We had exhibited for 3 days in the 20th International Jewellery Kobe, held at the Kobe International Exhibition Hall from 11/05/2016 to 13/05/2016.

The slowdown of global economy, which had been triggered by concerning with the slowdown of Chinese economy, became more serious. Furthermore, countries around the world and in each industry, corporate bankruptcy has been increasing by the poor business performance. It may be said that the industry of each countries which relies on China is totally devastated. It was caused by the sharp decline of orders or financial difficulties of local companies in China. In addition, by the export offensive of the cheap product or decline of demand of the resources in China, the bankruptcy of the affiliates companies in the world is advanced.

The low price of crude oil has negative impact on the oil related companies. Especially in America, it became obvious to be seen the bankruptcy often occurs among the shale-related companies. Management techniques by inflating the debt to produce shale backfired, and then the trouble of financing brought these bankruptcies. Number of bankruptcies since the second half of last year, when a crude oil price has begun to fall, was more than 60. And, it seems to be that the aggregate amount of indebtedness exceeds about 20 billion dollars (approximately 2 trillion yen). Even U.S. Apple Inc., their income was declined first time in 13 years, due to the weak dollar or sales slump in the emerging countries. In response to U.S. economic slowdown, FRB decided not to raise the interest rate at the U.S.Federal Open Market Committee (FOMC) in June, and revised the economic assessment of the U.S. economy to “slowed down”. It seems that the American economy which has been expanded in last 6 years appears to be weakened.

Also in Japan, the economy seems to get worse. Number of the budget-minded consumer is increasing, and this trend gives negative impact to the department store, restaurants, travel industry and others. Business sentiment index for the next 3 months is minus by the direct impact of earthquake, or possibility of spreading the atmosphere of self-restraint mood. In addition, the slowdown of corporate earnings has been accelerated. Performance of listed companies was strong until now, but it is becoming worse due to the economic slump of the emerging countries, weak resource price, or by the strong yen.

Moreover, it was believed that the Bank of Japan would advance the monetary easing in order to leverage the strong yen, but the Bank of Japan did announced to maintain the status quo of monetary easing against the their expectation at the Monetary Policy Meeting on April 28th.In response to this the yen soared approximately 3 yen in several minutes and the Nikkei Stock Average plunged 900 yen in the afternoon.Moreover, this negative chain did not stop. Due to the fact that the stock of export companies had been sold by the anticipation of performance anxiety from the strong yen, the Nikkei Stock Average had dropped below 16,000 levels and the yen became 105 levels against a dollar.Although the Bank of Japan had said that monetary easing would be added without hesitation if necessary, it was not so easy to carry out since The United States Department of the Treasury appointed Japan into the observation list of the foreign exchange control policy as one of the current account surplus countries in the Semiannual Report on International Economic and Exchange Rate Policies on April 29th.

Many people expect to see further strong yen, and the uneasiness of corporate earnings seems to rise more in the future. In addition to a growing uncertainty in this domestic and international economy, the influence on economy caused by the earthquake of Kumamoto began to appear. Then the Japanese Government decided to postpone the consumption tax hike to 10%, which had been scheduled on April 2017. This re-postponement might be a sign of saying that current Japanese economy is very bad.On the other hand, the problems, such as an impact on fiscal discipline or how to secure the financial resources to enhance social security might emerge.

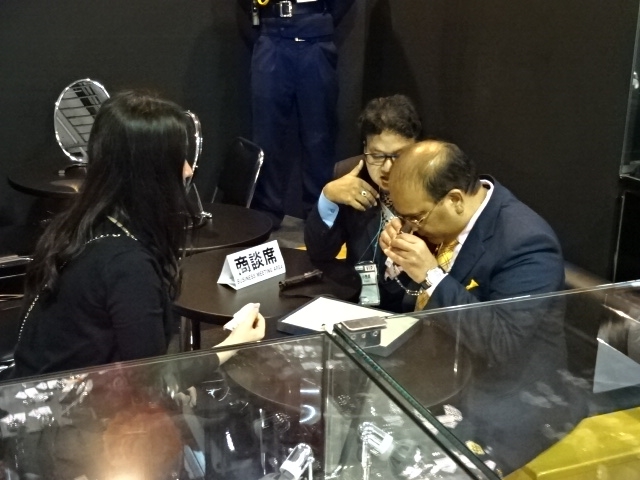

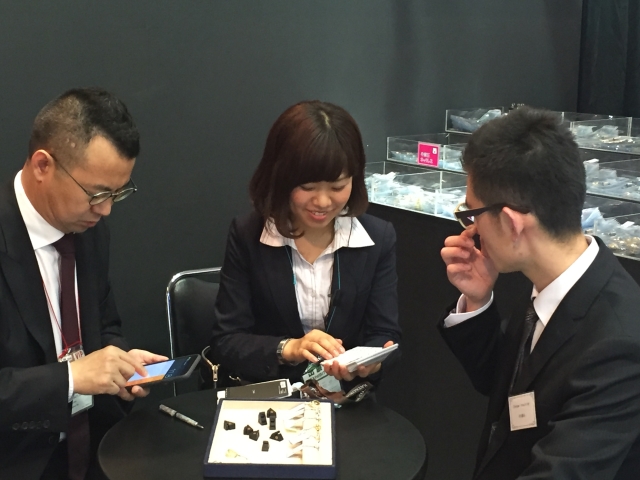

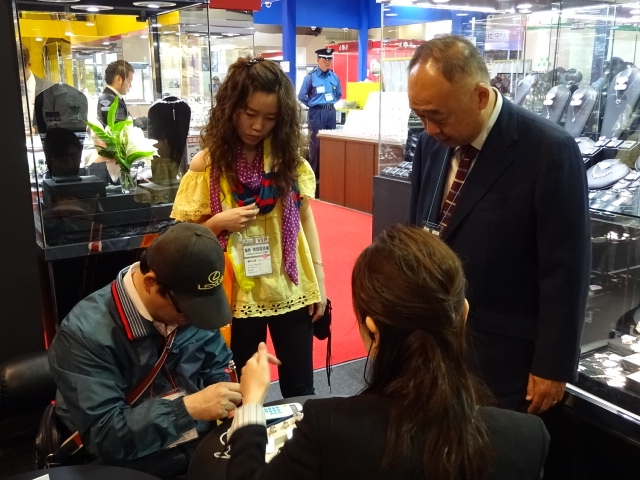

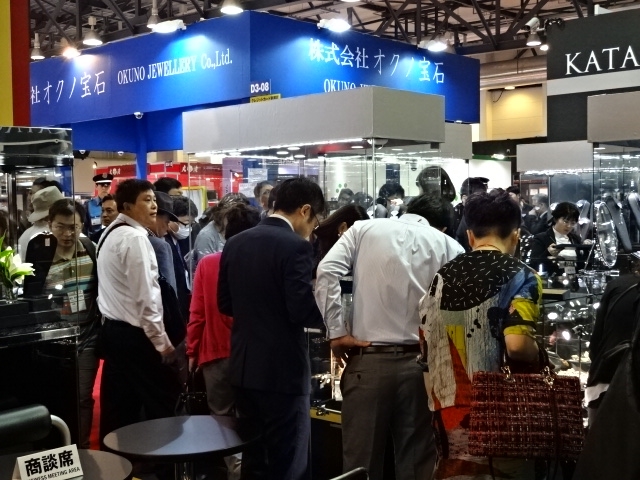

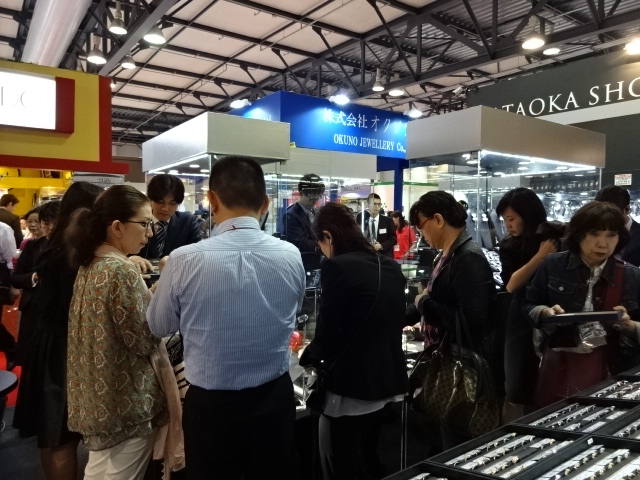

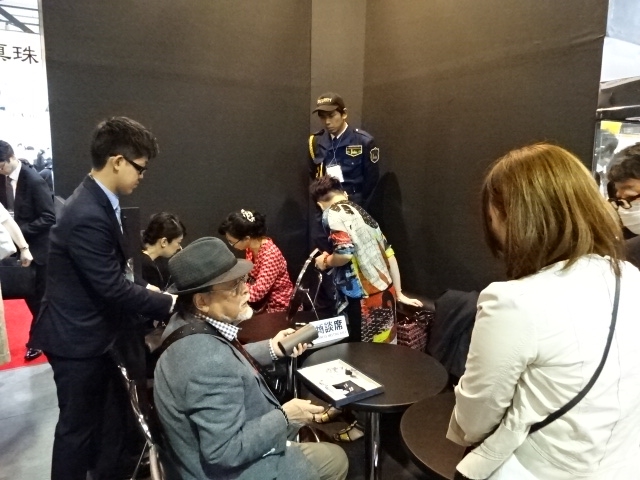

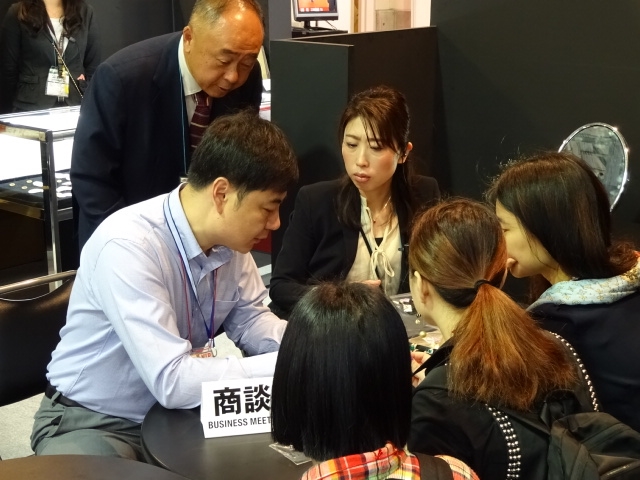

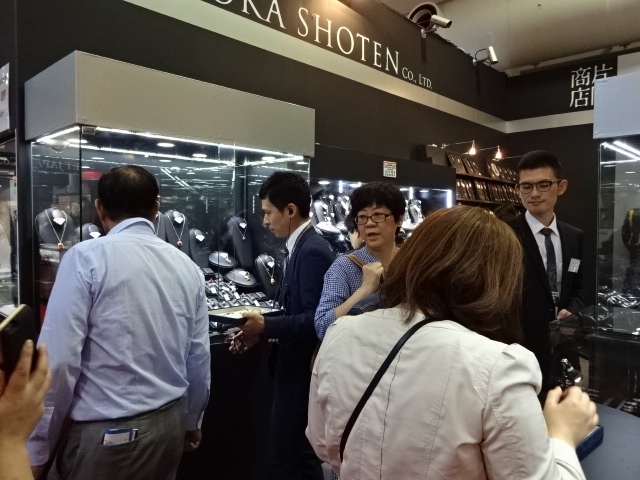

Because IJK was held under this kind of bad business confidence, the sense of anticipation was very low. However, the number of visitors at the opening ceremony on the first day was a lot and looked overflowing.The exhibition hall was crowded with many visitors right after the venue was opened, and there was no feeling of recession. The organizer seemed to had invited more overseas buyers than last year and the venue was bustled with overseas buyers. Even among such atmosphere, I believe that decrease in the purchasing unit price represented heavily the current world economy.

After all, the sale of the expensive product was difficult, and it seemed many buyers shifted to the sale of low-priced product. Therefore the unit price fell, but we had an impression that quantity sold was more than last year. The sales of the color stone jewellery, especially ruby, seemed to be well. But the number of visitors reduced extremely on the 3rd day, because many foreign buyers had left on the 2nd day.

Since IJK was held in the Kansai region, there were only fewer buyers from the Kanto region. And I had an impression that there were only few Japanese visitors came to this fair. Among the exhibitors, business performance at this fair was extreme.The exhibitors who really had understood the needs of their customers had satisfactory sales. It is inevitable to become increasingly tough environment in the future. I fully realize that I have to rethink how to steer my company in order to survive. In spite of this kind of severe situation, we had a lot of visitors this time. On the contrary, I was encouraged by all of you, and I am filled with gratitude. We will strive very hard to be your good business partner and try to provide you better products in the future.And now, we would like to give our sincere gratitude to all of you who visited our booth at IJK.