We had exhibited at Jewellery & Gem WORLD Hong Kong, held at Hong Kong Convention & Exhibition Centre for 5 days from 18/09/2024 to 22/09/2024. On August 5th, the Nikkei Stock Average plunged from its all-time high, recorded a drop greater than that of Black Monday in 1987 and this plunge in Japanese stocks shook the world.

The recent sharp drop in stocks is believed to have been caused by a combination of the Bank of Japan’s proactive stance on raising interest rates at the end of July and the weak U.S. Current Employment Statistics released on August 2, which led to a sense of a slowdown in the economy. This sharp decline was an extraordinary situation in which 800 companies, equivalent to 20% of all listed stocks, dropped to limit low level. The fear that their holdings could not be sold triggered further selling, resulting in sacrifice sales and chaos. And the yen, which hit 161 yen in mid-July, appreciated sharply to 141 yen to the dollar on August 5.

The rapid appreciation of the yen and the fall in stock prices have blown away the assets of many companies and individuals, raising concerns about the future of the economy. In addition to the slowdown in China’s economy, there are concerns about a recession in the United States, which is expected to gradually lower interest rates. Due to the change in the outlook for Japanese and U.S. monetary policy, the yen is expected to appreciate further. This incident has caused not only stock and foreign exchange prices but also many commodity prices to fall. In our industry, the market prices of not only gold bullion but also many other commodities have changed.

In particular, the price of diamonds has plummeted due to the economic slowdown in China and the problem with lab-grown diamond. If the yen appreciates more in the future, it will cause further declines in price. Therefore, transactions are fearful, and there are situations in which prices are not determined due to reluctance to buy. The prices of many other products have also fallen, but transactions of high-priced products in particular have decreased and quality standards for these products have become stricter.

In 2024, a series of major elections will be held in countries and regions around the world. Changes in leadership and politics in many countries could have an impact on global affairs. In Japan, the Liberal Democratic Party will hold a presidential election at the end of September, and a new president and prime minister will be decided. The outcome of the U.S. presidential election in November, which will have the greatest impact on the world, will change global diplomacy, politics and economics. Then, the market sentiment and economic outlook for our industry will likely change further.

On the 18th, the first day of the exhibition, the FRB shifted its monetary tightening policy to an easing stance, with the FOMC doubled its usual rate of interest rate cut by 0.5%, and raising the target range for benchmark interest rate from 4.75% to 5.0%. In addition, two more interest rate cuts are scheduled before the end of the year. In order to boost the economy and higher prices by lowering interest rates will be a tailwind for the U.S., but it would have a significant impact on the global situation. In Japan, the yen has been appreciating to the low 140yen level to the dollar, which has begun to have a significant impact on export-related companies.

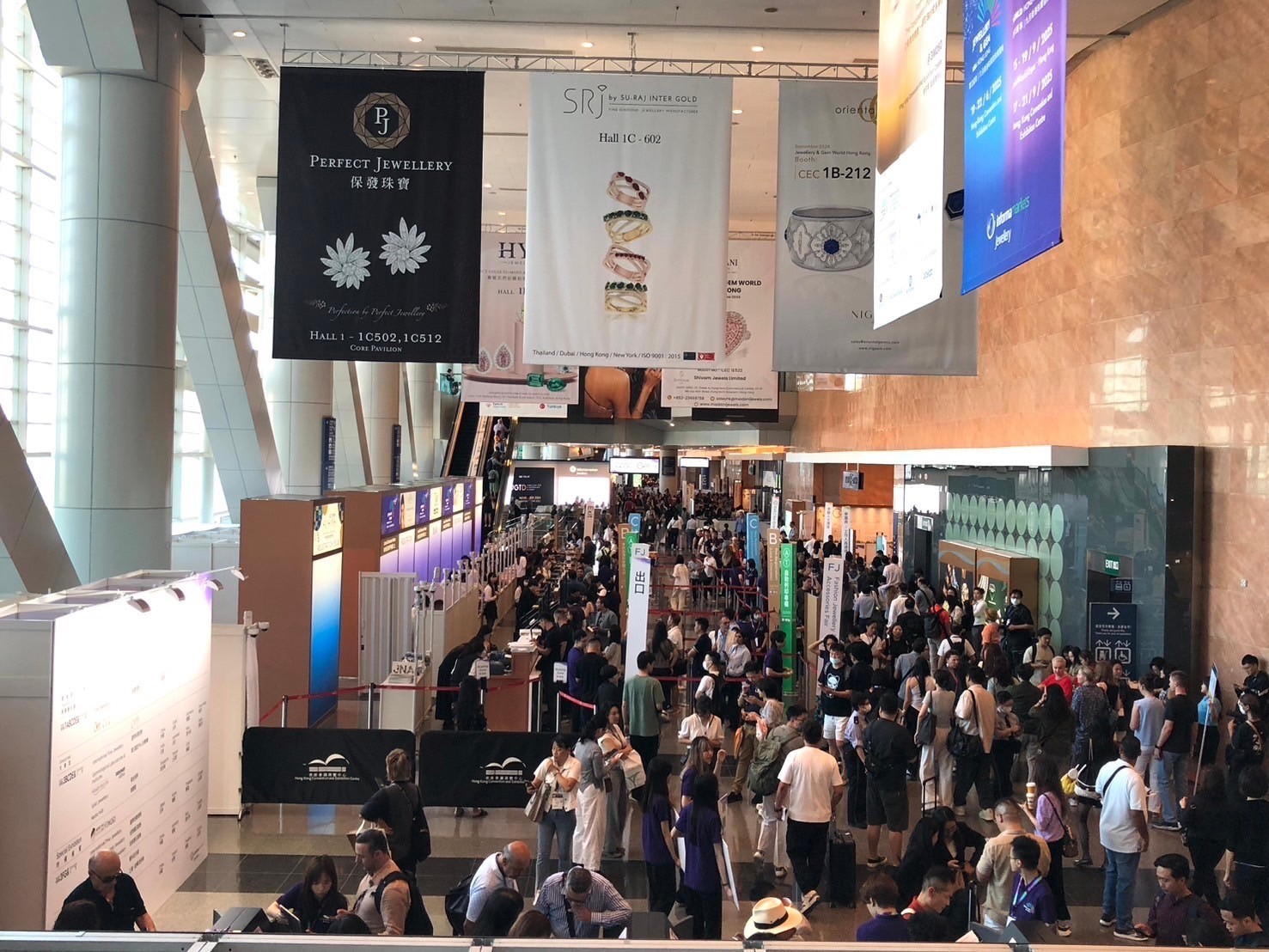

It seemed that this jewelry show, held under such circumstances, was a strong reflection of the current situation. What impressed me the most was the decline in the number of Chinese buyers visiting the show. It would not be an exaggeration to say that the number of visitors was not only half, but less than a third of the previous year. The jewelry show held in Hong Kong was mainly for Chinese buyers, and I had the impression that the show was quite deserted because of the strong reliance on Chinese buyers.

I have heard that the diamond and pearl show held at Airport Side was the same. The reason was that the economic situation in China was quite bad, but it was not the only reason. In Hong Kong, regulations on jewelry, precious metals, pearls, and other materials have become stricter, and legal restrictions have been established regarding these items, making Hong Kong a completely different place from its former status as a free port.

Cash delivery and logistics issues are much more severe than before, and the advantages of the Hong Kong location are disappearing for both sellers and buyers. Cash issues are becoming more severe for transactions over HK$120,000 as well as for US dollars. When our company made a deposit into the bank recently, some banks were only able to deposit 10,000 US dollars a day, and some were unable to do so at all, indicating that the political issues between the US and China are even affecting the private sector.

Logistics issues seem to be becoming much more tightly regulated as well. The regulations in China have become quite strict, pearls are not allowed to be brought in, and other products are also strictly regulated. It is becoming increasingly common cases where people bring in undeclared goods and get taxed or arrested at Chinese customs.

Even if the goods are brought into China without a declaration, surprise inspections are conducted at stores in mainland China, and if the goods are determined to be undeclared, they may be subject to taxation, confiscation, or even arrest.

Under these circumstances, there is no advantage in going all the way to Hong Kong to purchase goods, which seems to have contributed to the sharp decline in the number of Chinese buyers. In addition to the sharp decrease in the number of European and American buyers due to the previous legal restrictions in Hong Kong, this sharp decrease in Chinese buyers has given us an opportunity to reconsider the future changes in the market and the market price of merchandise. The high cost to exhibit in Hong Kong is also taking a toll on exhibitors, and it is likely that the number of exhibitors would decline and the jewelry shows would shrink on the future.

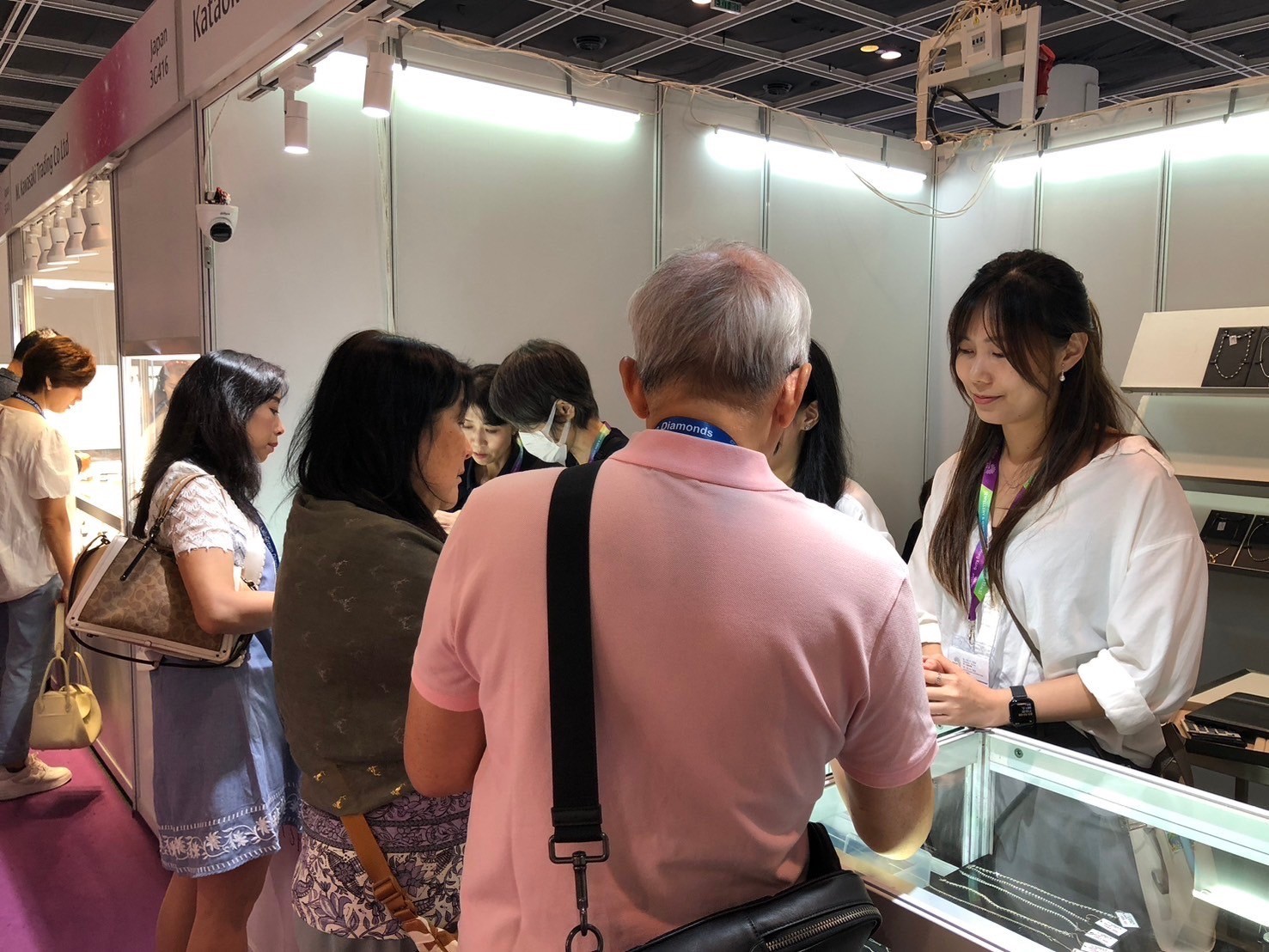

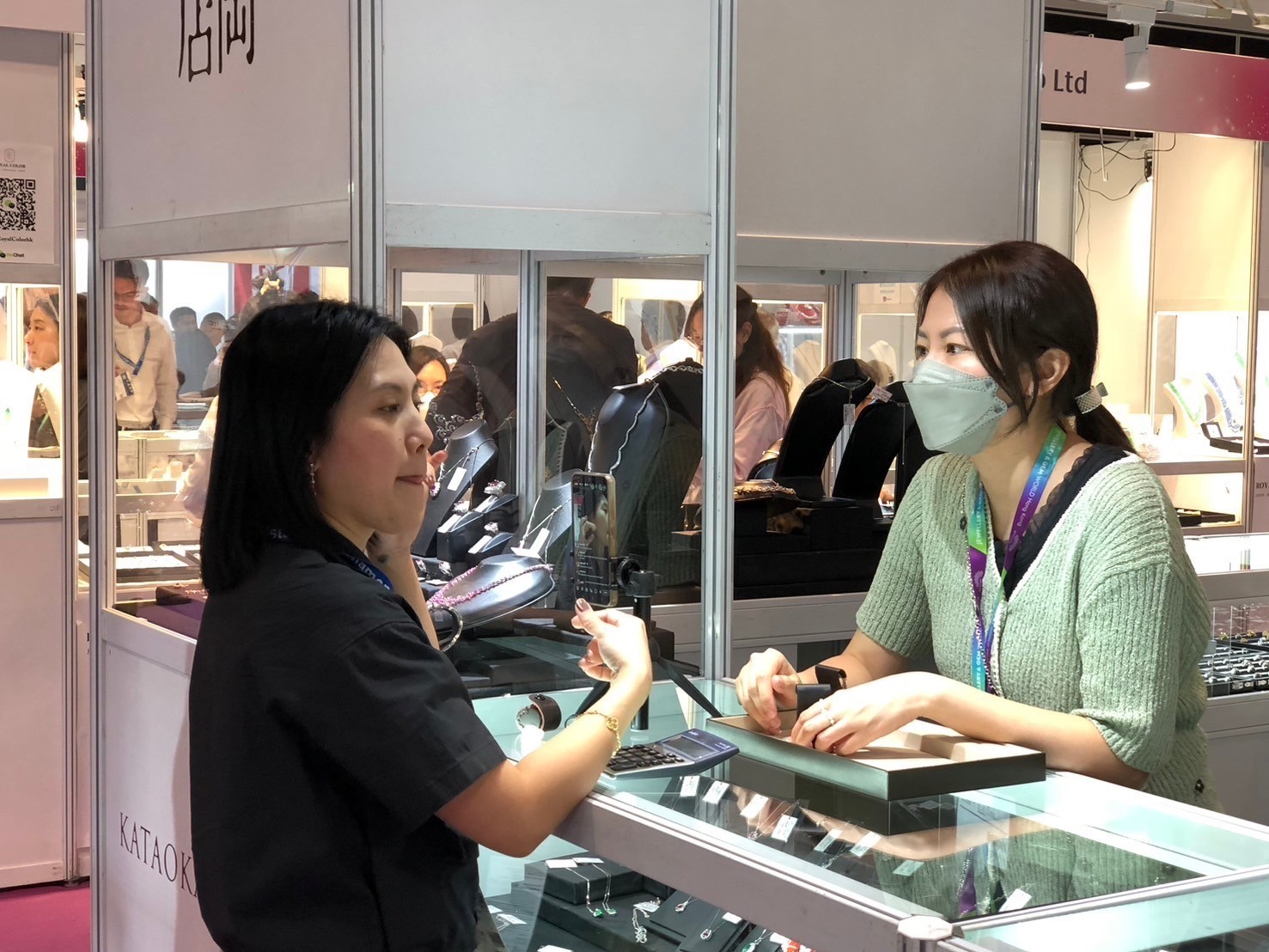

Most of the people who came this time had little to do with this regulation, and they were purchased the items they needed. Despite the gloomy atmosphere, the products exhibited by Japanese companies were still very popular, and it seemed to be more crowded than other countries’ booths. We will continue to monitor the current situation and work on to change our direction. We hope to see you again at the next jewelry show and would like to thank everyone who came regardless of the circumstances.