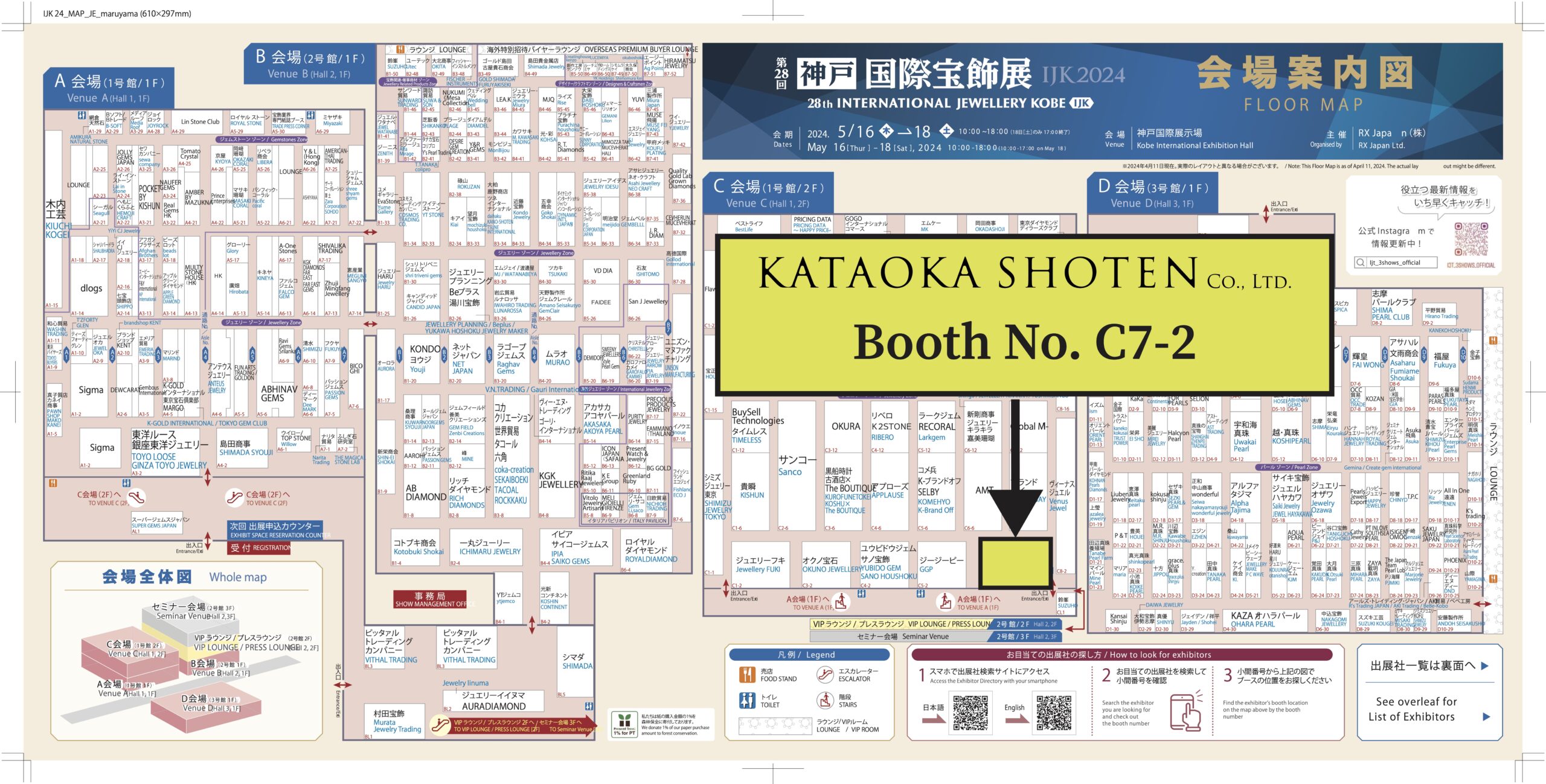

We had exhibited at the 28th International Jewelry Kobe (IJK2024), held at Kobe International Exhibition Hall for 3 days from May 16 to 18, 2024.

Obviously, the situation is Japan is changing, and the Japanese economy is about to emerge from a long tunnel of economic stagnation, known as the ‘lost 30 years’.

Japan achieved rapid economic growth in the 1960s, overcame two oil shocks in the 1970s and then enjoyed a golden era in the 1980s. At the heyday of the bubble economy in the late 1980s, it was even said that the price of land within the Yamanote Line alone could buy the whole of the USA. However, the bubble burst in March 1990 when the Ministry of Finance imposed restrictions on the total amount of land-related loans and the Bank of Japan tightened monetary policy in order to curb the land bubble.

Furthermore, with the collapse of the Soviet Union in 1991 and the end of the Cold War, a wave of globalization hit Japan. The restrictions previously imposed by borders and tariffs have been removed, allowing people, goods and money to move freely come and go of the country. This globalization has led to a decline in the value of all people, goods and money in Japan, and seems to have been one of the factors behind the progression of deflation.

In addition, after the bursting of the bubble economy, Japan experienced a series of events that worsened people’s consumer confidence, including the Great Hanshin-Awaji Earthquake un 1995, the appreciation of the yen following the change of government to the Democratic Party of Japan in 2009, the Great East Japan Earthquake in 2011 and the consumption tax increases 2014 and 2019. Furthermore, Japan has changed from a demographic dividend to a demographic burden, with a low birthrate and an aging population, resulting in a country with a large elderly population and low productive capacity. These combination of factors led to a long period of stagnation in Japan.

However, this situation is now about to change. The spread of the new coronavirus, the conflict between the aUS and China, and the new Cold Was between East and West that began with Russia’s invasion of Ukraine, have resulted in the re-opening of the border wall and a return from globalization to the nationalism approach. Then the COVID-19 calmed down, the distribution of people, goods and money resumed, were was a move to restructure the supply chain, moving production from China to their own country, and the social structure of the new Cold Was between East and West became increasingly intense.

With this, a wave of inflation has hit the world, including in food and energy. Furthermore, the depreciation of the Japanese yen has also accelerated as result of the interest rate hikes implemented by the US to curb inflation. The weak Japanese yen has provided a tailwind for exporters, with many listed companies recording record profits and the Nikkei Stock Average hitting a post-bubble high, with all-time highs on the horizon. The Japanese economy seems to be experiencing a revival here and therewith inbound tourism increasing due to the weak Japanese yen.

On the other hand, many small and medium-sized enterprises (SMEs) are suffering due to the high cost of raw materials caused by the historically weak yen, which is worsening their profits, and labour shortages. In particular, the situation seems to be considerably more difficult for unchanged company. In the current social structure, the proportion of Generation Z (born after the mid-1990s) in society is increasing, and their values and needs are changing significantly.

This situation applies to a large extent in our industry, where the situation is getting tougher year by year, as many companies still have the old business models. In addition, the current depreciation of the yen and global inflation are making it impossible for many commodities, including gold bullion, to cope with the rising prices. Although Japanese products seem cheap from a global perspective, in Japan they seem to be much more expensive than before, and the sales frontline is facing a very difficult situation.

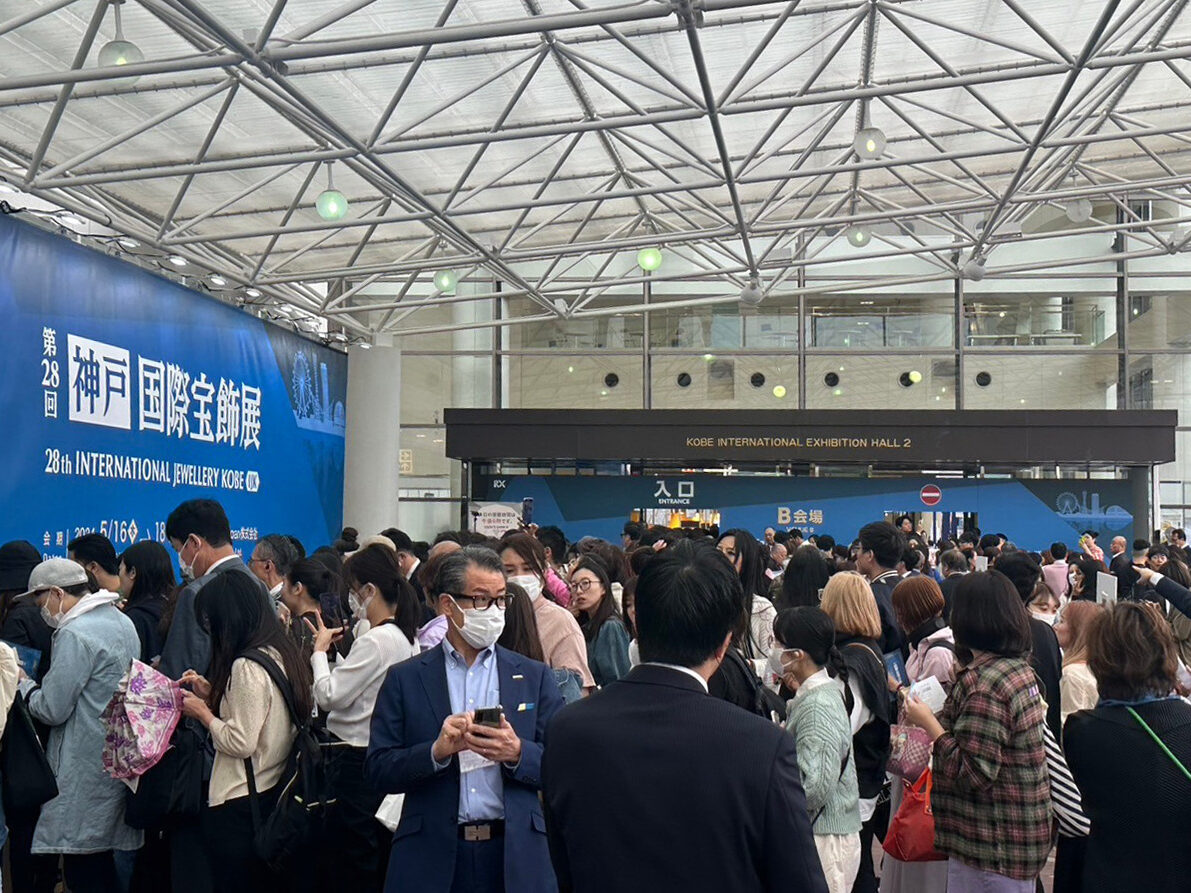

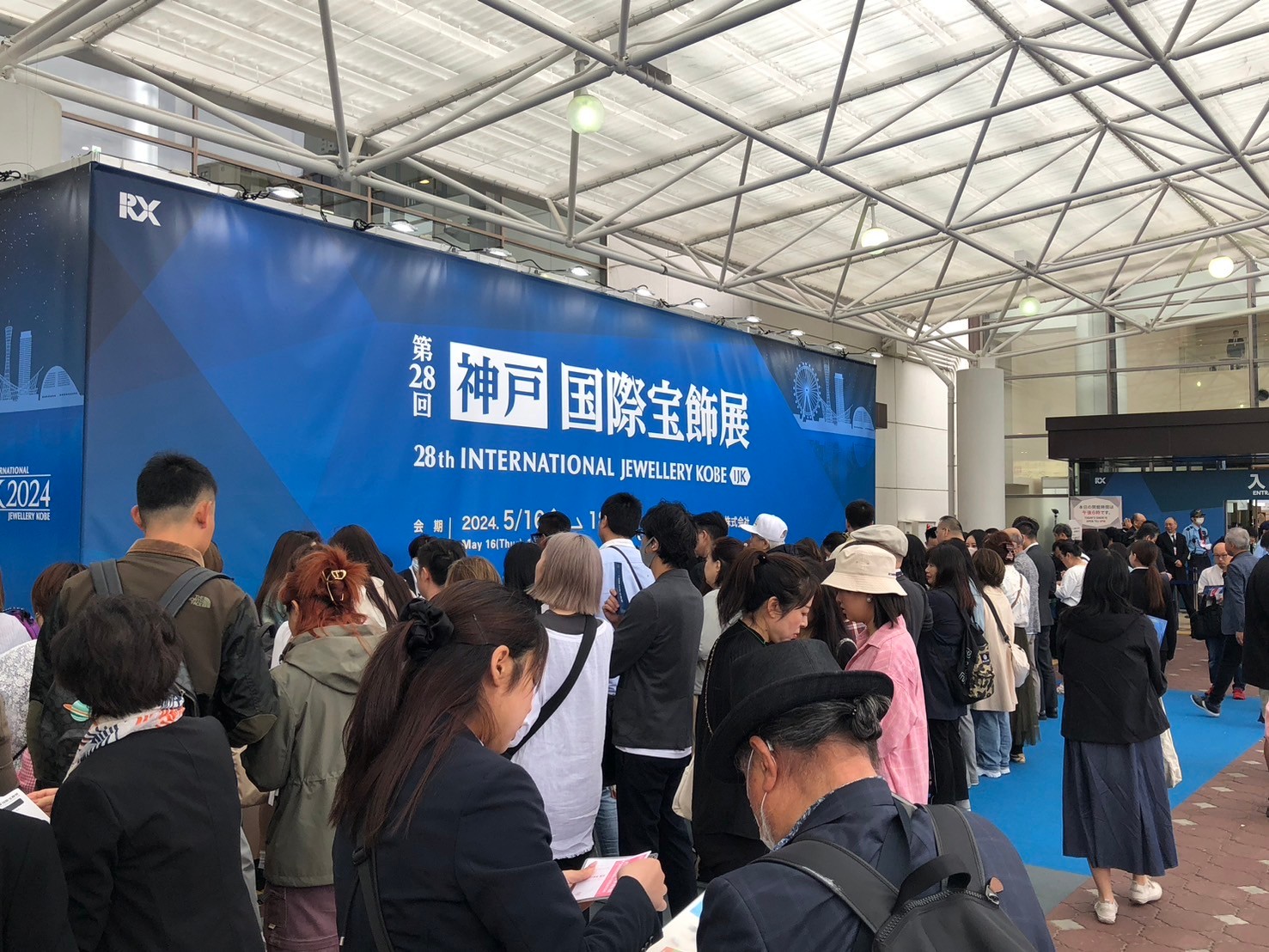

It is against this backdrop that this year’s jewellery show was held in Kobe, Japan. On the first day of the show, the entire venue was crowded with visitors to the jewellery show. It just seems that the jewellery show was a strong representation of the current situation. The number of Chinese buyers visiting the exhibition dropped dramatically due to the economic downtown in China, and the number of Japanese visitors was unprecedentedly low, as if to show the difficult situation on the Japanese retail sales front.

The jewellery industry is changing dramatically. Looking at the exhibitors at this event, it seemed that many companies that had strengthened their corporate structures through mergers and acquisitions had set up large booths and were attracting many customers with their product power. We got impress that even companies that had attracted more customers in the past were struggling to attract customers if their products and product mix were the same as before or weaker than before. The needs for commercial products have changed and it may be time to review the products have changed and it may be time to review the product mix, prices, etc.

At our booth, too, the faces of those who came to the IJK were very different this time. Fewer Chinese and Japanese buyers visited the exhibition, which was attended for three days by overseas buyers from the new jewellery boom, especially from ASEAN countries. The commercial products required are also slightly different from those of Chinese and Japanese buyers, and we felt that there are new needs. This trend may continue in the future.

We too will be working to prepare for the next jewellery show in line with this changing shape of the industry. We hope to see many of you again at the next jewellery show. Thank you for coming to this jewellery show.