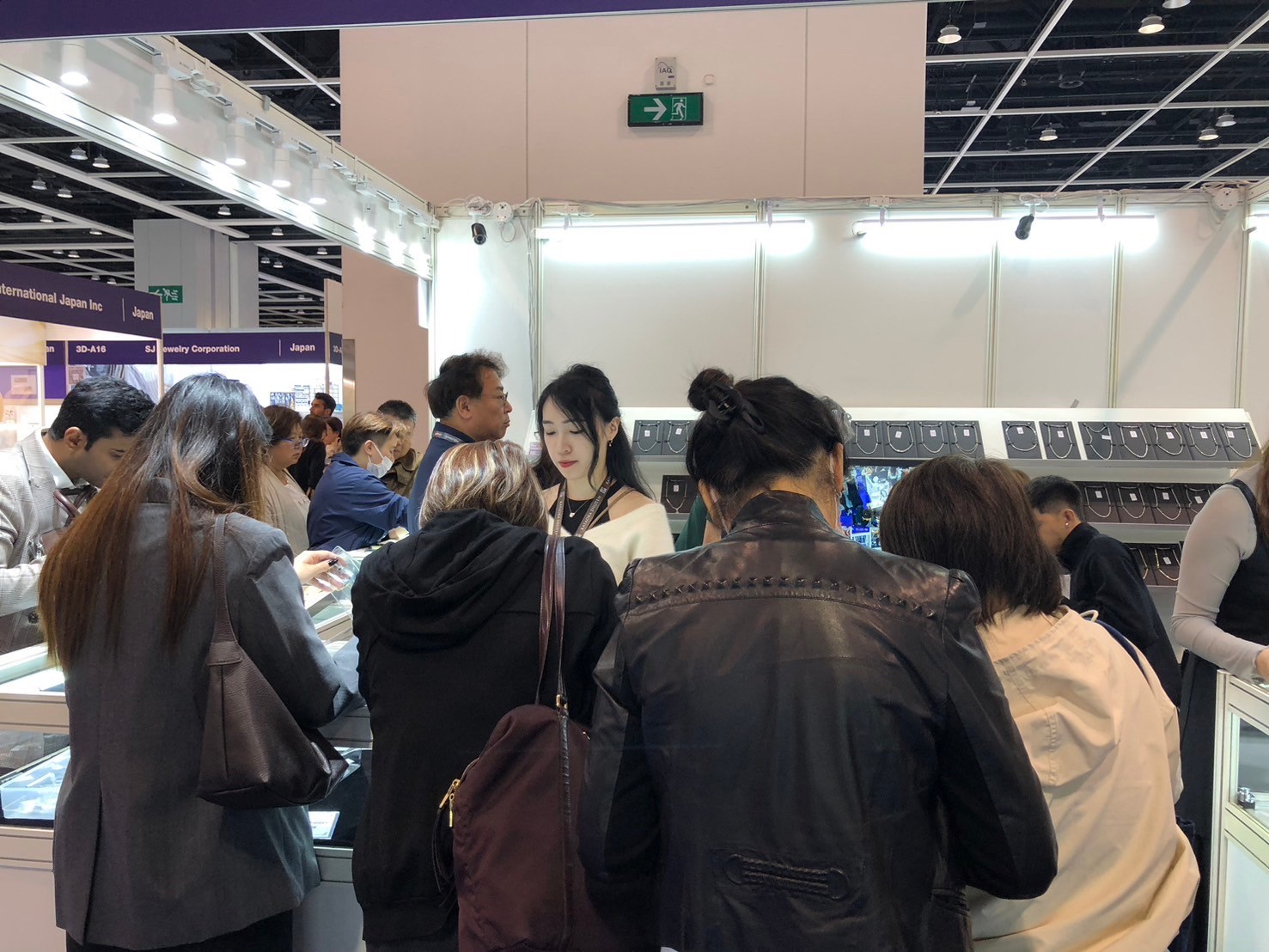

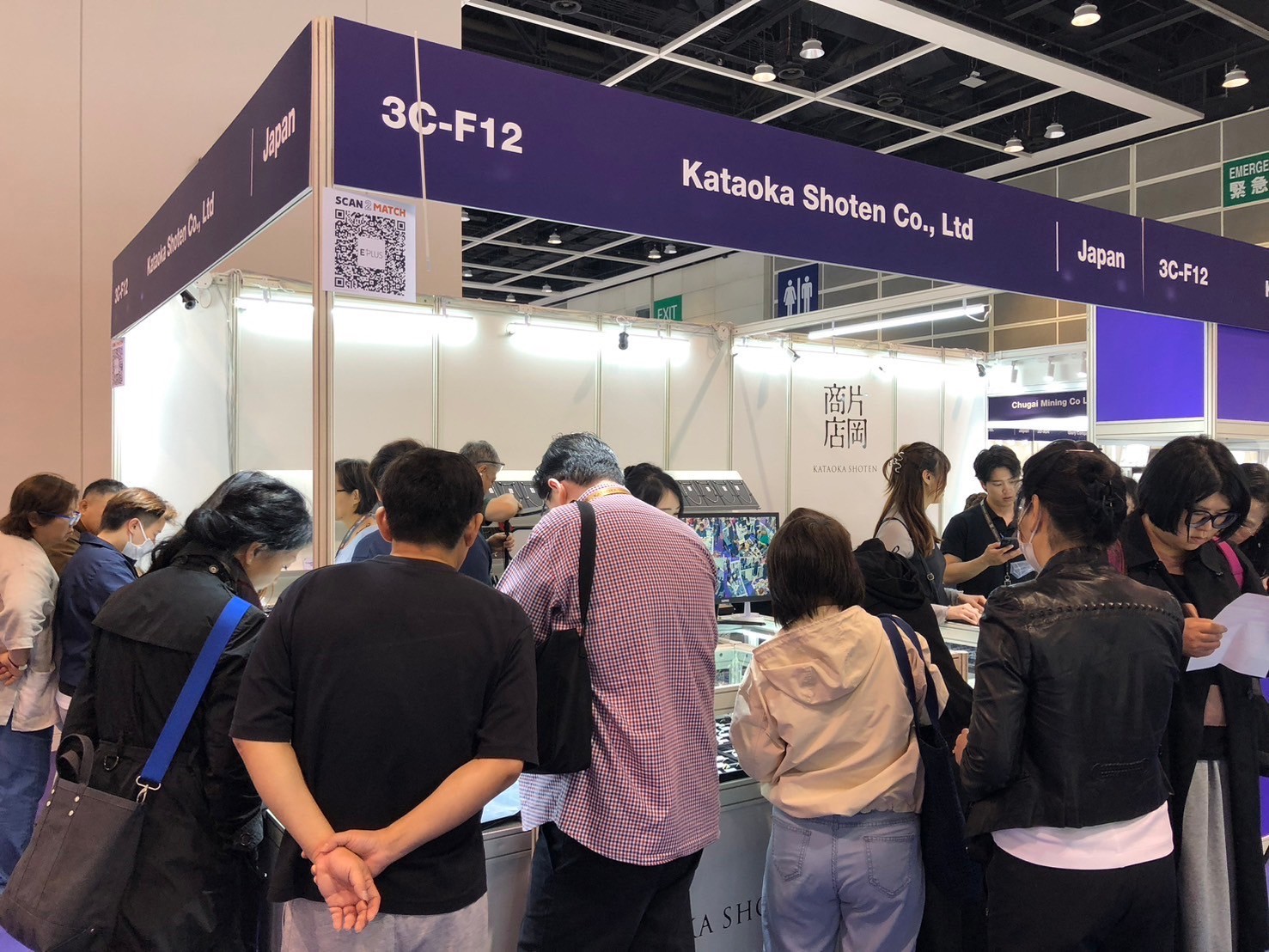

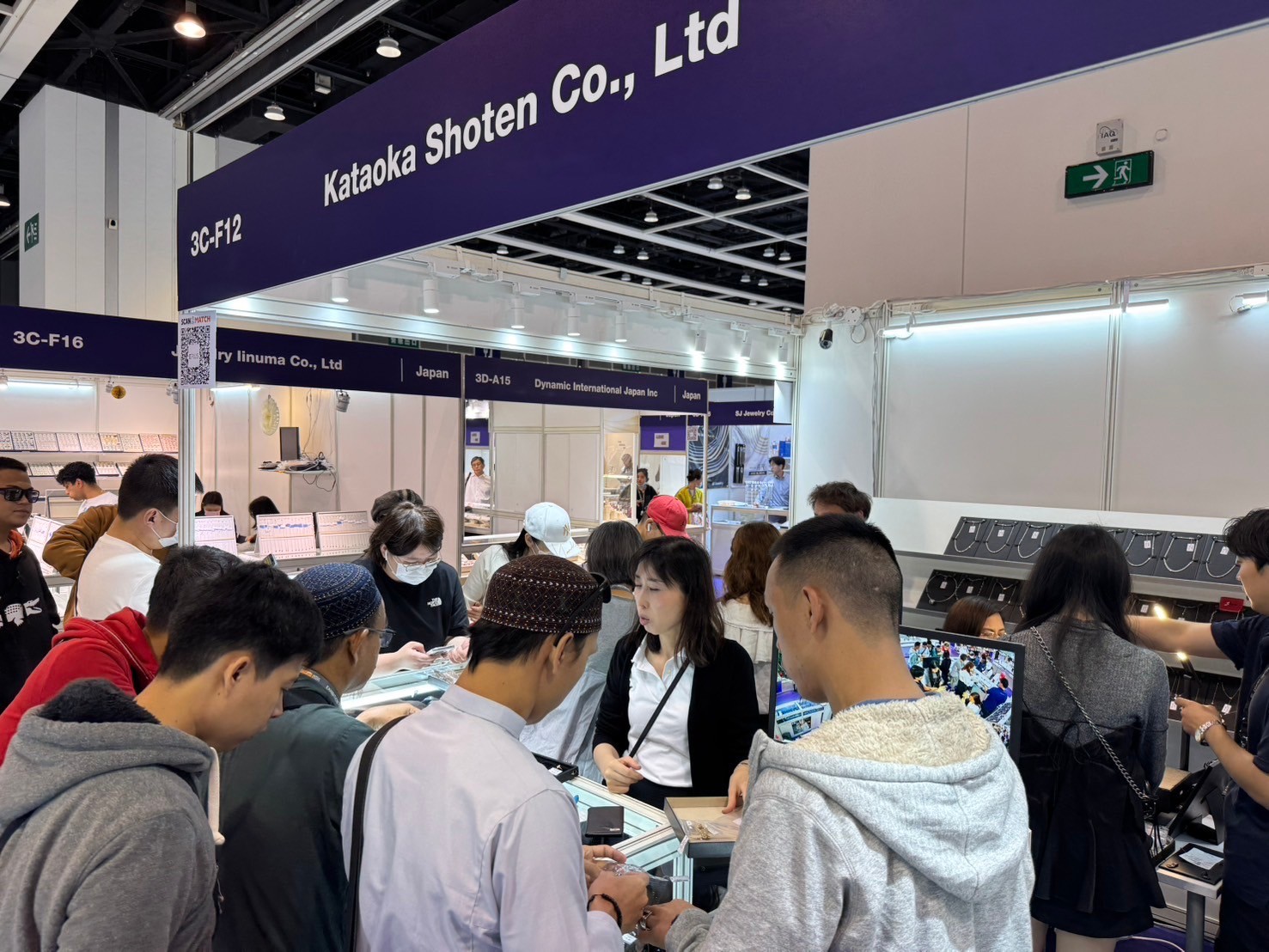

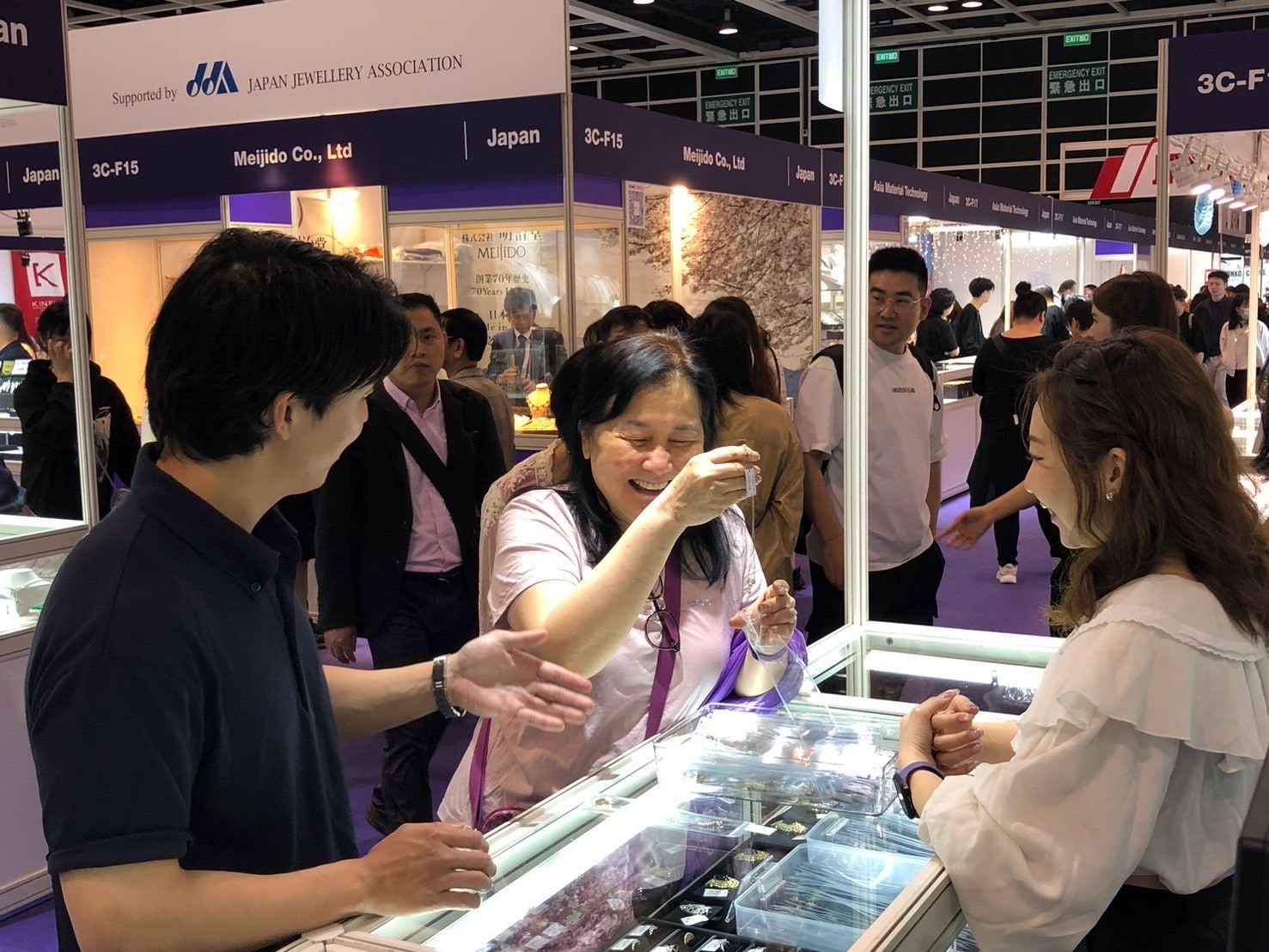

Although expectations were low due to the poor global economic climate, it seemed that there were more visitors than the previous year. The Japan Pavilion was bustling with many visitors from the first day until the final day. However, the number of Chinese buyers seemed to have decreased drastically, as if to indicate the sluggish Chinese economy. The jewelry show held in Hong Kong, which had previously relied on China, is now bustling with buyers from other countries, and I got the impression that the Hong Kong Jewelry Show is also undergoing major changes.

The products that are selling well also seem to be shifting away from the colored stone products that have been sold mainly to China up until now. There is little demand for expensive colored stones items in particular, and they do not buy unless they are very cheap or of good quality, resulting in a rather tough situation. It seems that new goods and goods that had not been interested before were selling well. I felt that this jewelry show seemed to have a potential for the future with the emergence of new buyers.

We would like to express our sincere gratitude to all the visitors who visited or booth. In response to the greatly changing circumstances in the future, our company will also undergo changes and strive to ensure your satisfaction. We hope to see you again at the next jewelry show. Thank you.