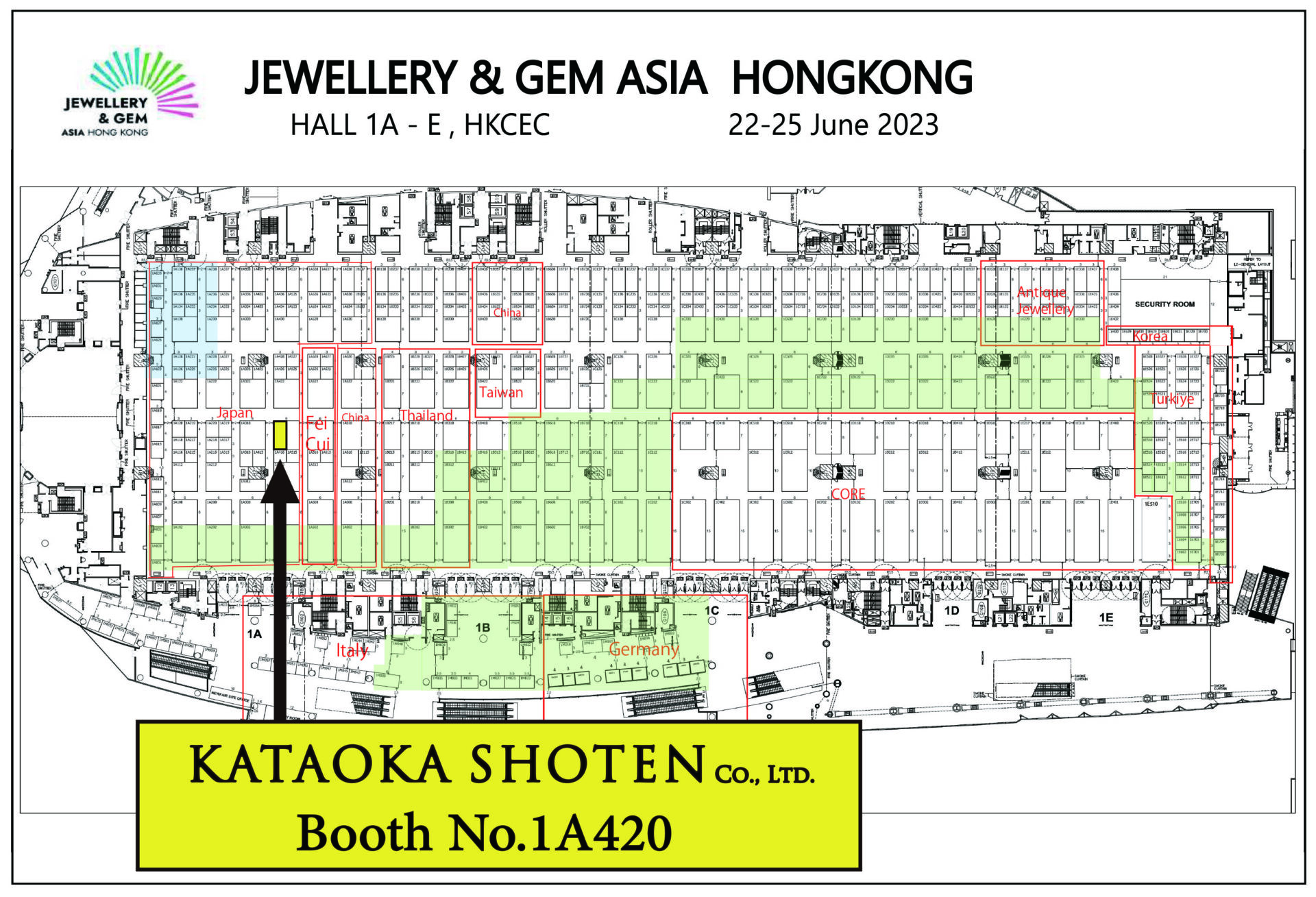

We had exhibited at the JEWELLERY & GEM ASIA Hong Kong, held at Hong Kong Convention & Exhibition Centre for 4 days from June 22nd to 25th, 2023.

Society and the economy were completely different before and after the pandemic, and the world is now approaching a turning point that may be said to occur only once in 50 years.

The era of low inflation and low interest rates is over, and we are finally entering an era of full-scale inflation. We may enter the era of the greatest inflation since the 1970s and 1980s. Moreover, unlike previous periods, inflation this time is likely to be driven by a shrinking economy due to a declining population, rather than the kind of inflation that occurred during the high-growth period, when companies made more and more money and the economy expanded due to population growth.

The major problem with this inflation is not simply that it is caused by excess demand, but that it is the result of a combination of various factors. The biggest factor is said to be quantitative monetary easing. Due to the pandemic of the new coronavirus, economic activities have stopped all over the world, and the money supply (currency supply) had increased tremendously. As a result, the amount of money supply has become too large and has become a factor in the progress of inflation.

In addition, the rise of China has changed the composition of the world. China has metamorphosed itself from the world’s factory to the world’s top consumer market. Considering the composition of the new Cold War structure and political risks, there is a widespread movement among many countries to withdraw their factories from China, which used to be the world’s factory. Inflation is also driven by the fact that if we manufacture goods outside China, the price of goods has to rise.

The issue of the war between Russia and Ukraine is also a factor in the progress of inflation. Russia is one of the largest resource-rich countries in the world. European countries imported natural gas from Russia through pipelines. Russia accounts for 40% of palladium production, and Ukraine accounts for 70% of neon production, which is used in laser light sources for semiconductor manufacturing. Krypton, which is used for the same purpose, accounts for 80% of global production in Russia and Ukraine together. Unless the war ends or alternatives come out, the price of these scarce resources will continue to soar.

Inflation is likely to be a factor that changes the structure of many industries in the future. The market price for most of the products in our industry has soared. A mismatch is beginning to occur between the market price of the product and the sales style that has been carried out for some time. Some products that have been at the store for several years are cheaper than current import and manufacturing prices, and in recent years there have been unthinkable situations where they are purchased by importers and wholesalers instead of users.

In a situation where goods of the previous market price cannot be sold in stores, it is difficult to purchase goods of the current market price, and without new goods, they may fall into a vicious cycle of losing customers and declining sales. As the deflation period of the past 30 years has finally come to an end and we have entered the era of inflation, the industrial structure of our industry is changing, and it will be difficult to remain if the structure was not be transformed. It would not be an exaggeration to say that the world trend is now approaching a major turning point.

The Hong Kong Jewelry Show, held under such circumstances, disappointed many exhibitors. The jewelry show held in March was a bubble-like affair, and most people expected the June show three months later to be just as lively. However, the show started off in a quiet atmosphere with an unprecedentedly small number of visitors.

One of the reasons is that The Shanghai International Jewelry Show was held in Shanghai, China, from June 22nd to 25th, at exactly same time as the Hong Kong jewelry show. It seems that many people who used to be the main buyers of the Hong Kong Jewelry Show had exhibited at this Shanghai International Jewelry Show and they did not visit the Hong Kong Jewelry Show.

Another factor seems to have been the start of Submission of Cash Transaction Report in Hong Kong on April 1.If a cash transaction of HK$120,000 or more is carried out, it is obligatory to declare the name, address, ID, etc. of the purchaser, and those who are uncomfortable with this requirement had been discouraged from purchasing. Until now, most transactions in Hong Kong by exhibitors from countries other than Hong Kong, including Japanese companies, have been in cash, and it is likely that this will continue to have an impact in the future.

The current inflationary trend was also another factor in this case. Today, the price of merchandise continues to rise. It seems that those who purchased a lot of goods at the Hong Kong show in March and the Kobe show in May hasn’t been able to sold out the purchased items yet. Under such circumstances, I had the impression that they were reluctant to purchase products at even higher prices. It seems that some people are starting to refrain from purchasing even pearls, which is in what could be called a bubble right now, because they are too expensive.

Many people felt the atmosphere at this jewelry show and said that the market price of the merchandise would go down in the future. In fact, there were many exhibiting companies that actually dropped their sales significantly, so it is possible that the market price will fall. However, it is difficult to imagine that the price of goods will fall in the current era of full-scale inflation, and it may be a sign of entering a state of stagflation. Our industry would change dramatically, and it will be more difficult than ever to keep up with future trends.

The Hong Kong show in June, which was held the first time in three years, seemed to be a turning point and a guideline for the industry in the future. We will work on future tasks and hope to see you all at the Hong Kong Jewelry Show in September. We would like to thank everyone who came to the event despite the difficult situations.See you all in September.