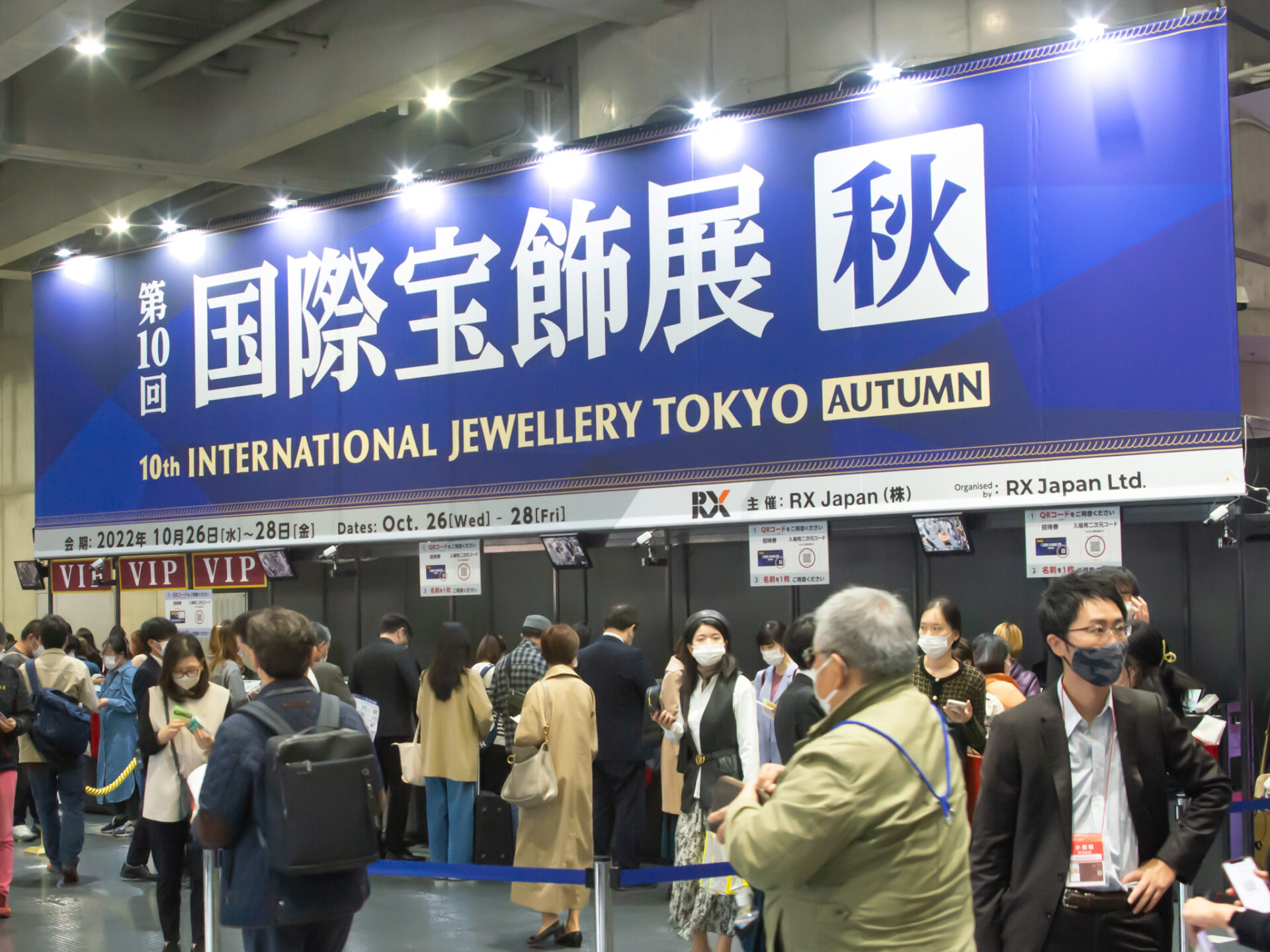

We had exhibited at the 10th International IJT Autumn 2022, held at Pacifico Yokohama, for 3days from 10/26/2022 to 10/28/2022.After two years, the situation of the corona crisis has become normalized, and people’s lifestyles and the way companies operate have changed significantly.In addition, the world economy has been hit hard by the factor of Russia’s invasion of Ukraine.

The unstoppable decline in the yen’s value in a profoundly changing trend may produce major changes in the future. Some believe that the yen’s depreciation is due to the difference in monetary policy between the U.S. and the Japan, and the other says that it is temporary caused by inflation by the factors such as the corona crisis and the Russia-Ukraine war, but it looks that the situation is more serious than that.

In terms of the real effective exchange rate, which indicates the real value of the yen relative to all major currencies, this depreciation of the yen has fallen to the level of 50 years ago, the lowest since 1972, and it is becoming increasingly plausible that the gross domestic product (GDP) in dollar terms in 2022 will fall below $4 trillion for the first time in 30 years, overtaken by Germany and become the fourth largest in the world. If the value of the yen continues to decline, Japan’s national strength will decline, and its position with emerging countries may be reversed in the future.

In fact, there is a lot of talk about inflation in Japan, and the prices of many things are rising, but the perspective view from foreign countries, they are quite cheap, and those who came from abroad or went abroad and returned are surprised by the low prices in Japan. If the entry of foreigners from overseas is eased in the future and the number of foreigners visiting Japan increases, people may realize how inexpensive Japan is and buy Japanese assets, just as Japanese companies and individuals used to buy up overseas assets during Japan’s high economic growth period.

The trend of globalization of the world economy is starting to flow back due to the principle of nationalism and the global supply chain is being disrupted. Six months have already passed since Russia’s invasion to Ukraine, and in the meantime, energy prices such as oil and natural gas have skyrocketed. Also, extreme weather caused by global warming is causing tremendous damage around the world. These inflationary forces are deep-rooted problem and will not be easily solved.

For the past 20 years, especially developed countries have been supplying an unusually large amount of funds. A massive amount of money that has nowhere to go flowed into the financial market, such as the stock and bond markets, inflating a bubble without a sense of bubble. And now, due to full-scale inflation, that money is likely to head for the next investment destination, real assets at the inflation site.

In our industry, this inflation has been a major game-changer, too. The cost of merchandise continues to rise by the inflation. However, due to the sluggish economy, it is difficult to keep up with the current market price in Japan. Conversely, foreign buyers who feel that Japanese merchandise is undervalued due to the sharp depreciation of the yen are purchasing more than Japanese companies.

Starting with China, the United States, the Philippines, Vietnam, Indonesia, Malaysia, and other countries are gaining recognition for Japanese commercial materials, and good ones are being exported overseas. I think this trend is likely to continue for the time being. In Japan, it is an urgent issue to take countermeasures that can lead to sales in response to the current market sentiment and future market sentiment.

The current situation in Japan is considered quite severe. However, the historic depreciation of the yen, along with the current heightened risk in the world, may be the perfect opportunity. Wage levels in Japan, which are relatively cheap among major foreign countries, and the current depreciation of the yen, which further lowers production costs, are major tailwinds. It seems that there are ways to strengthen the domestic economy, such as returning to production bases and capturing the inbound market, and attracting foreign capital. I believe that this difficult situation can be overcome if Japan is able to demonstrate its inherent strengths.

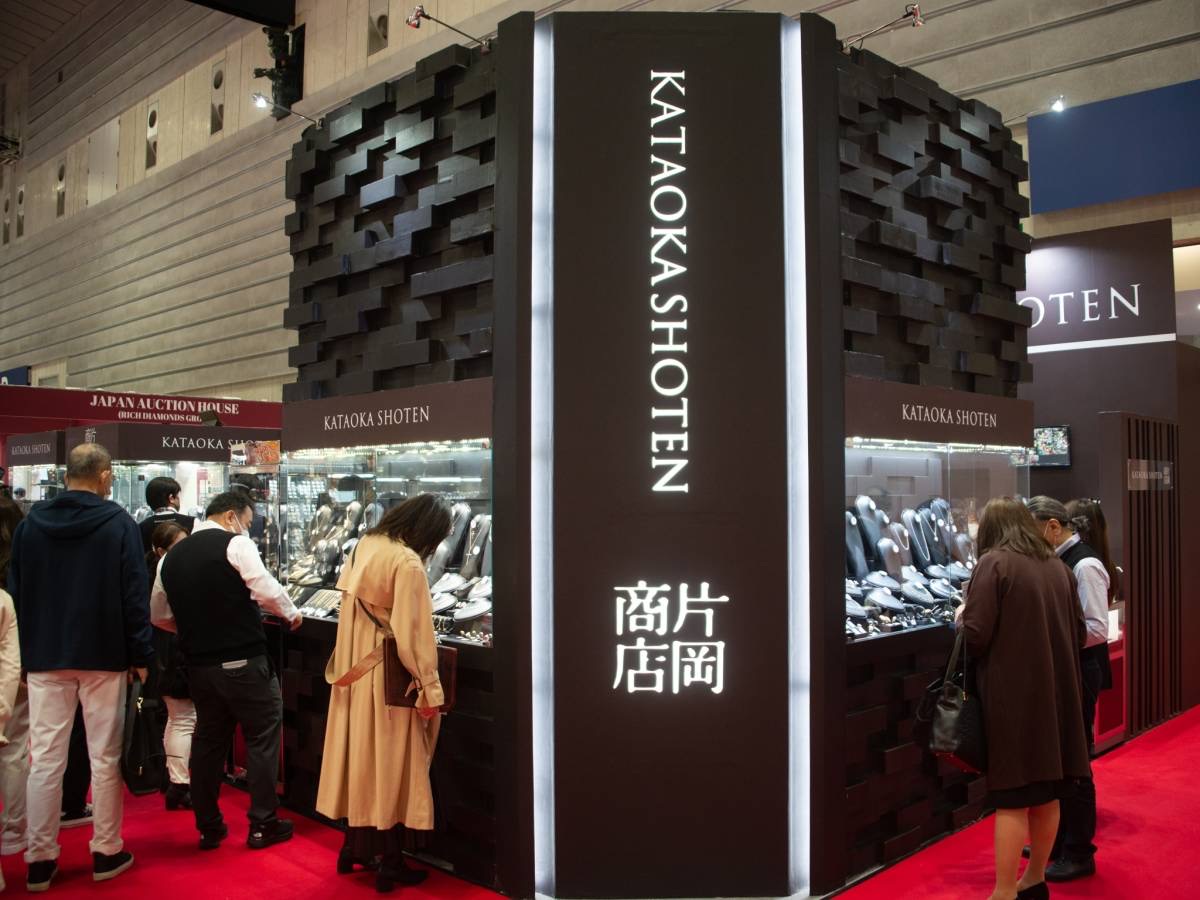

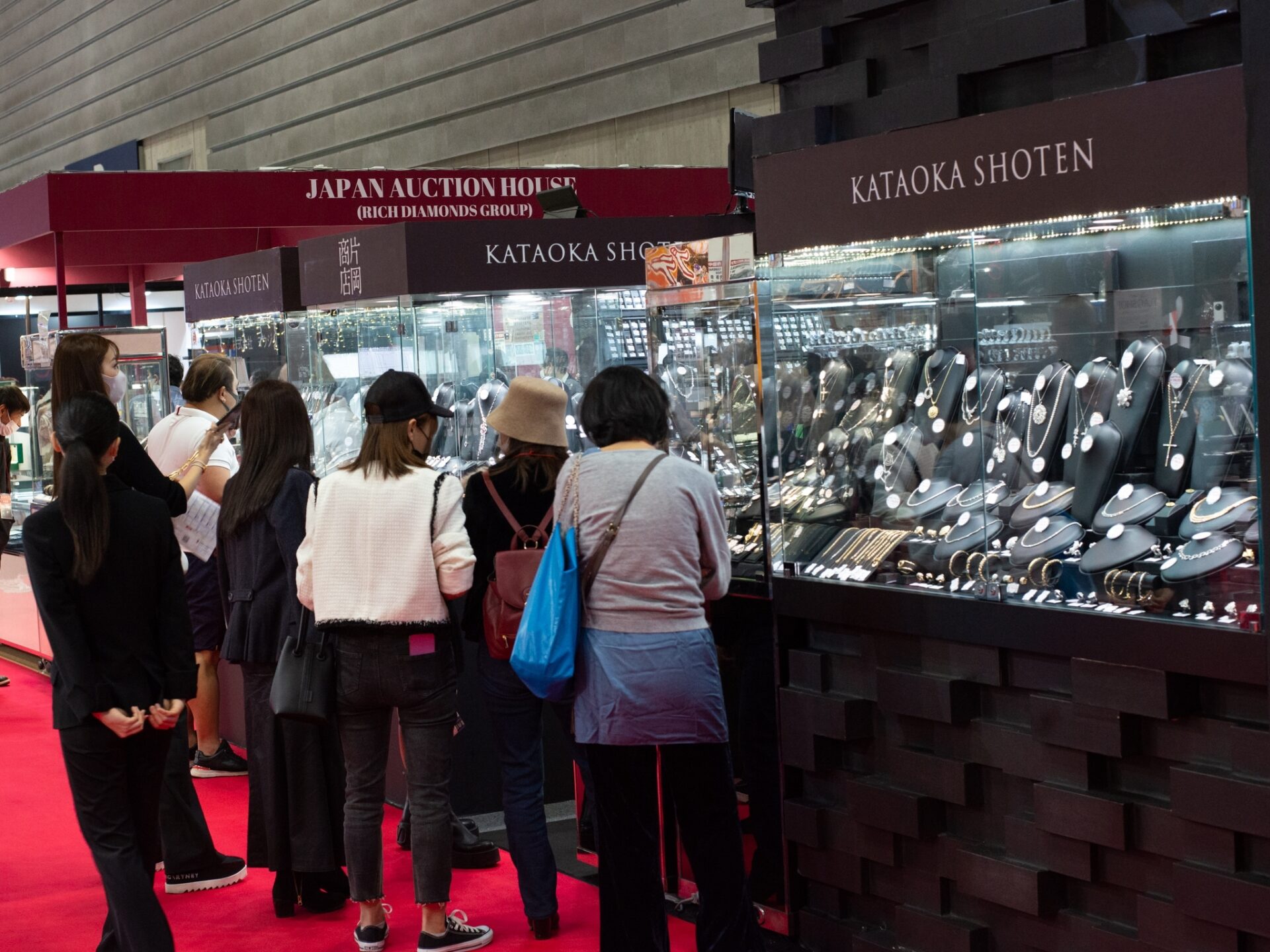

This jewelry show, held under the current harsh Japanese environment, seemed to have an atmosphere that could not be overstated as a show for live commerce. As if to represent the sign of changing times, the buyers export products overseas by making full use of SNS. It seemed that the exhibition was more lively than before with the fact that the yen is weak. This trend will probably continue to accelerate in the future.

Due in part to the simplification of immigration from overseas, we saw many overseas buyers this time. In addition to the popularity of Japanese jewelry, overseas buyers with a surplus of money were eager to purchase due to the current rapid depreciation of the yen. Another reason is that the jewelry show in Hong Kong is unlikely to be fully reopened, and Japanese companies are not being able to exhibit in Hong Kong at this moment. These are the reason why foreign buyers have no choice but to come to Japan to buy Japanese jewelry.

This year’s jewelry show was one in which we felt the difference between Japan and other countries. In Japan, the number of working-age people is decreasing due to the declining population, and there are also problems with the way people work and the motivation to work. Then, with the recent sharp depreciation of the yen, the outflow of foreign workers has started, and if the yen continues to weaken in the future, even Japanese may leave for overseas jobs.

The situation in Japan is becoming quite severe, but we will keep a close eye on the situation in Japan in the future and continue to work hard so that we can make better suggestions to those who visit us.This time, many people came from the first day to the last day in an atmosphere reminiscent of the pre-pandemic situation. We sincerely thank you for visiting our booth, and would appreciate if we could work together with you to build better business relation next year.