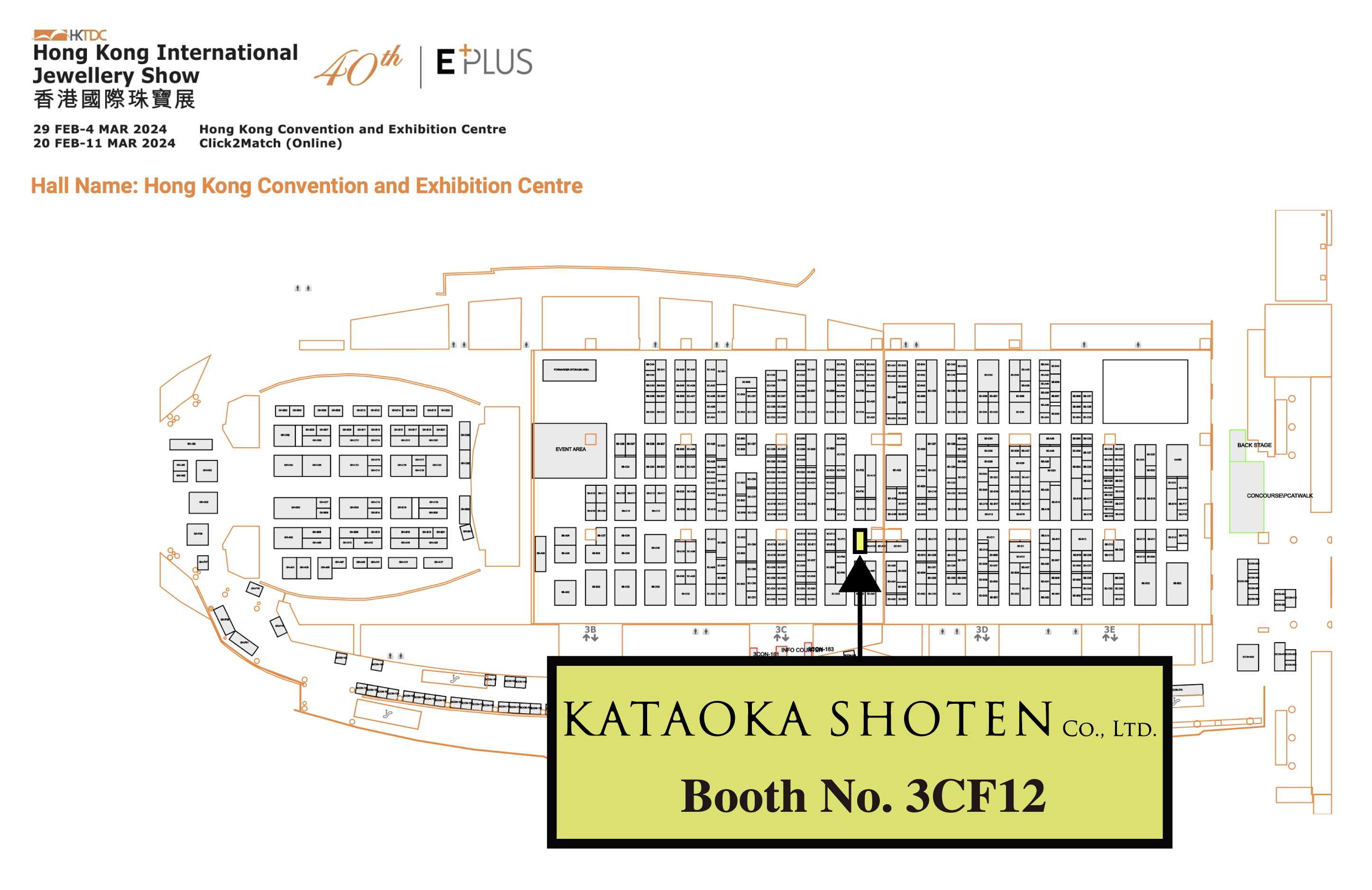

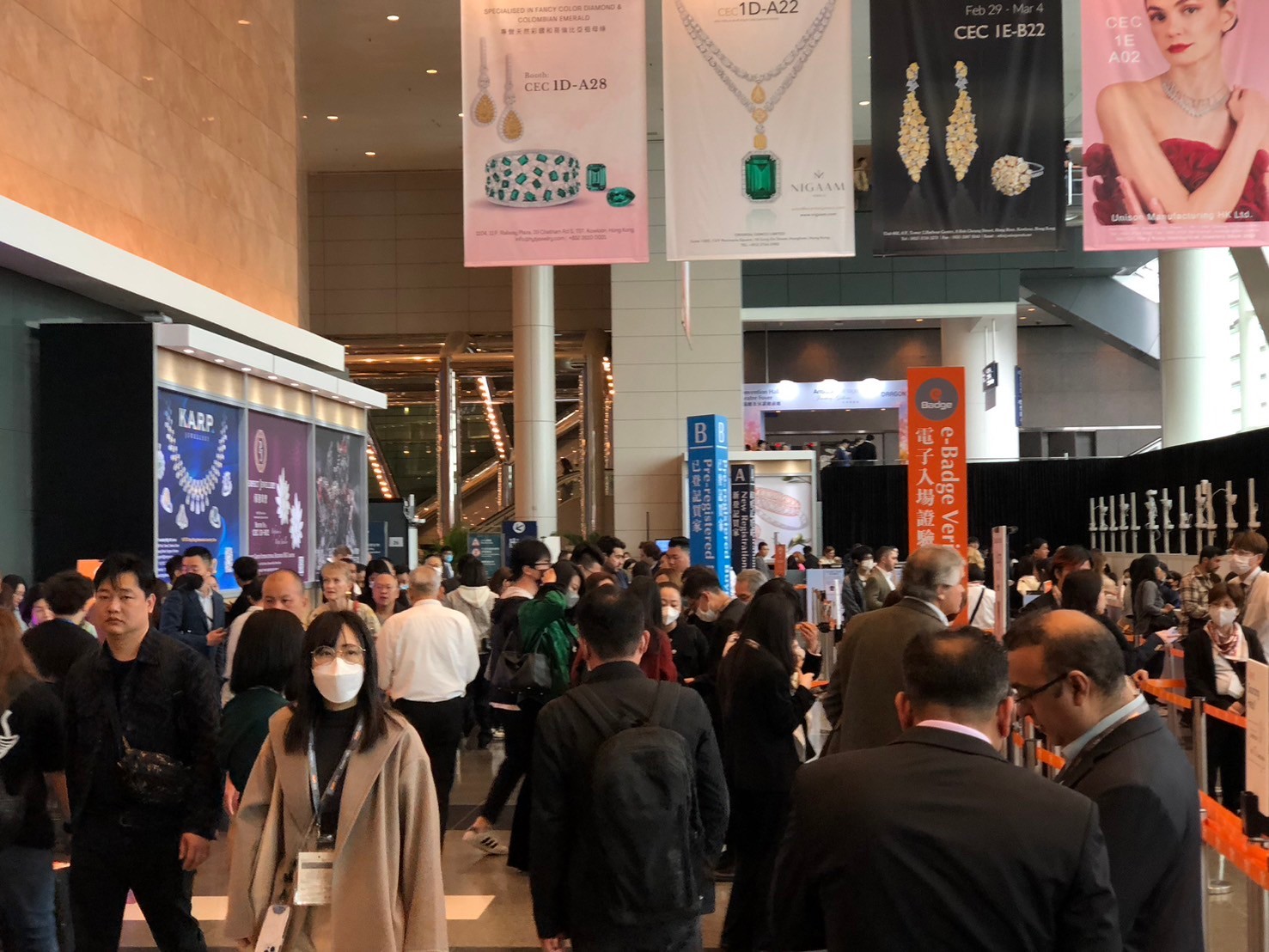

We had exhibited at the HKTDC Hong Kong International Jewelry Show 2024, held at the Hong Kong Convention and Exhibition Center for 5 days from February 29th to March 4th, 2024.

This year marks 26 years since Hong Kong was returned to China from the U.K., and three years have passed since the implementation of the Hong Kong National Security Law, the authorities have further tightened their control of free speech, and combined with the wave of recession, the former enthusiasm of Hong Kong has faded away.

On January 30, the Hong Kong government announced the enactment of the National Safety Ordinance to further strengthen regulations in addition to the National Security Law, which came into effect at the end of June 2020. The new law is expected to reform the British- era legal provisions and establish new crimes such as rebellion and imitating foreign interference.People and businesses dealing with increasingly sensitive texts should exercise caution, as they reflect interpretations from mainland China that include information related to Hong Kong’s economic and social development, major policy decisions, and science and technology in their coverage.

The current political uncertainly inHong Kong and the tightening of regulation under the COVID-19 have resulted in the exodus of tens of thousands of people from Hong Kong and a significant decline in the city’s reputation and economy. In addition to this, tensions between the U.S. and China and China’s economic slowdown are creating more challenges for Hong Kong. The number of real estate transactions, which had been rising in what could be called a bubble situation, has hit a 33-year low, underscoring the serious real estate recession. The situation is likely to continue to be difficult, along with the real estate recession in China.

Hong Kong used to be known as a tourist and shopping paradise, and was crowed with many tourists, but today there are no signs of its former self. When Hong Kong’s come and go was normalized in February 2023, Hong Kong was expecting a rapid economic recovery, but the situation has since fallen far short of expectations. Currently, shopping in Hong Kong is becoming less attractive as tourists’ behavior patterns shift from goods to services.

There are related to exchange rate issues such as the depreciation of the RMB and the appreciation of the HKD. The HKD is pegged to the USD, and when the RMB depreciates against the USD, the RMB also depreciates against the HKD. The economic slowdown in China may accelerate the depreciation of the RMB and appreciation of the HKD in the future. These are a cross-border crossing that have had a significant impact on the consumption behavior of Hong Kong people and have not been seen in the past.

In addition, recently there has been a rapid increase in the number of Hong Kong residents who visit mainland China and overseas to enjoy consumption from Hong Kong. The reality is that at the current exchange rate, it is more affordable to enjoy consumption in other countries than in Hong Kong. The number of Hong Kong residents leaving Hong Kong has exceeded the number of those entering the region, and it appears that consumption that should have been generated in Hong Kong is now flowing out if he region. The current situation seems to indicate that the recovery of tourists visiting Hong Kong is also very difficult.

Thus, the Chinese economy, which has a very large impact on Hong Kong, is in a very difficult situation. As a result of the zero-Covid policy, China’s economy is in a deep decline. In 2021, the real estate bubble burst and became more severe, and financial instability began to surface in 2023. Youth unemployment also reached 21% in 2023, and the authorities stopped releasing data after July.

Furthermore, foreign investors have drastically reduced their investment in securities, and companies are scaling back or withdrawing from their Chinese operations one after another. Since China’s currency and finance are based on a quasi-dollar standard, the People’s Bank of China (PBC) cannot take steps to significantly expand monetary volume or cut interest rates without large inflows of foreign funds, and without the backing of foreign currency, the yuan has lost credibility and the yuan’s depreciation cannot be stopped.

Chinese middle class and high net worth individuals, who consider it risky to invest in the regulated and opaque Chinese financial market, have also given up on the Chinese market and are rushing to take their assets overseas. Many predict that China’s economy will continue to slow down due to the depreciation of the RMB and the ongoing deflation of the Chinese economy. Our industry is currently heavily dependent on China, and we are concerned about future trends.

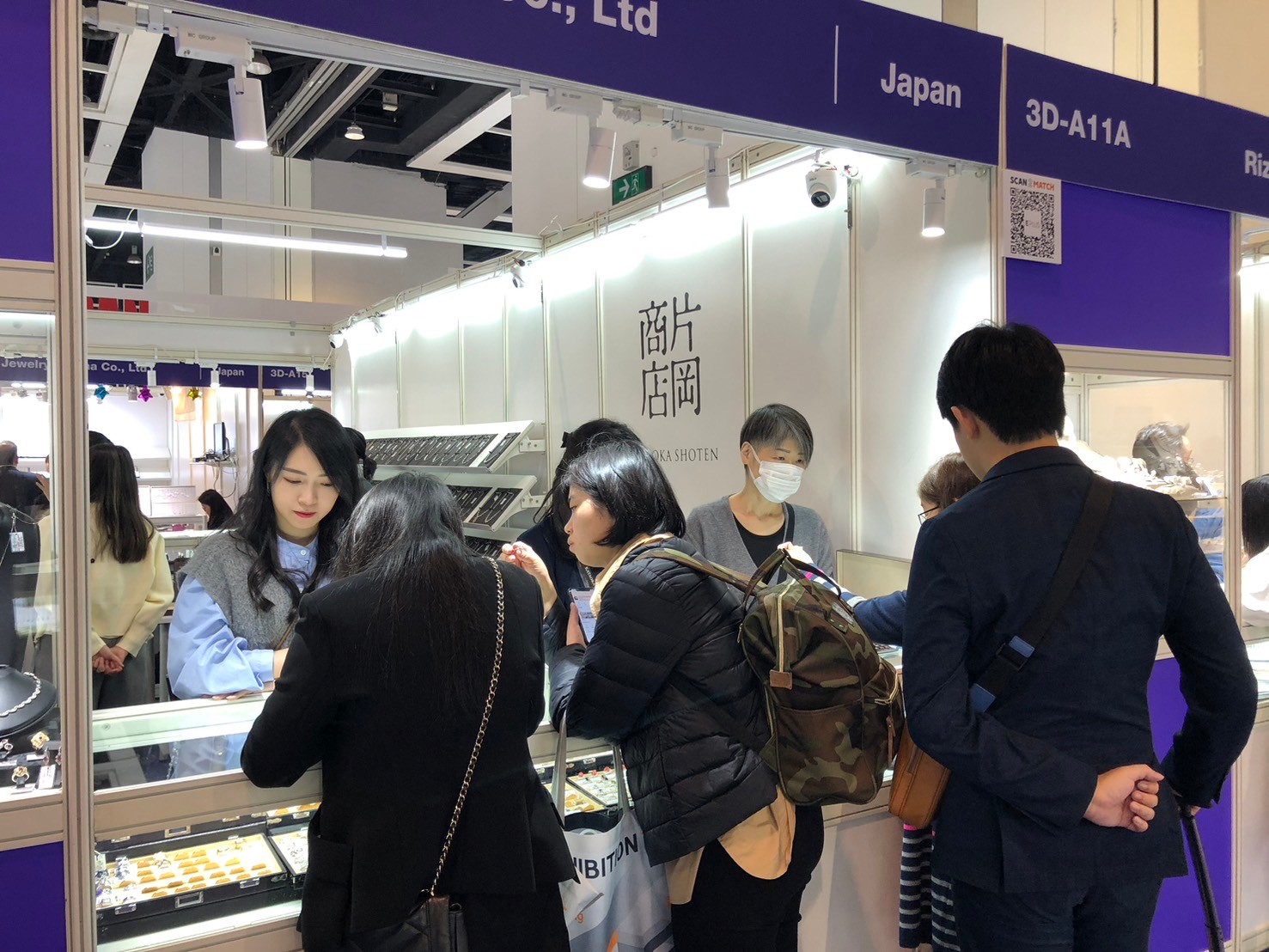

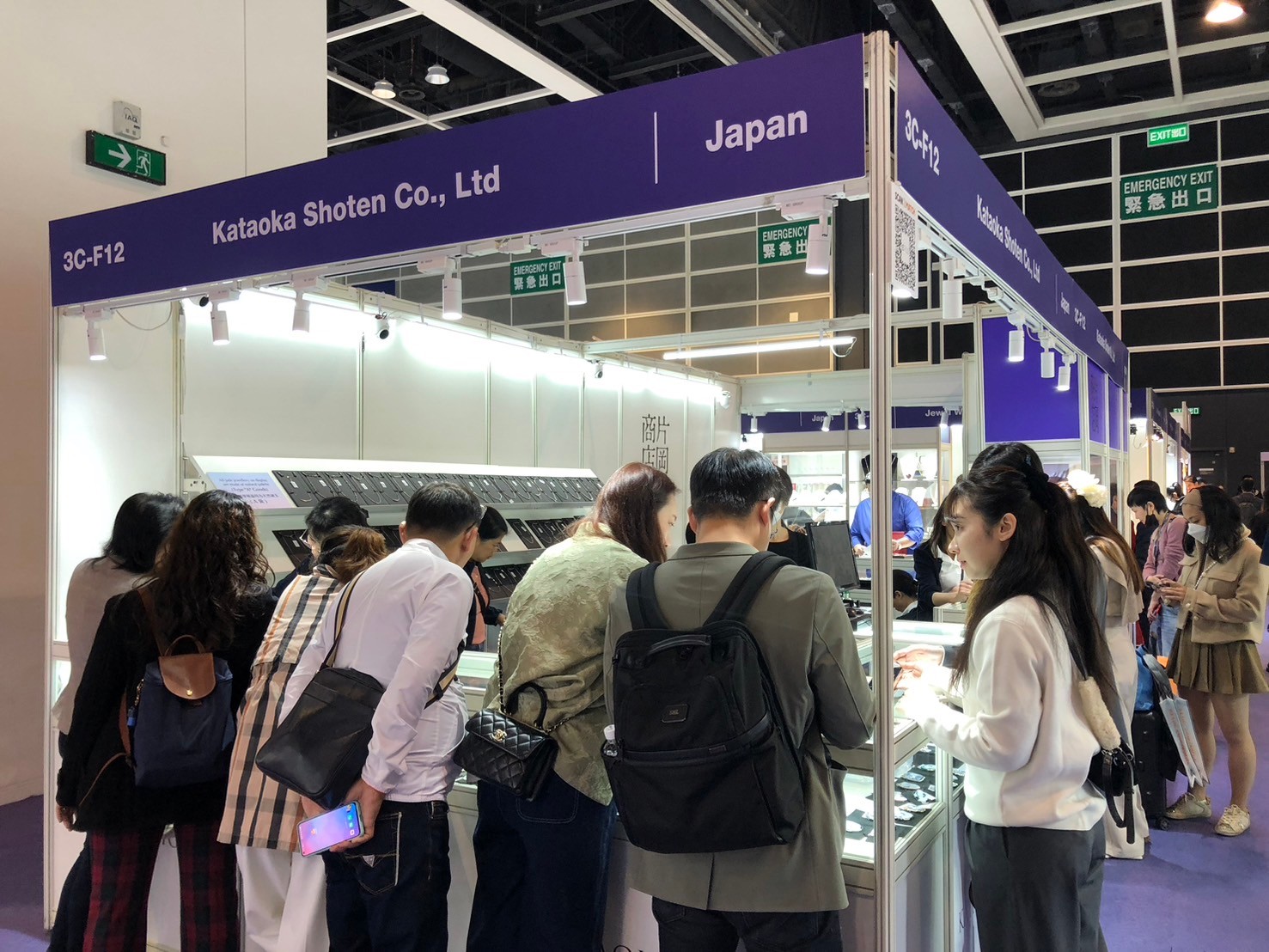

It was under such circumstances that the Hong Kong Jewelry Show was held this year. The number of buyers from mainland China was much lower than in previous years, and since the majority of buyers were from mainland China, the total number of visitors to the Hong Kong jewelry show was also much lower than in previous years. It was a tough show for exhibitors who were hoping for mainland Chinese buyers.

Sales of items for China, especially high-end items, were sluggish, and many exhibitors sold less than in previous years. Pearls, which had been selling like a bubble in the Chinese market, also showed sluggish growth, clearly demonstrating the harshness of the current situation in China. This may be a turning point that will change the shape of the industry and the market price of each product.

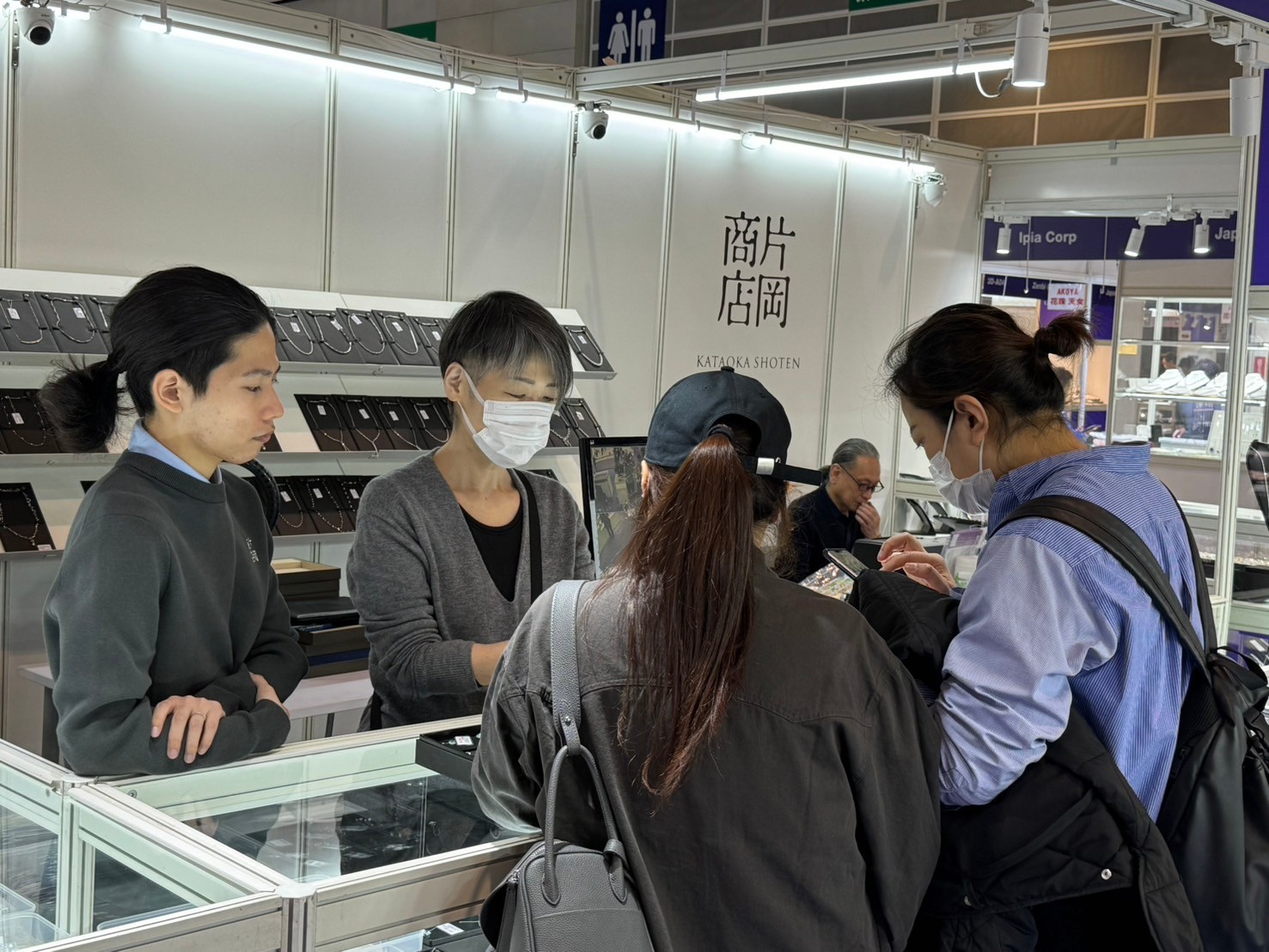

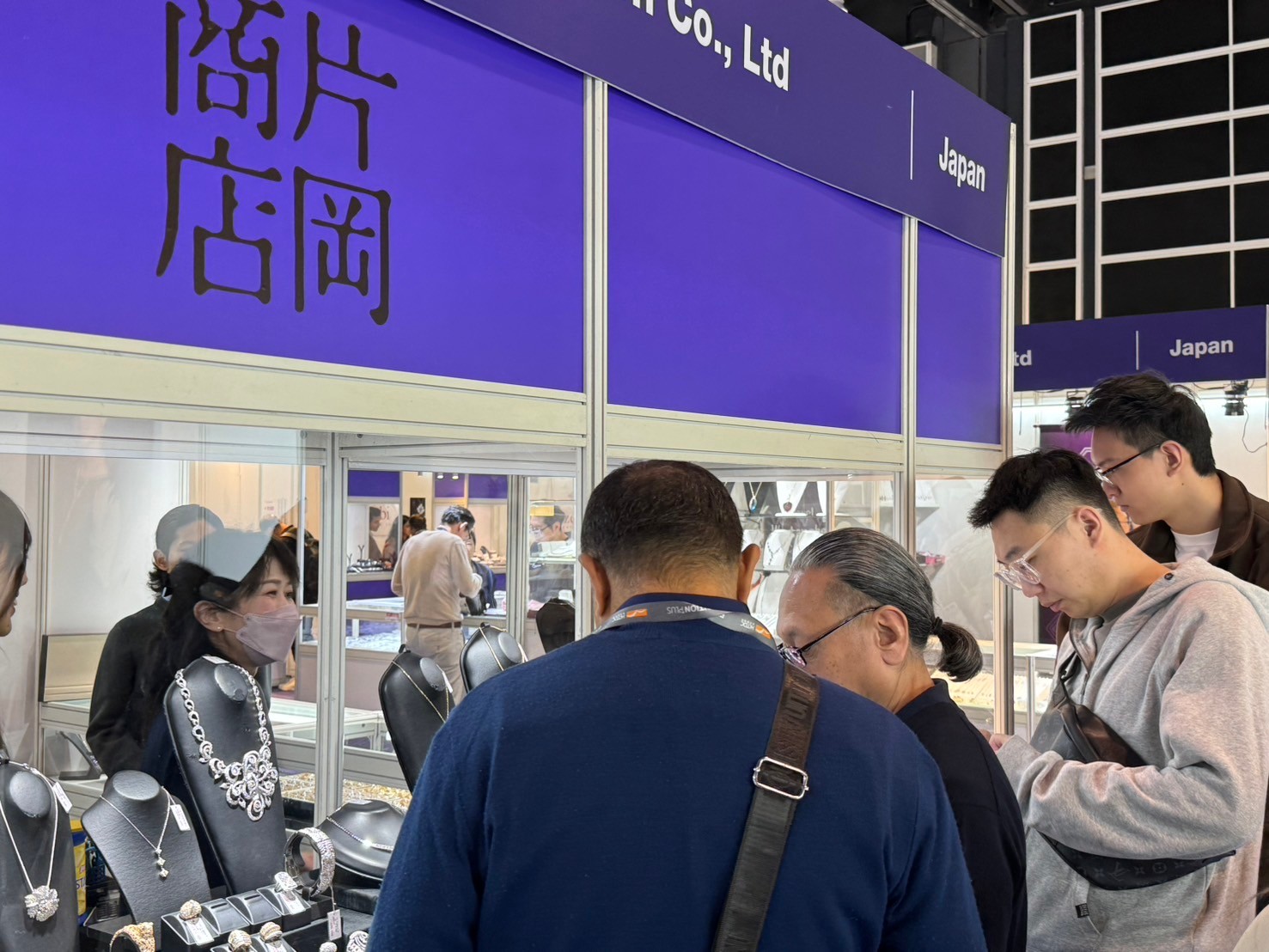

However, when looking outside of China, the jewelry show was a time of development in a variety of countries. Buyers from India and other ASEAN countries seemed more energetic than before. I got the impression that the jewelry market is going to change in the future. At our booth, there were only a few buyers from mainland China, but new buyers from other countries visited our booth.

In this rapidly changing environment, we will continue to prepare to meet your expectations at the next jewelry show. We would like to thank everyone who visited our booth. Thank you very much. We hope to see you again at the next jewelry show.