We had exhibited at the 12th International Jewelry Tokyo Autumn (Autumn IJT), held at Pacifico Yokohama for 3 days from 23/10/2024 to 25/10/2024. With the election of new Liberal Democratic Party President Ishiba on September 27, Japan is entering a phase of great change.

At the beginning of next week, 30th on Monday, the Nikkei average fell sharply by 1,910 yen to 37,919 yen level, the largest drop since the 1990s on the first day of trading after the new president was selected. The uncertainty of the new president’s policy seems to have caused this situation. He has expressed his desire to strengthen anti-Abenomics and tax on financial income, and foreign investors seem to be wary of the possibility of a headwind in the stock market.

On the 30th, in the foreign exchange market, the yen against the dollar rose to 141 yen, the first time in about two weeks that the yen has appreciated against the dollar. In addition to the new president not ruling out further interest rate hikes by the Bank of Japan, the reduction of interest rate differentials between Japan and the United States is expected to accelerate as a result of the Fed’s interest rate cut. And, the strong yen could lead to a decline in the operating profits of export-related companies, which might have an impact on their performance.

The new president then met with the governor of the Bank of Japan and expressed his view that the environment was not conducive to raising interest rates. In addition, the U.S. employment statistics released on October 4th showed growth that significantly exceeded market expectations, and the strong market supported consumption and the expectation that the economy would remain resilient through the first half of 2025, led to a broad sell-off of U.S. Treasuries. The rise in US interest rates encouraged dollar buying, causing the yen to the 149 yen level to the dollar for the first time since the end of August. It is necessary to keep a close eye on the situation as it changes rapidly due to politics and the economy.

Surplus funds in the market are drawn up by foreign financial institutions and investment funds and invested in markets such as New York. Then, US banks and investment funds lend to emerging markets in search of higher investment returns. China, which has enjoyed a booming economy until now, is a good example. The rise in Japanese stock prices appears to be due to the slowdown of the Chinese economy, and international investment funds that had been heading toward financial markets such as Chinese stocks, flowing into the Japanese stock market.

The real economy should not be doing so well, but only stock prices are abnormally high in Japan. In fact, the number of bankruptcies of small and midsize companies in Japan is accelerating. The number of corporate bankruptcies in the first half of 2024 exceeded 5000 for the first time in 10 years. Rising prices, a shortage of human resources, a lack of response to changing times, and the full-scale repayment of zero zero loans which was the government’s financial support program for the Corona disaster, seem to be the main reasons. Rising interest rates are also likely to be a factor in increased bankruptcies in the future.

Furthermore, the outcome of the U.S. presidential election in November will significantly change the world situation. The world has the potential to become even more chaotic due to a cultural clash between the two regions: Western countries around the G7, and the Global South where is a new economic zone that includes Russia, North Korea, Iran, and developing countries in the southern hemisphere, which gathering around China. We must pay close attention to the future stance of Japan in the world and the changes in the situation.

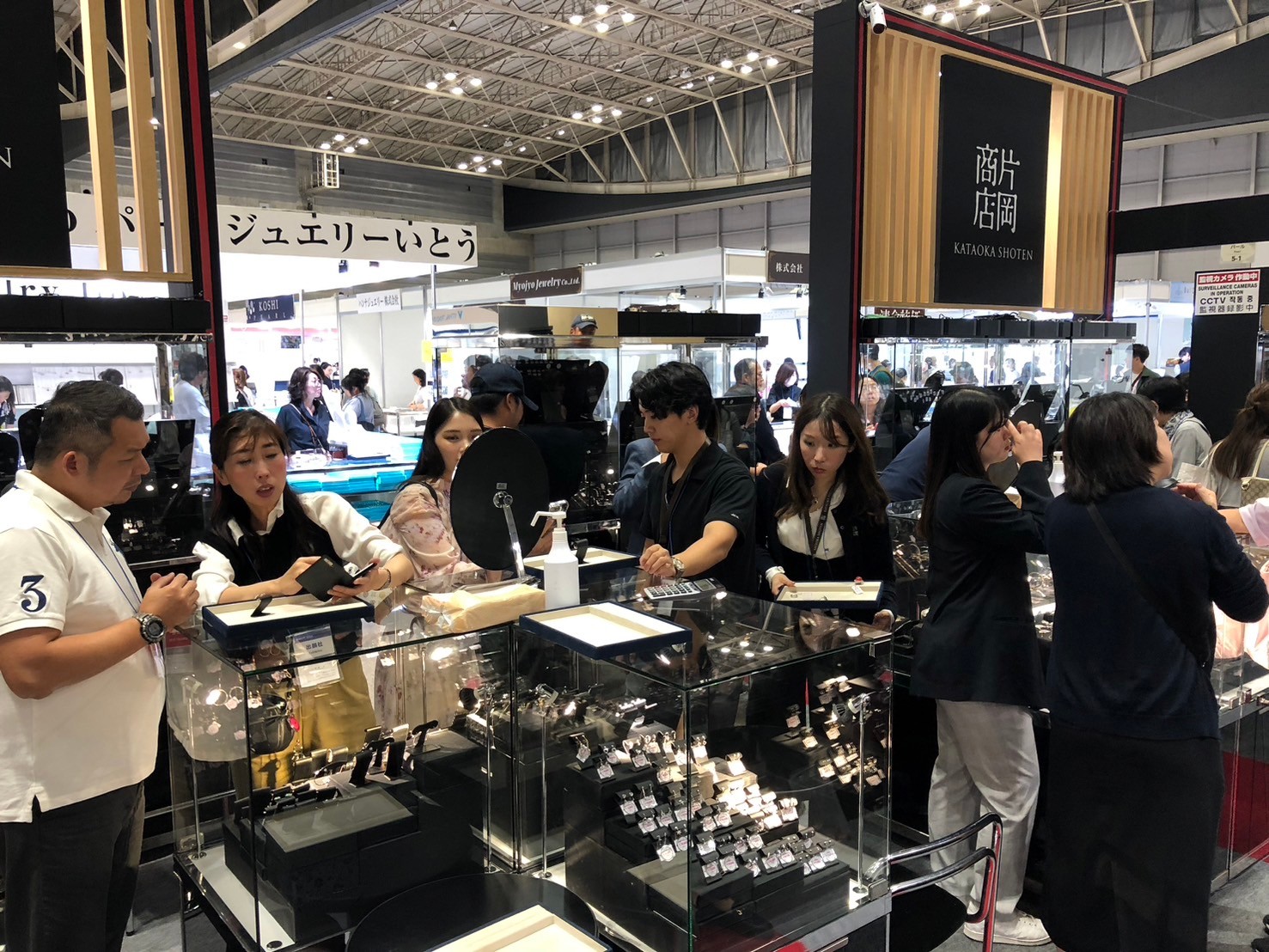

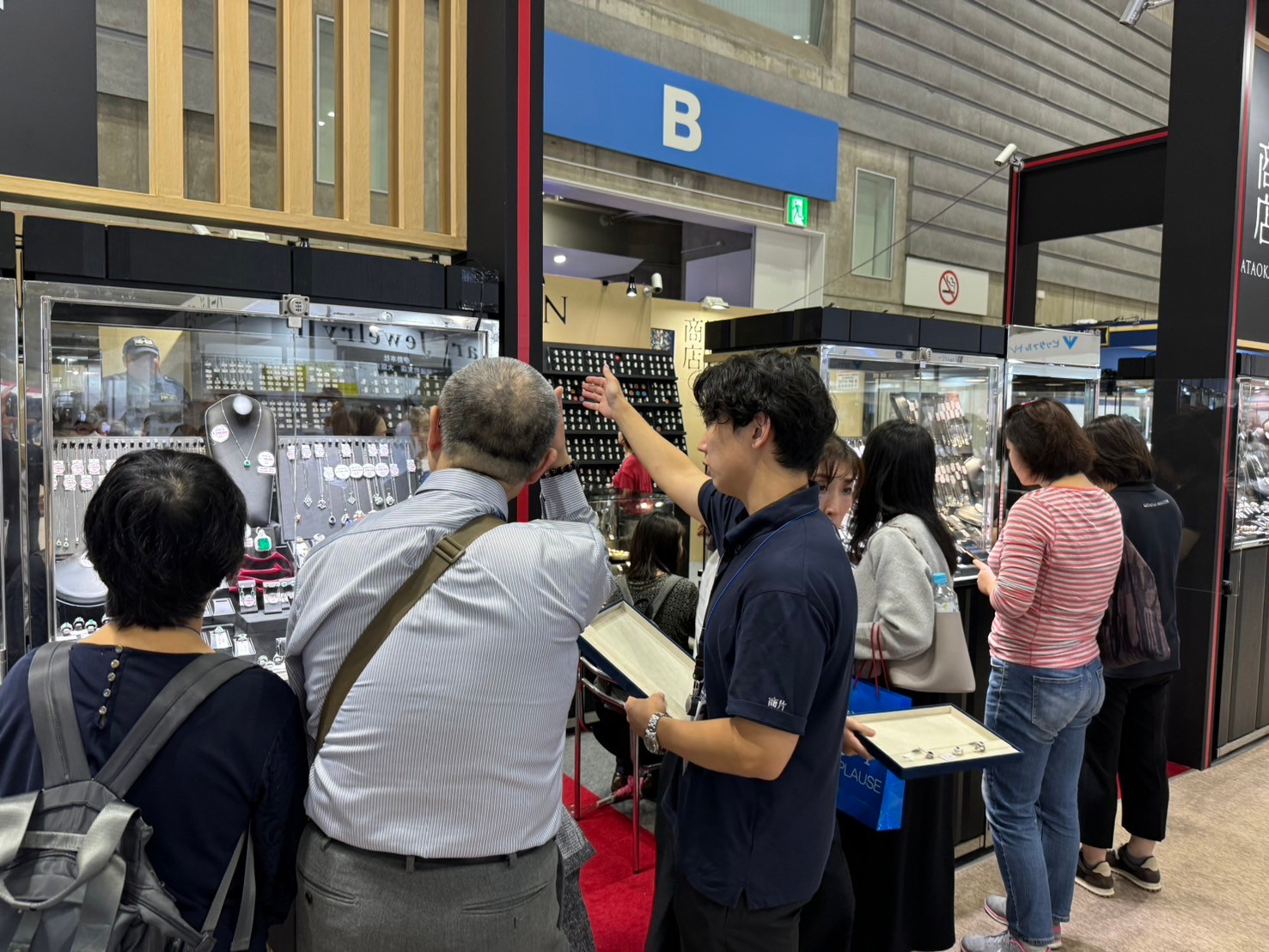

The jewelry show held in Yokohama this time also seemed to reflect the current state of the industry. The number of Chinese buyers and Japanese visitors was unprecedentedly small, reflecting China’s economic slowdown and the poor state of Japan’s real economy. There were many visitors and buyers with little purchasing motivation, and it seemed like many of them were trying to research the current market situation. The current situation is probably worse than we think.

The fact that the Beijing International Jewelry Fair was held in China, from October 24th to 28th at almost the same time as the Yokohama Jewelry Show also appears to have been a factor in the sharp decline in Chinese buyers. Many of the companies exhibited at the Beijing jewelry show had been to the Japan jewelry show as buyers, and if the show will be held in China at the same time in the future, the number of Chinese buyers is likely to be similarly decrease.

On the other hand, I felt that there were less live streamers than before, but sales by live commerce seemed to be still active. And, the booth welcoming live streamers seemed to be crowded. The current situation for diamonds and pearls is grim due to the sudden drop in prices, but live commerce seems to have been less affected so far. The form may change in the future, but live commerce using SNS is likely to remain.

However, if the number of Japanese visitors to jewelry shows held in Japan stays so low, the nature of jewelry shows in the future may change. In fact, some of the exhibitors said they would not participate in the next jewelry show in Yokohama. Exhibiting costs are increasing and the cost-effectiveness is becoming worse year by year. If the size of the show become smaller in the future, the jewelry show will lose its appeal.

Politics and economics are beginning to have a significant impact on our industry. And the speed of change will likely continue to increase. This jewelry show held in Yokohama was the last one of this year. We will keep up with the upcoming changes and continue to prepare for the jewelry show in January next year. We look forward to seeing you at the next jewelry show. We would like to express our sincere gratitude to all of you for attending this year’s event. Thank you and see you soon at the next show.