Happy New Year. We sincerely appreciate the exceptional support and kindness you extended to us over the past year. This year is expected to bring significant changes, and we are committed to responding swiftly and meeting your expectations. We look forward to your continued patronage and support in the year ahead.

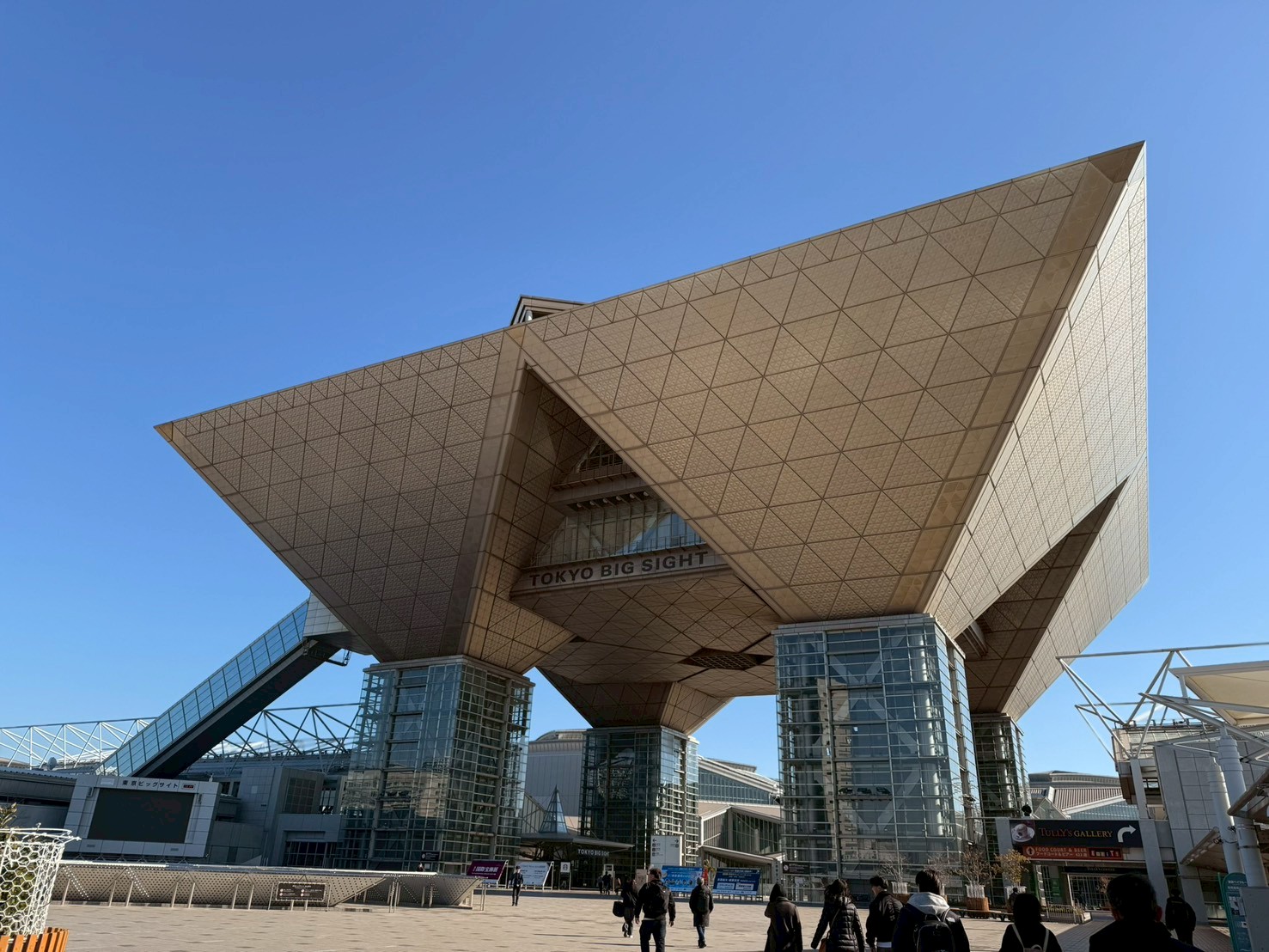

We exhibited at the 37th International Jewellery Tokyo (IJT 2026), held at Tokyo Big Sight for four days from January 14 to 17, 2026.

Due to the weak yen and rising energy prices, 2025 became a year of accelerating inflation, with the cost of daily necessities and other goods increasing across the board. It was also a year when Japan was booming with foreign tourists, as inbound tourism surged due to the weak yen. Furthermore, the yen’s depreciation has provided a strong tailwind, particularly for large corporations, and has also contributed to the rise in Japanese stock prices. On the other hand, companies that rely on domestic demand, as well as small and medium-sized enterprises, were unable to pass on rising costs to their prices, resulting in a widening gap between firms.

It was also a year in which division became the norm in both international politics and the global economy. In particular, in U.S.–China relations, sectoral conflicts and divisions have become the norm, especially in the areas of semiconductors, artificial intelligence, and security. In the financial sphere, while central banks around the world signaled the end of their rate‑hiking cycles, they refrained from abruptly easing monetary policy, making a world of higher interest rates the new normal. The world’s reliance on excessive, debt‑driven growth has diminished.

Despite having avoided a major recession, the global economy lacks the prerequisites for high growth, resulting in structurally entrenched low growth. The concentration of industries shaped by political factors is expected to intensify further in 2026. In particular, sectors such as artificial intelligence, energy, and security are projected to expand in ways closely aligned with national strategy, while traditional consumer‑driven industries are likely to stagnate. If growth occurs only in specific sectors instead of the economy as a whole, additional disparities are likely to arise.

In 2026, the Takaichi Cabinet’s policy direction and the global economic environment, including the effects of Trump-era tariffs, are expected to play a major role in shaping Japan’s economic outlook. It is becoming increasingly difficult to separate politics from the economy, making it all the more necessary to consider the two as an integrated whole. It is likely to be a year in which the direction of politics, the ability to adapt to the international environment, and the sustainability of the economic structure will all be put to the test.

Moreover, heightened awareness of global economic uncertainty and geopolitical risks has driven investment funds into gold, based on its perception as a relatively safe asset. The resulting surge in gold prices is also likely to become a major factor reshaping our industry this year. Last year, gold prices rose by 70%, and early‑year tensions between the United States and Venezuela suggest that gold, as a safe‑haven asset, may rise further this year.

In addition, silver and platinum prices are also surging, driven by the sharp rise in gold. Since silver and platinum have much smaller markets than gold, even relatively modest capital inflows can cause significant price movements, so I’m very interested in how they will behave going forward. However, prices of silver and platinum have more than doubled to record highs, and jewelry products made primarily from precious metals, including gold, are now facing a significant price mismatch with the retail market. While investment in precious metals continues to grow, the slowdown in jewelry sales appears likely to reshape the structure of the industry in the years ahead.

The Tokyo Jewelry Show, held under these circumstances, began with fewer visitors than in previous years. The current travel restrictions imposed by China on trips to Japan had a significant impact, resulting in a sharp decline in the number of Chinese buyers. Recently, the number of visitors from Japanese retailers has been declining, so the atmosphere felt somewhat underwhelming, despite it being the largest jewelry show held in Japan.

It also seemed that the recent surge in precious‑metal prices had created a somewhat unsettled atmosphere. Indeed, the listed prices differed noticeably from those seen just a few months ago, and many visitors appeared unable to hide their surprise at the changes across the various exhibitors. Because prices are higher than before, many people said they would not be able to sell the products even if they purchased them, and it seemed that many therefore refrained from buying. In many cases, existing inventory is priced lower than current market levels, so the situation is understandable.

While some buyers were holding back on purchases, many others were increasing their procurement out of the belief that prices would continue to rise and that certain products might become unavailable in the future. In fact, many exhibitors reported strong sales, and despite the sharp decline in Chinese buyers, a surprising number of booths still appeared quite lively. Polarization in procurement is likely to continue going forward.

At this jewelry show, despite a sharp decline in the number of Chinese buyers and a decrease in Japanese visitors, many exhibiting companies reported strong sales. The main reason appears to be that, due to the recent surge in precious‑metal prices, much of their inventory had been purchased before the spike and was therefore cheaper than the current market level, attracting buyers who were specifically targeting these lower‑priced goods. If the market shifts in the coming period, it will likely become increasingly difficult to determine whether to pursue an aggressive purchasing strategy or adopt a more restrained approach, given the uncertainty surrounding the industry’s direction.

Furthermore, I am also concerned about the situation in which the global financial market is bubbling due to a surplus of money. With excess money combined with rising inflation, an investment boom has emerged; however, the bubble could burst if any key factor goes wrong. If the bubble bursts, it will trigger severe asset deflation and lead to higher interest rates. At that point, the situation in our industry is likely to change even further.

We have seen significant changes since the start of this year. Even in such conditions, we were pleased to welcome many visitors to our booth. Despite the sudden changes in the situation, most people remained forward‑looking, and we had many opportunities to discuss how the future might unfold and how we should navigate it. These conversations gave us a valuable chance to think positively, even in such a challenging environment.

In the year ahead, we will remain committed to meeting your expectations as we navigate new conditions. It is our sincere hope that we can work together to overcome the challenges that lie ahead. We extend our heartfelt appreciation to all who visited us. Thank you for your support, and we look forward to working with you again this year.