We had exhibited at Japan Jewellery Fair 2019, held at Tokyo Big Site West 1・2 Hall & Atrium, for 3 days from 28/08/2019 to 30/08/2019.

The environment surrounding the world is worsening. U.S. President Trump had announced that he would invoke the Fourth Sanctions against China, which imposes tariffs on almost all Chinese products, and China has announced a moratorium on purchases of agricultural products from the U.S. as a sanction against his announcement.Furthermore, in order to gain an advantage in exports, China strengthened the depreciation of the currency and lowered the exchange rate to 7 yuan to the dollar, for the first fall in 11 years. On the other hand, the U.S. has designated China as a currency manipulation country, and the conflict between the two countries had been deepening. Additional tariffs are accelerating relocation of the overseas factories from China, while the imposition of tariffs in the U.S. is hurting consumers.Both the U.S. and China are now facing an unwinable crisis that undermines the global economy.

The unilateralism and protectionism of the U.S. has severely disrupted the global situation and has had a major impact on the world’s economy and finance. Concerns about the worsening of the global economy have increased and stock prices are falling all over the world. In the U.S., NY stocks have lost $ 1147 since the announcement of additional tariffs, the biggest decline in this year and other countries are also seeing total declines.In addition to the plunge in stock prices caused by the conflict between the U.S. and China, the currency peso and stock prices plummeted in response to unexpected results in the presidential primaries in Argentina.The Hong Kong market also saw a plunge in value due to the intensifying demonstrations. Both political and economic factors have affected the situation.

Risk evasion attitudes are strengthening globally from the current situation, and global money is looking for safety and is moving toward gold, yen, and government bonds. Gold has increased the value around $ 350 over the past year, reaching 6 year high of over $1500, and the yen has also risen sharply to 105 against a dollar.The yield on 10 year government bonds issued by the U.S. and the U.K. fell below the yield on 2 year government bonds, for the first time in 12 years in the European government bond market. This phenomenon, long-term and short-term interest rates reversed, is referred as the ”reverse yield”. This is believed to indicate a future recession, and the financial market is raising anxiety about the situation for the first time since 2007-2008 at the time of the financial crisis.

The reemergence of trade friction between the U.S. and China has led to a slowdown in the global economy and a decline in corporate profits. Japan’s business performance has also begun to deteriorate, with listed companies reporting a 15% decline in net income in the April-June quarter compared with the same period last year, with manufacturing reporting a 45% decline. The impact is expected to increase further after July. There are also increasing number of zombie companies around the world who are unable to cover interest payments on debt.

There exist about 5300 companies around the world, number have doubled since 10 years ago, accounting for 20% of the 26,000 listed companies (excluding finance) in Japan, the U.S., Europe, China and Asia. An increasing number of companies have become financially weak due to an increase in interest payments despite a decline in interest rates as their liabilities continue to swell due to excess expenditures. As a result of monetary easing, even companies with weak profitability and finances can rely on debt to prolong their lives. The FRB is cutting interest rates for the first time in 10 and half years, and the world’s central banks are starting to follow with strong monetary easing. This monetary easing is expected to increase the number of zombie companies. If business performance deteriorates due to a slowdown in the real economy and the procurement interest rate of zombie companies with weak finances rises, there is the possibility of a series of funding failures, and this issue is also a risk for the global economy.

Because of sluggish sales due to the economic slowdown, the market price of our industry is declining. Diamonds are particularly noticeable, and their prices are falling due to sluggish sales overseas, especially in India. Many people in the industry believe that the future will be even worse and there might be further decline in prices. The price of high-priced range of colored stones has also dropped unless they are very rare. The global economic slowdown is starting to have a major impact on our industry.

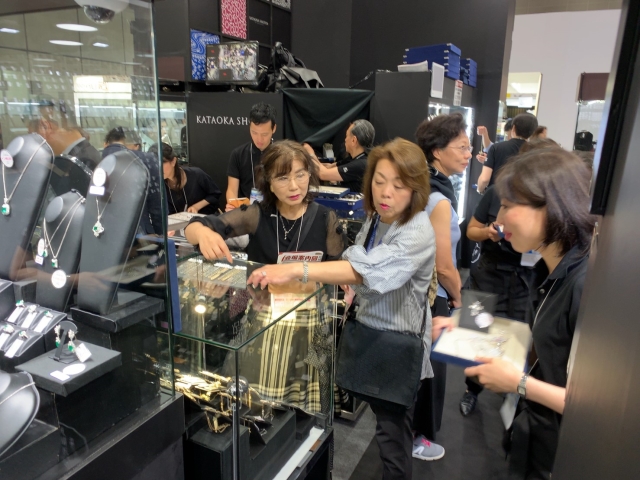

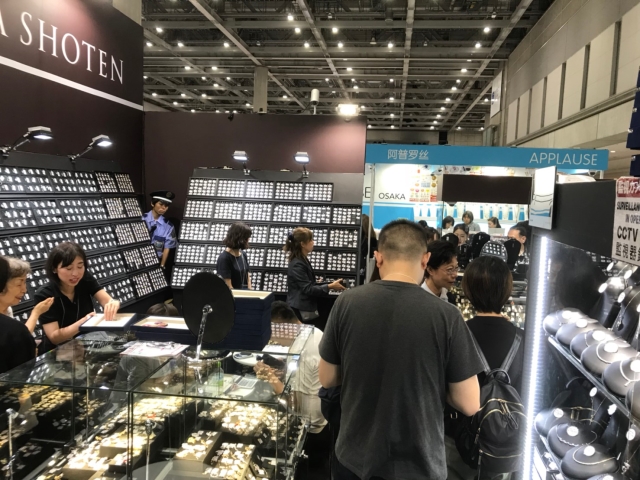

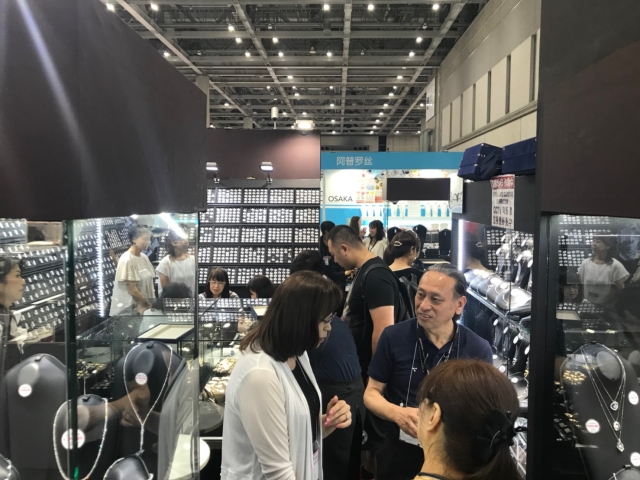

Under these circumstances, this jewelry show was held as the perfect timing for the last-minute demand before the consumption tax hike in October and the business battle before Christmas. However, it seemed that this jewelry show was very quiet because there were few visitors compared to the previous show due to the current global situation. The number of buyers from overseas was also very small, and I felt that they were less willing to buy. It was the last chance for Japanese before the tax increase in October, but there were many voices that it was not relevant because the current situation was too bad. Regardless of the current political and economic situation, the jewelry show itself has become a mannerism with the same kind of planning and atmosphere every time, and it seems to be a factor that the number of visitors decreases year by year. I think that it’s probably about time for the jewelry show itself to be questioned how it should be.

This jewelry show was held at a difficult time due to a combination of negative factors worldwide. We would like to express our heartfelt gratitude to all of you who came to our booth at this time.

Most of the people who came here this time were philosophical about the current situation, and all of them were positive about what they should do in the future, and on the contrary, I received energy. We will strive hard to overcome this difficult situation together with you. I hope to see you again at the next jewelry show.