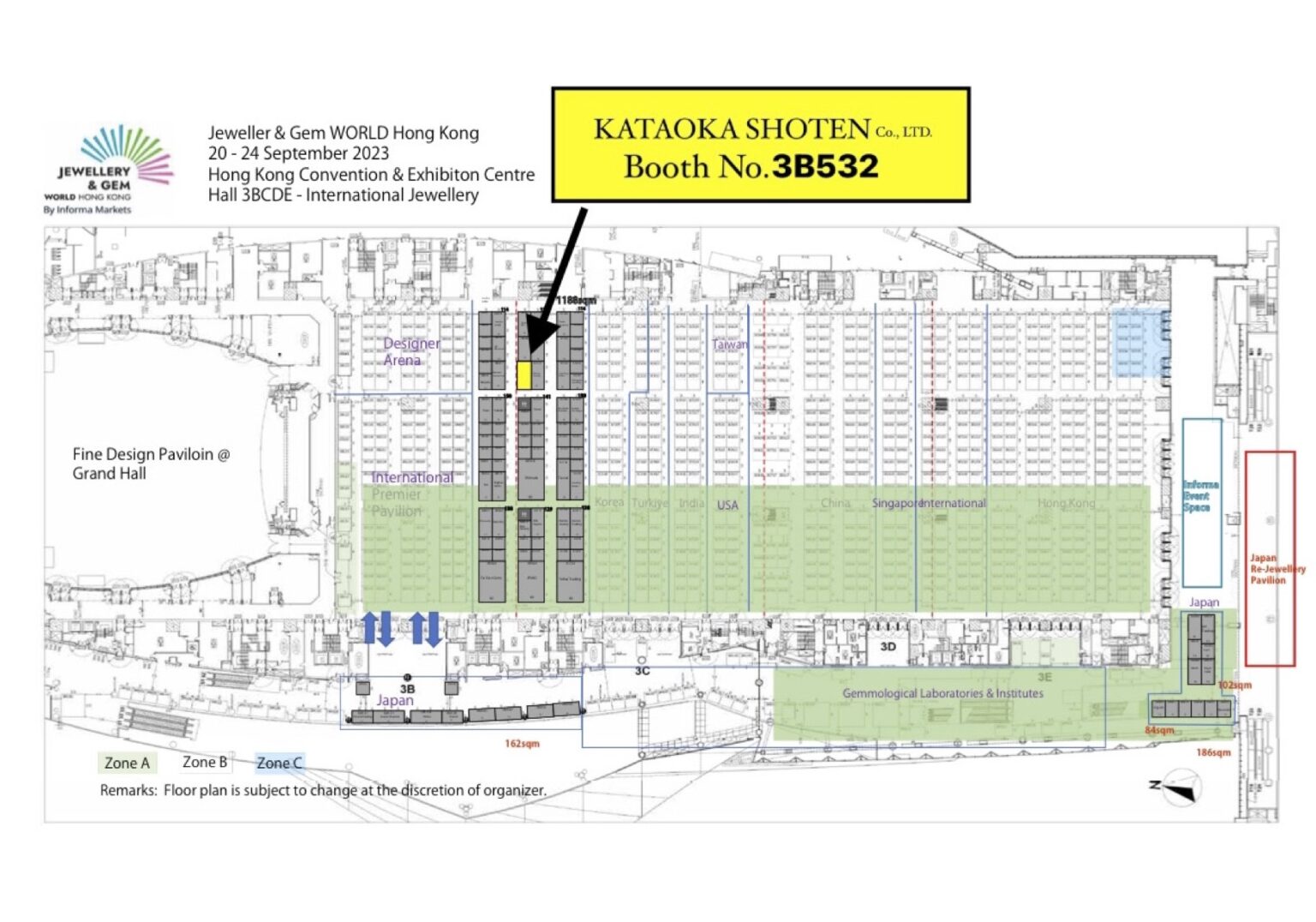

We had exhibited at Jewellery & Gem WORLD Hong Kong, held at Hong Kong Convention & Exhibition Centre for 5 days from September 20 to 24, 2023.

A global recession, including China, has become a reality and is beginning to spread to the rest of the world. In China, the growth rate trend is rapidly decreasing, partly due to the declining population growth rate. Lower expectations of future growth have created an oversupply structure through suppressed demand, and the risk of double deflation has increased as real estate prices and price increase rates have fallen sharply to the downside. There are concerns that Chines economy would follow a path similar to the post-bubble Japanese economy, which fell into a long-term slump.

Chinese real estate giant Evergrande Group filed for Chapter 15 bankruptcy protection on August 17th. 60% of the company’s assets are office buildings and condominiums that are under construction, and 70% of its liabilities are outstanding payments to construction companies and others. Many projects have been halted due to delays in payments to construction companies.

In China, the purchase of a condominium is based on full payment in advance, and the developer could obtain cash first, rather than handing it over after completion as in Japan. Although financing should have been easy, the company ended up filing for bankruptcy. The company is in the process of restructuring its business, but if the company were to officially go bankrupt, huge amounts of unpaid debts to construction companies and other parties would become apparent, which in turn could lead to a widespread chain of bankruptcy involving construction companies and their business partners.

At the same time, real estate giant Country Garden is also reported to be on the verge of bankruptcy. Approximately half of the company’s assets are also under construction, and most of its debts are unpaid to construction companies. The company’s locations are spread throughout China, including rural areas, and there are concerns about the impact on local economies in the event of the company’s bankruptcy.

This real estate slump has prevented the region from attracting more companies, and revenues from the sale of land-use rights by local governments have plummeted, causing the debt of Local Government Financing Vehicle, an infrastructure investment company under the Chinese local government, to swell. The debt is expected to swell to 100 trillion yuan (approximately 2,000 trillion yen) by 2027. Urban Investment Bonds issued by LGFVs are believed to be mainly purchased by individuals and companies holding bank wealth management products and trust products for investment purposes, public and private funds, as well as insurance companies, creating a situation where LGVF risk could spill over into the financial system.

The People’s Bank of China (PBC) has been cutting interest rates in response to a sense of urgency over the weakening demand for funds from businesses and households due to the economic slowdown, and the declining in bank lending due to increasing deflationary fears caused by sluggish domestic demand. Historic inflation is reaching its peak, and the goal may be in sight for the rapid interest rate hikes by central banks in developed countries. If China’s GDP declines by 1%, the global growth rate is expected to be pushed down by 0.4%, and Japan’s by 0.3%.Changes in the Chinese economy are becoming a risk to the global economy.

China, which has transformed from the world’s factory to the world’s market, has enormous influence on our industry. Since March, when corona restrictions were eased, global markets have reopened as a result of post-COVID, and our industry had been very active and the atmosphere was good, and prices of each commodity had been constantly rising. However, the situation changed all at once due to the uncertainty of the Chinese economy, which began with the real estate recession in China.

The mood in foreign markets has deteriorated and the prices of various commodities begun to decline. The prices of products in the high price range have fallen significantly due to the wait-and-see situation. Diamonds, in particular, prices have fallen significantly due to the influx of lab-grown diamond into the market.

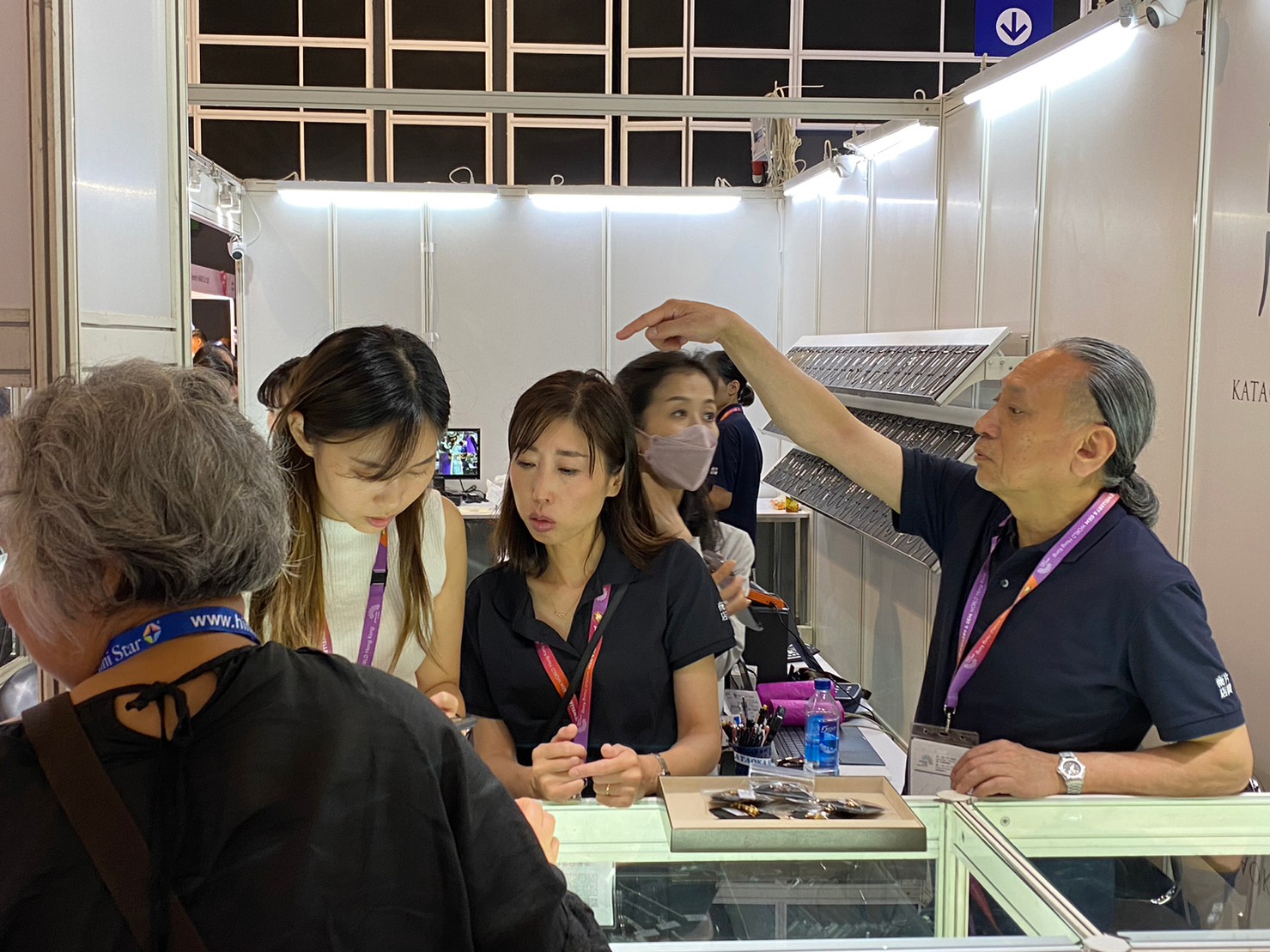

The first day of the jewelry show began with a somewhat bleak but not deserted crowd. Buyers’ requirement is even stricter than before, perhaps due to the current economic situation, and unless the quality and price matched the product, they would not purchase. And, there seemed to be fewer business negotiations where people wanted to buy something because it might sell like before. The range of commercial products that buyers needs becoming considerably narrower.

In the current situation where the market prices of products are falling due to the economic slowdown, there were many exhibitors with merchandise whose prices were too high, and there were many cases where business negotiations were not successful. While pearls and gold prices continue to rise, prices of many other products have fallen significantly in recent months. While the current shortage of goods causes high auction prices, it has become very difficult to judge future trends under the sluggish in sales outlets.

I mentioned the poor business confidence in China, but due to digitalization, China’s economy is spreading from central cities to small and medium-sized cities, and income gap is gradually narrowing. As the digital generation emerges and the scale of consumption expands throughout China, China will likely achieve further development.

Our current industry, which has no choice but to rely on China, is likely to be in a difficult situation if we do not pay close attention to future trends in China and respond to these changes. Although under such a difficult circumstance, we thought that we were able to have more people than expected. We would like to express our sincere gratitude to everyone who came this time. Thank you very much and see you again soon.