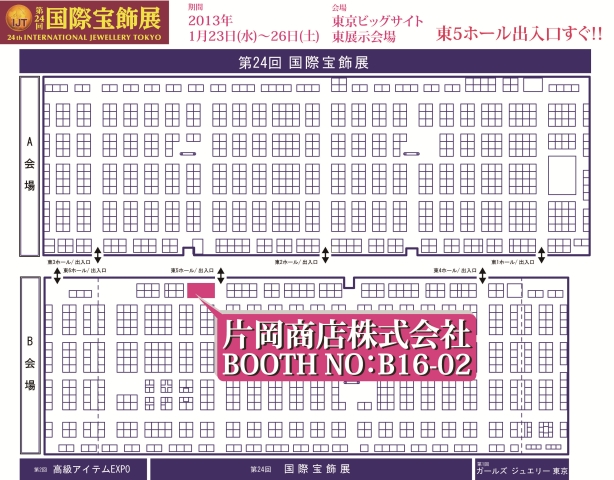

The 24th International Jewelry Tokyo (IJT2013) had started on January 23, 2013 at the Tokyo Big Site for four days. Since the new year began, weak yen and high stock prices had been progressed from a feeling of expectation about the new Prime Minister Abe’s economic policy (so-called Abenomics) consisting of three targets of the growth strategy aiming to rouse the bold monetary easing, flexible financial dispatch, boost private investment, and the mood of the Japanese economy seemed to ease a bit.

However, in order not to be influenced by the mood, it seems to become more important to study essence of many risks of the Japanese economy, such as the remarkable rises of the crude oil price due to the geopolitical risk, fiscal cliff problem of America only put off for 2 months, sovereign crisis in Europe, Japan-China relations and so on.

The economic conditions seemed to be sluggish worldwide when I paid more attention abroad, and the World Bank revised a GDP growth rate of the world economy of 2013 downward with 2.4% on 15th. Although it was expected that the GDP growth rate of the China’s economy rise to 8.4%, however the possibility of the investment slowdown was deeply concerned about, then China’s GDP growth rate was speculated with 8.0% in 2014 and 7.9% in 2015.There is the viewpoint that the economy of other BRICS countries slows, and the world economy is expected with low growth in 2013.

The growth of the ASEAN countries attracting attention as the Chinese next investment seems to be outstanding, especially sudden rise of the VIP (Vietnam, Indonesia, and the Philippines), the middle-income bracket and the wealthy would expand to approximately 7 times more in these three countries by 2020.And foreign enterprises seem to push forward their investment rushingly by saying that population composition is young. We won’t be able to take our eyes off a central trend of the world economy that would be moving from east to west in future. In addition, rapid weak yen from the New Year caused the sudden rise of the price of gold, diamond and color stone in our industry, did encourage many Japanese companies to sell vigorously by the first sale of the year.However, there would be fewer and fewer materials throughout the trade and acquisition seem to be becoming more and more difficult due to the cost rising by the weak Japanese yen.

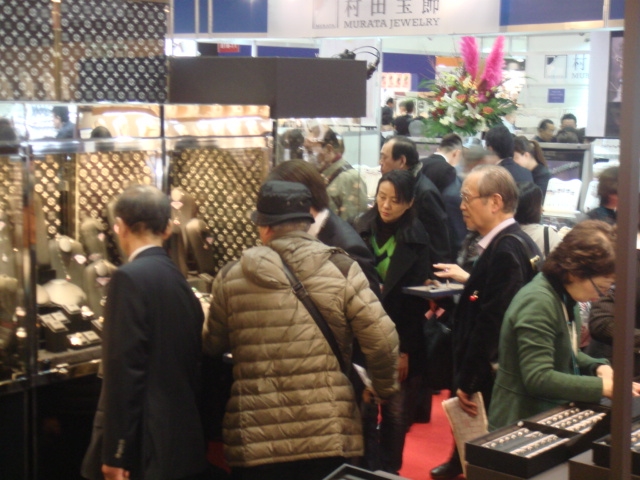

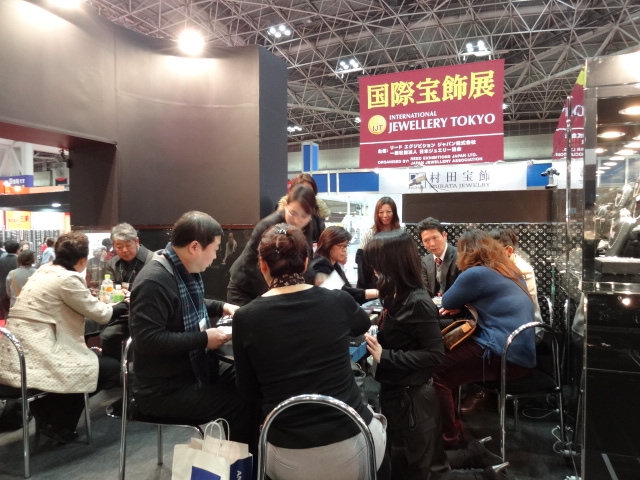

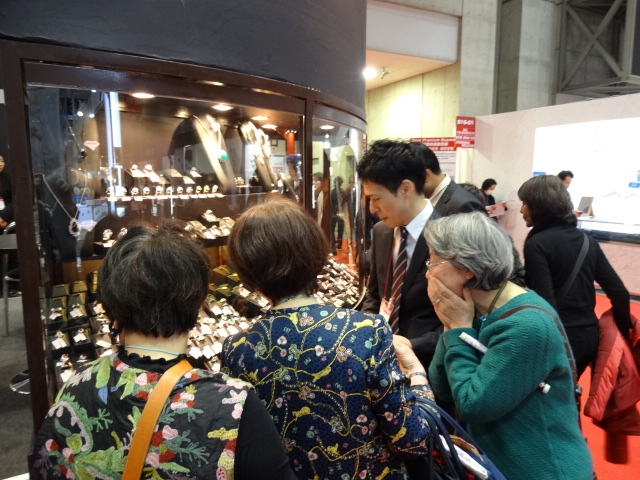

IJT 2013, as the first jewelry show of this year, had started, with a lot of good expectations concerning various elements. As we expected, there were a lot of buyers, including the buyers from abroad, came right after the show began, and gave us a good atmosphere. Although Chinese buyers were most popular buyers in the previous year, this seemed to change a bit. We felt that Taiwanese buyers came more than Chinese buyers, and also felt that the number of Indonesia and Malaysian buyers increased. Overseas buyers, every one of them who came all the way to Japan to buy at this time, had desire to purchase seriously.

However, I strongly felt the revival of Japanese buyers with a sense of having been overwhelmed by overseas buyers in recent years at this fair. From the morning until the end of the day, for 4 days, we had opportunities to have substantial business talk with the every buyer who visited our booth. ”This year might become a good year”, many people have said, I felt like that had been a good thing, not previously subjected atmosphere. To all the people who came to visit our booth and gave us good support, we would like to express our gratitude to have this fair been finished with great success. In addition, we look forward to meet all of you at the next jewelry show. Thank you.