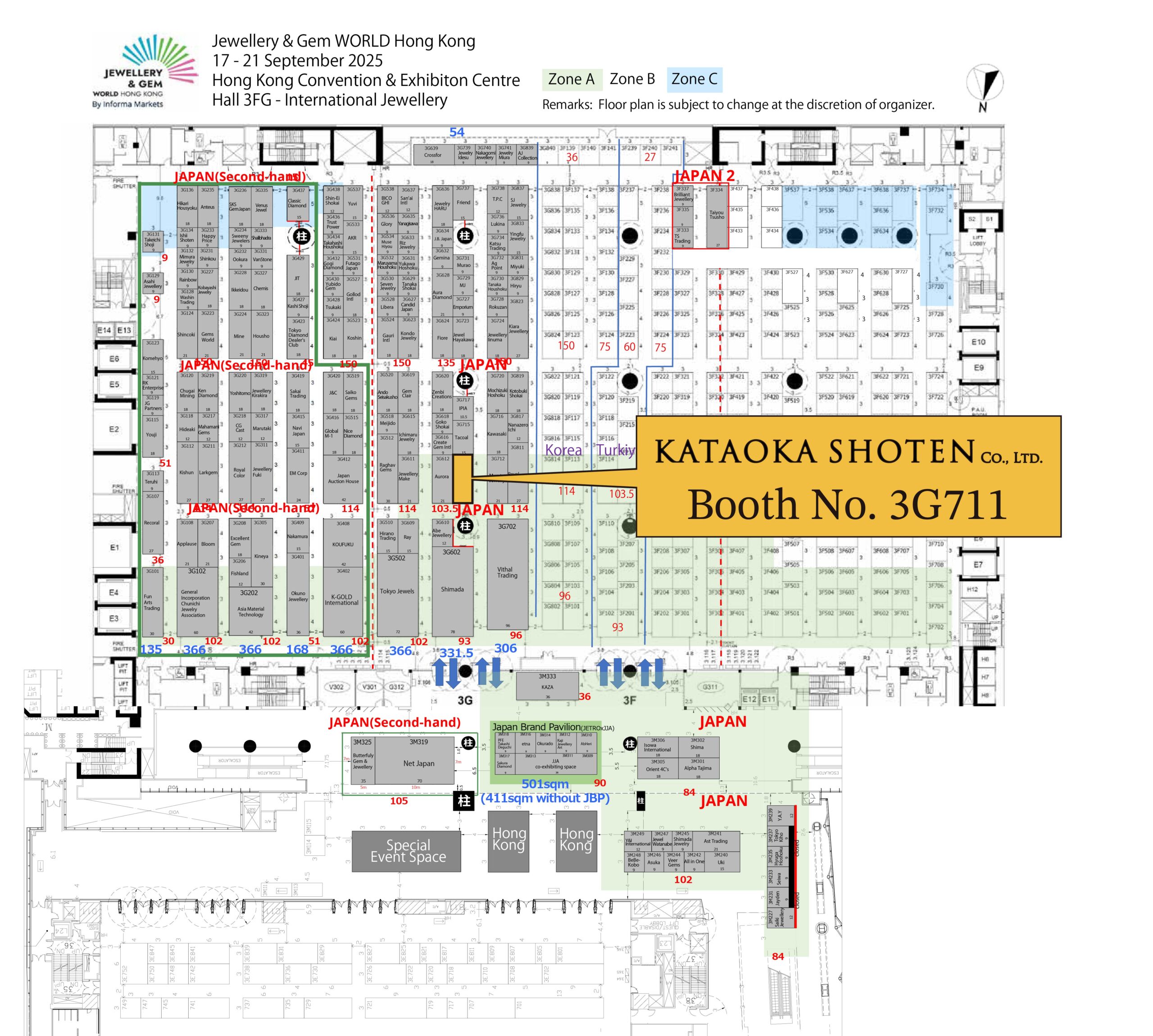

We exhibited at Jewellery & Gem WORLD Hong Kong, which was held at the Hong Kong Convention & Exhibition Centre over five days, from September 17 to 21, 2025.

The uncertainty surrounding the situations in Ukraine and the Middle East, coupled with the impact of Trump’s tariffs, is fueling instability in the global economy and society, while heightening anxiety across the international community and financial markets. These factors are increasingly influencing the dynamics of our industry.

The Trump tariffs are starting to negatively affect companies that rely on overseas exports. Overseas demand has dropped sharply since Trump’s tariffs were enacted, exerting downward pressure on the exchange rate and other key economic indicators. The High-end brand watches exported to the US, which typically have very low profit margins, seem especially vulnerable to the impact of tariffs.

In addition, the slowdown in China’s economy has dampened consumer demand overseas. The weakening economic sentiment is affecting market prices across our industry. Diamonds, in particular, are facing a prolonged slump due to the ongoing issue of synthetic and lab-grown stones. Prices of other products, particularly those in the higher-end segment, are also on the decline.

However, the prices of precious metals such as gold and platinum—key materials in jewelry production—continue to rise, leading to significantly higher costs for finished jewelry products. The economic downturn, coupled with surging product prices, has created a significantly tougher sales environment. While some prices are declining and others increasing, global inflation continues to complicate the picture, leaving the overall outlook uncertain and the business environment increasingly difficult to navigate.

Gold prices continue to accelerate, repeatedly hitting new record highs. A major factor driving this trend is the growing expectation of a substantial interest rate cut by the Federal Reserve, amid global political instability, rising unemployment in the United States, and a slowdown in job growth. Falling interest rates are boosting gold investment, and prices are expected to keep climbing. Other precious metals are also benefiting from this trend, with rising demand lifting their prices.

If the FRB cuts rates too aggressively, inflation may flare up again and accelerate. Combined with China’s efforts to expand the yuan-based economic sphere, there is growing concern over the weakening of the U.S. dollar. If inflation accelerates, it may dampen personal consumption, slow economic growth, and weaken the U.S. dollar—potentially contributing to a broader global economic slowdown. Close attention should be paid to the FRB’s forthcoming policy decisions.

Should the future international order fragment into multiple parties and impose economic barriers, the world will be divided into various blocks, and prices will rise even further, just like during the Cold War era. The free flow of people, goods, and capital has stalled, and global trade may face significant disruptions. Our industry risks being at the mercy of volatile future trends.

Although global economic conditions remained difficult, the Hong Kong Jewelry Show—Asia’s premier event—still attracted considerable attention and optimism. However, from the very first day, I had the impression that the visitor turnout was noticeably lower than in previous years. The number of buyers from China was limited, and due to political factors, there appeared to be a decline in buyers from Europe and the United States as well.

The show held near the airport featured not only loose diamonds, but also pearls, which had been selling well until now, decreased drastically due to the economic downturn in China, and companies dealing in products that rely on China seemed to be struggling considerably. I felt once again that the jewelry show held in Hong Kong was greatly influenced by China.

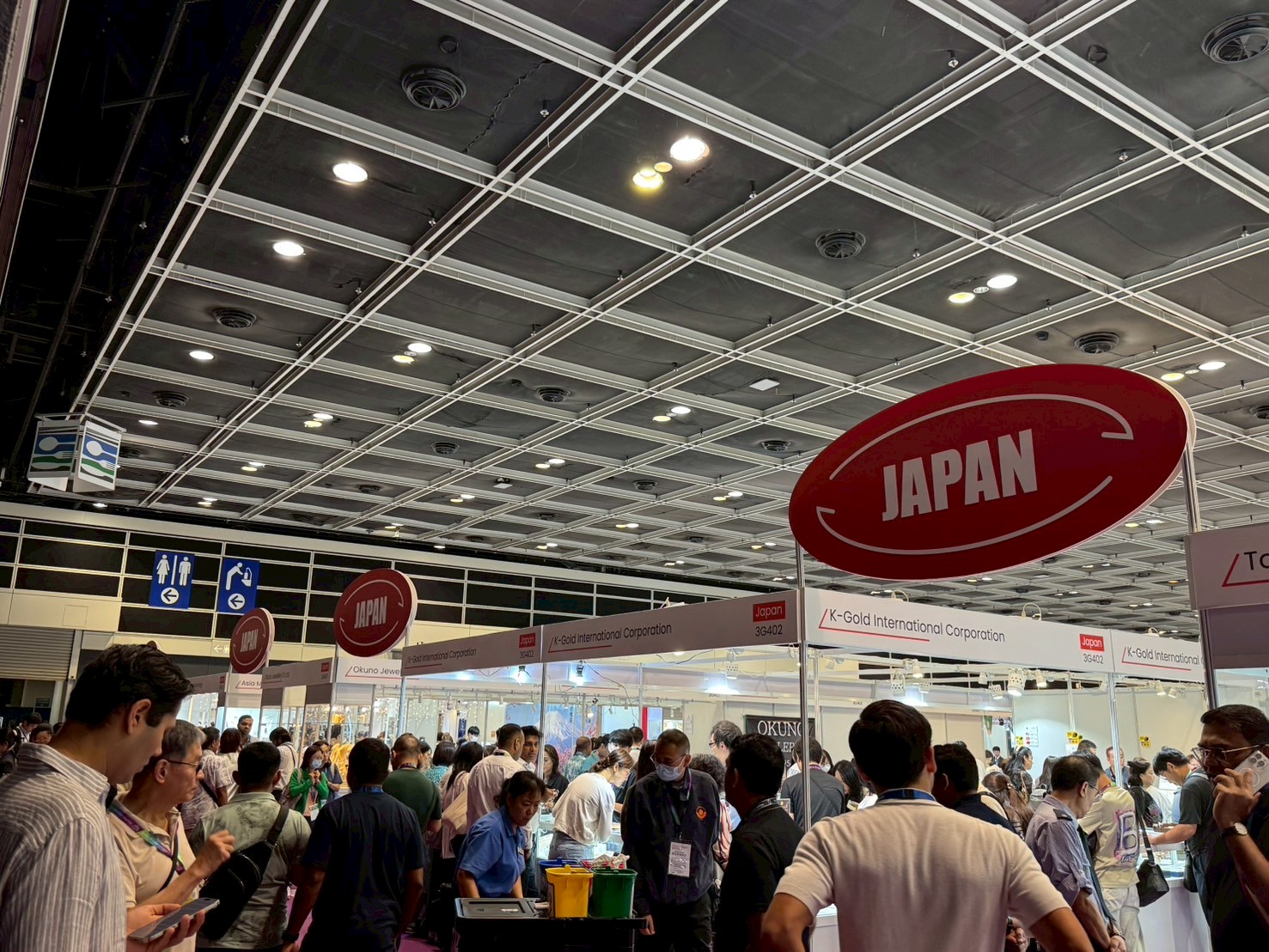

However, the Japan Pavilion at the convention center was bustling with activity at this show. Although raw material sales remain sluggish, Japanese-made products continue to enjoy strong demand among overseas buyers. Although there seemed to be fewer Chinese buyers than usual at the convention center, the venue was lively with buyers from ASEAN and other emerging markets with limited past purchasing activity.

Due to the current weak yen, Japanese goods appeared significantly cheaper to overseas visitors. With the current global inflation, Japanese price levels are low, and Japanese products also seem inexpensive. If the price levels between Japan and the rest of the world widens in the future, this trend may become stronger. Still, it shows that Japan’s national power is waning, so we can’t be entirely pleased.

During our visit to Hong Kong, we felt the city had changed dramatically. Hong Kong, once a vibrant and unique financial hub in Asia, has seen many of its residents emigrate overseas, leaving the city somewhat subdued. With the implementation of the National Security Law and accelerating inflation, many locals find life increasingly difficult both politically and economically. I was surprised to hear that even for dining, locals are skipping restaurants in Hong Kong and heading to Shenzhen, just an hour away, for more affordable options.

The jewelry exhibition in Hong Kong is likely to evolve considerably in the future, influenced by various global trends. This time, we had many visitors at our booth. We were grateful to welcome many visitors to our booth this year. We will continue to embrace change and take on new challenges. To all who visited us, we extend our heartfelt thanks. We look forward to seeing you again at the next jewelry show.