We exhibited at IJT Autumn 2025, which was held at Pacifico Yokohama over 3 days, from October 29 to 31, 2025.

With rising stock prices and a weak yen, Japan is booming with inbound tourism, and many places are crowded with people. As foreign capital continues to flow in and inflation accelerates, can this situation truly be called a bubble-like boom?

The election of Mrs. Takaichi as the new leader of the LDP, followed by her appointment as Prime Minister, has accelerated the depreciation of the yen amid growing expectations for a revival of Abenomics-style expansionary fiscal and accommodative monetary policies. Prime Minister Takaichi pledged to invest in AI, semiconductors, biotechnology, and other growth industries, prompting a rise in stock prices amid expectations of expansionary policies. This development is providing additional momentum to Japan’s export and manufacturing industries, and has triggered a notable influx of foreign capital and investment.

Meanwhile, rising import costs are placing greater financial pressure on non-exporting companies and households, with little sign of improvement in living conditions. The rise in the Nikkei average is primarily driven by foreign investors, which also carries the risk that funds could be abruptly withdrawn if global financial conditions change. Since the real economy and domestic consumption have not yet fully recovered, it seems that the divergence between stock prices and the real economy appears to be widening.

The large-scale monetary stimulus under Abenomics contributed to yen depreciation, which in turn enhanced export competitiveness. This led to increased corporate earnings, rising stock prices, and improved employment, producing short-term economic benefits. However, the prolonged reliance on a weak yen to support the economy led both the government and businesses to delay structural reforms. Consequently, Japan experienced a significant decline in the yen’s value and its international competitiveness. It could be said that despite appearances of prosperous, the reality suggests a steady downward trajectory.

Moreover, with little public awareness, the growing influx of immigrants to Japan, particularly from China, is influencing key sectors of daily life, including education, real estate, and business. There has been an increase in cases of entering Japan by applying for a Japanese highly skilled worker visa, which has less stringent conditions. An increasing number of people are living normally in Japan for over a year, registering their companies, complying with Japanese laws, and applying for income tax return and social insurance, leading to more individuals obtaining permanent residency.

Japan is strengthening its acceptance of foreign nationals to address declining birthrates and labor shortages, and is working to attract highly skilled professionals to spur economic growth. Therefore, Japan is creating new visas for investors and relaxing and expanding its visa system, in addition to the existing visas for management and highly specialized professionals. Japan offers a favorable climate, high levels of safety, and renowned cuisine, along with clean air and well-maintained cities. Coupled with the weak yen and China’s worsening economic outlook, these factors appear to be contributing to a sharp rise in immigration from China.

I’ve started noticing more Chinese residents in Japan, not just tourists, out and about on the streets. The number of Chinese children enrolled in educational institutions such as schools is on the rise, and Chinese investment in Japanese real estate continues to grow steadily. Vacation rentals driven by real estate investment are increasingly becoming a social concern. Moreover, acquisitions of Japanese companies by Chinese entities are becoming increasingly common. Chinese investment in Japan may surge, and a time could come when Japanese technology is leveraged to manufacture products domestically and export them back to China.

In the future, economic and political elites will likely emerge from among immigrants. As Japan sees a rise in highly skilled and influential immigrants, rather than predominantly low-skilled workers as in the past, it may be time to reconsider its immigration policy. Japan appears to be thriving due to the inflow of foreign capital, but it is time to ask how Japan redefines itself.

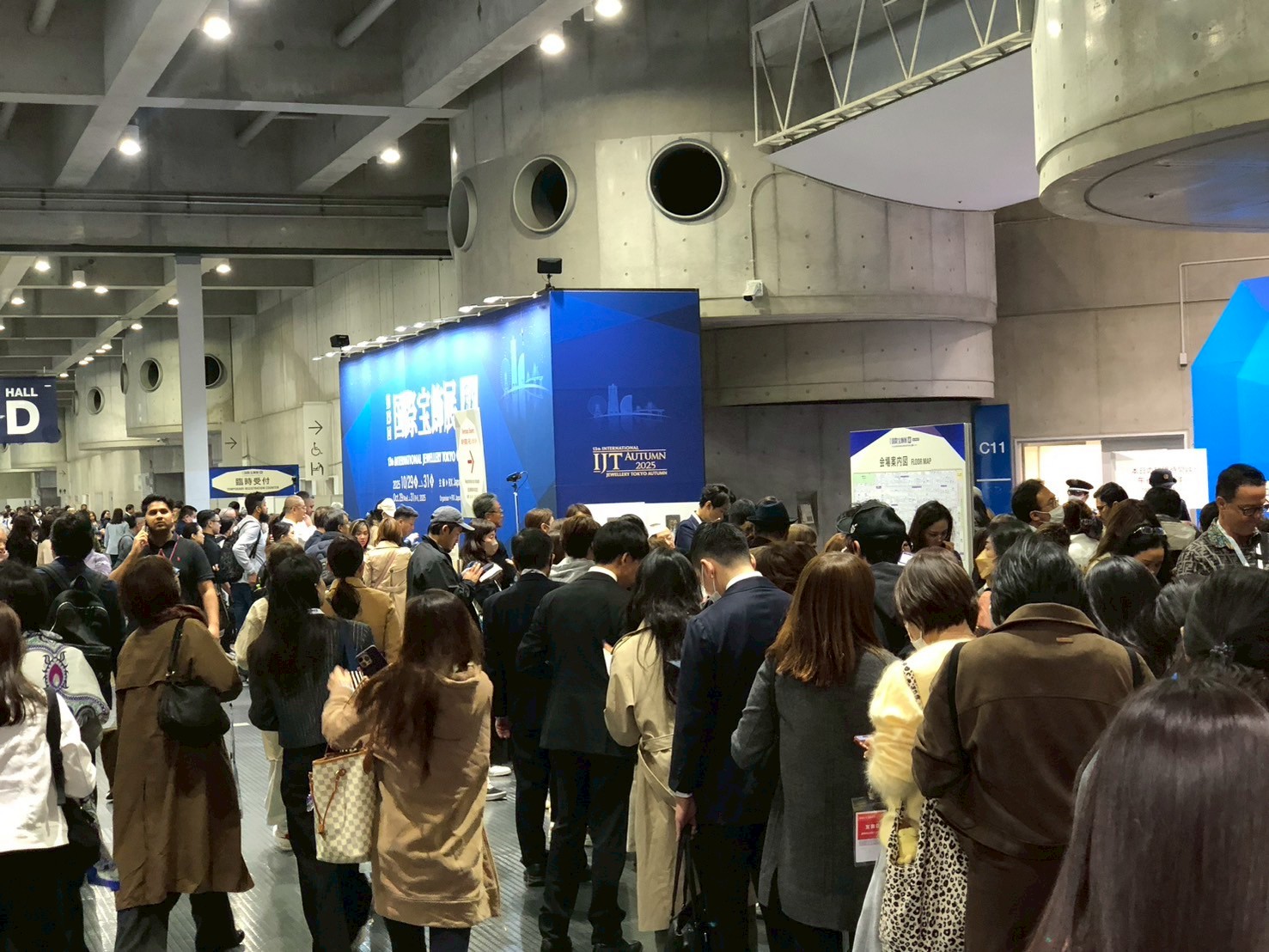

This jewelry show, held under such circumstances, was a show that truly evoked the power of overseas. Although the number of Chinese buyers appeared lower than usual due to China’s economic slowdown, the jewelry show was bustling with buyers from other countries. With the current weakening of the yen and rising prices of gold and other items driving investment, it was once again clear that Japanese-made products are extremely popular.

On the other hand, the number of Japanese buyers was relatively low, and the visitors seemed to be in a difficult situation. In Japan’s retail sector, the aging customer base and declining interest in jewelry among younger generations are becoming increasingly pronounced. Adding to this is the sharp rise in product prices driven by the weakening yen and persistent inflation, making it increasingly difficult to afford new purchases. Unless swift action is taken to respond to the significant changes in product prices, the situation is likely to become even more challenging.

This jewelry show reflected dramatic changes in pricing and significant market transitions, signaling the onset of a new era. Although jewelry sales are declining in Japan and China, we remain optimistic about the potential of emerging markets. Product prices are likely to fluctuate as they adjust to the dynamics of the new market.

Even within our industry, the contrast in market momentum between Japan and overseas has become increasingly evident. If current trends continue, Japan may see a growing outflow of premium goods to overseas markets, resulting in a domestic landscape increasingly characterized by lower-tier products. As Japan’s jewelry industry enters a new era, structural reforms have become increasingly urgent. Just as new digital markets like AI are thriving, our industry too must undergo transformative change now more than ever.

This year has brought many changes, and next year is likely to bring even more. Our participation in this jewelry show was our last exhibition for the year. We sincerely appreciate the continued support we’ve received over the past year. We extend our heartfelt gratitude, and we look forward to seeing you again at next year’s jewelry show.